Innovation outposts focus on embedding a dedicated team within startup ecosystems to identify disruptive technologies and emerging trends early, enabling proactive strategic adaptation. M&A scouting targets specific acquisition opportunities by assessing company fit, financial health, and market potential to drive inorganic growth and consolidate competitive advantage. Explore how combining innovation outposts and M&A scouting can optimize your organization's market agility and long-term value creation.

Why it is important

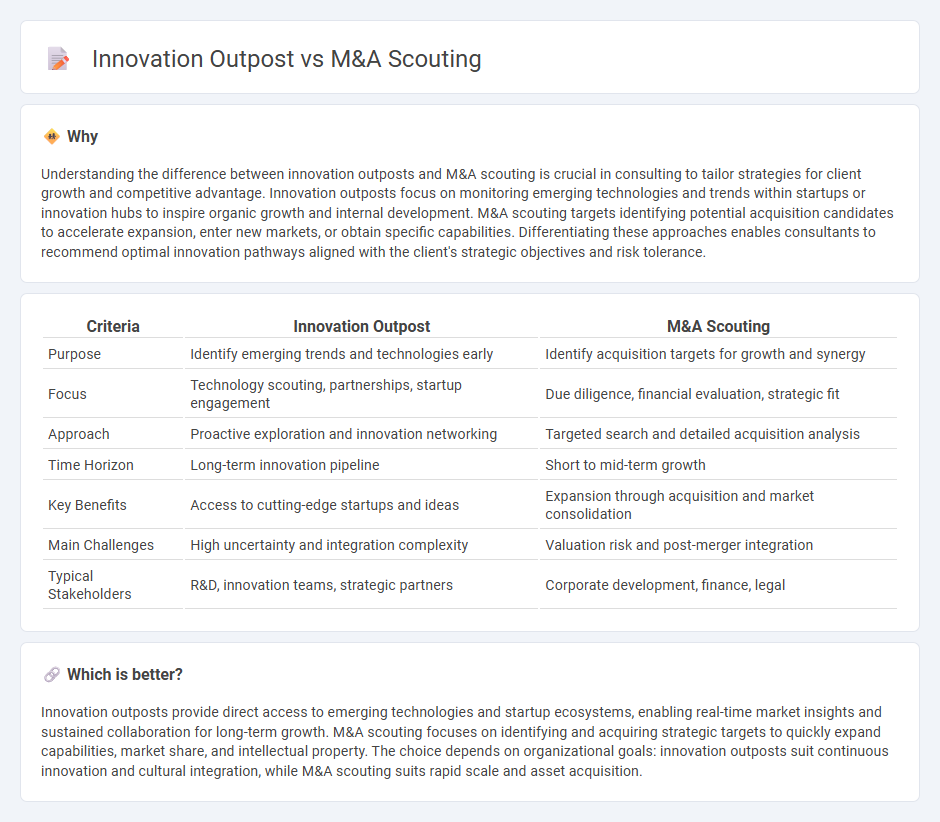

Understanding the difference between innovation outposts and M&A scouting is crucial in consulting to tailor strategies for client growth and competitive advantage. Innovation outposts focus on monitoring emerging technologies and trends within startups or innovation hubs to inspire organic growth and internal development. M&A scouting targets identifying potential acquisition candidates to accelerate expansion, enter new markets, or obtain specific capabilities. Differentiating these approaches enables consultants to recommend optimal innovation pathways aligned with the client's strategic objectives and risk tolerance.

Comparison Table

| Criteria | Innovation Outpost | M&A Scouting |

|---|---|---|

| Purpose | Identify emerging trends and technologies early | Identify acquisition targets for growth and synergy |

| Focus | Technology scouting, partnerships, startup engagement | Due diligence, financial evaluation, strategic fit |

| Approach | Proactive exploration and innovation networking | Targeted search and detailed acquisition analysis |

| Time Horizon | Long-term innovation pipeline | Short to mid-term growth |

| Key Benefits | Access to cutting-edge startups and ideas | Expansion through acquisition and market consolidation |

| Main Challenges | High uncertainty and integration complexity | Valuation risk and post-merger integration |

| Typical Stakeholders | R&D, innovation teams, strategic partners | Corporate development, finance, legal |

Which is better?

Innovation outposts provide direct access to emerging technologies and startup ecosystems, enabling real-time market insights and sustained collaboration for long-term growth. M&A scouting focuses on identifying and acquiring strategic targets to quickly expand capabilities, market share, and intellectual property. The choice depends on organizational goals: innovation outposts suit continuous innovation and cultural integration, while M&A scouting suits rapid scale and asset acquisition.

Connection

Innovation outposts serve as strategic hubs that identify emerging technologies and market trends, providing critical insights for effective M&A scouting. By leveraging data from innovation outposts, companies can pinpoint high-potential startups and technologies, streamlining the acquisition process and driving growth. This synergy enhances decision-making accuracy and accelerates the integration of novel solutions into existing business models.

Key Terms

M&A Scouting:

M&A scouting identifies startups and emerging technologies that align with a company's strategic growth ambitions, leveraging data analytics and market intelligence to pinpoint high-potential acquisition targets. This approach accelerates competitive advantage by acquiring innovative capabilities and entering new markets faster than organic development. Explore how integrating advanced M&A scouting techniques can enhance your corporate growth strategy.

Deal Sourcing

M&A scouting focuses on identifying strategic acquisition targets by leveraging market intelligence, financial analytics, and industry networks to uncover high-potential deals. Innovation outposts prioritize early-stage technologies and startups, acting as hubs for continuous innovation monitoring and ecosystem engagement to facilitate long-term growth. Explore our comprehensive insights to optimize your deal sourcing strategy.

Target Identification

M&A scouting focuses on identifying acquisition targets that align strategically with a company's growth goals by analyzing market trends, financial health, and competitive positioning. Innovation outposts prioritize early detection of emerging technologies and startups to foster collaboration and integration with internal R&D efforts. Explore effective strategies for target identification to enhance your corporate innovation and growth initiatives.

Source and External Links

Acquisition scouting - what is it? - Strategic Allies - Acquisition scouting is a confidential, step-by-step process led by experienced professionals to identify and connect with synergistic, "off-market" acquisition targets that align with a company's strategic goals and capabilities.

Acquisition Scout - a step by step plan - TKM Consultants - The acquisition scout methodology involves market trend analysis, relationship-building with target companies, and initial due diligence to assess strategic fit before formal acquisition discussions begin.

Merger & Acquisition Scouting - People and Properties - M&A scouting services leverage industry networks and market intelligence to identify, shortlist, and support light due diligence for acquisition targets that meet specific strategic criteria.

dowidth.com

dowidth.com