Operational due diligence focuses on evaluating the internal processes, management quality, and operational risks of a target company to ensure efficiency and performance stability. Commercial due diligence analyzes market dynamics, customer base, competitive positioning, and revenue growth potential to assess the commercial viability of an investment. Explore our detailed insights to understand how these due diligence types drive informed decision-making in consulting.

Why it is important

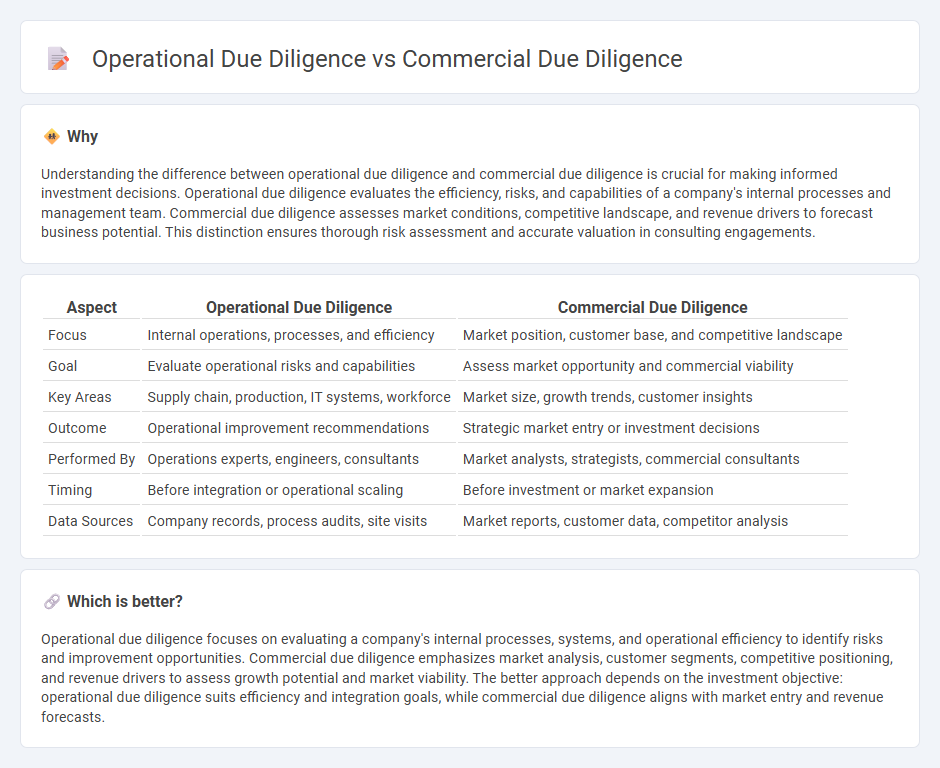

Understanding the difference between operational due diligence and commercial due diligence is crucial for making informed investment decisions. Operational due diligence evaluates the efficiency, risks, and capabilities of a company's internal processes and management team. Commercial due diligence assesses market conditions, competitive landscape, and revenue drivers to forecast business potential. This distinction ensures thorough risk assessment and accurate valuation in consulting engagements.

Comparison Table

| Aspect | Operational Due Diligence | Commercial Due Diligence |

|---|---|---|

| Focus | Internal operations, processes, and efficiency | Market position, customer base, and competitive landscape |

| Goal | Evaluate operational risks and capabilities | Assess market opportunity and commercial viability |

| Key Areas | Supply chain, production, IT systems, workforce | Market size, growth trends, customer insights |

| Outcome | Operational improvement recommendations | Strategic market entry or investment decisions |

| Performed By | Operations experts, engineers, consultants | Market analysts, strategists, commercial consultants |

| Timing | Before integration or operational scaling | Before investment or market expansion |

| Data Sources | Company records, process audits, site visits | Market reports, customer data, competitor analysis |

Which is better?

Operational due diligence focuses on evaluating a company's internal processes, systems, and operational efficiency to identify risks and improvement opportunities. Commercial due diligence emphasizes market analysis, customer segments, competitive positioning, and revenue drivers to assess growth potential and market viability. The better approach depends on the investment objective: operational due diligence suits efficiency and integration goals, while commercial due diligence aligns with market entry and revenue forecasts.

Connection

Operational due diligence assesses a company's internal processes, systems, and capabilities to ensure operational efficiency and risk mitigation, while commercial due diligence evaluates market positioning, customer base, and competitive landscape to validate revenue streams and growth potential. Both types of due diligence are interconnected as thorough operational insights support the commercial analysis by confirming that the business can effectively deliver on its market promises. Integrating these assessments provides investors and stakeholders with a comprehensive understanding of a company's overall viability and strategic fit.

Key Terms

**Commercial Due Diligence:**

Commercial due diligence evaluates market dynamics, customer behavior, competitive landscape, and revenue projections to assess a target company's growth potential and market position. It provides investors with critical insights into demand drivers, pricing strategies, and risks associated with commercialization, enabling informed investment decisions. Explore deeper insights into commercial due diligence for strategic business growth and risk mitigation.

Market Analysis

Commercial due diligence primarily evaluates market attractiveness, competition landscape, customer demand, and growth potential to inform investment decisions. Operational due diligence emphasizes the company's internal capabilities, ensuring operational efficiencies, supply chain robustness, and scalability align with market realities. Discover detailed insights into how both due diligence types impact strategic market analyses.

Competitive Positioning

Commercial due diligence rigorously analyzes market dynamics, customer segments, and competitive landscape to assess a company's future revenue potential and growth opportunities. Operational due diligence evaluates internal processes, supply chain efficiency, and organizational capabilities to determine the company's ability to maintain or improve its competitive positioning over time. Explore deeper insights into how these two due diligence types shape strategic investment decisions.

Source and External Links

How to Conduct Commercial Due Diligence More Efficiently - Commercial due diligence is a comprehensive review of a business from financial, legal, operational, and market perspectives to inform and reduce risk in mergers, acquisitions, or investments.

Commercial Due Diligence - Definition, Importance, Process - It is an audit of a target company's commercial activity, long-term viability, and potential, typically initiated by buyers or sellers during M&A to assess risks and value before finalizing deal terms.

What is commercial due diligence? - KPMG International - Commercial due diligence provides a detailed understanding of a target company's commercial prospects by analyzing market, competitive, and operational factors, often requiring less management time than other due diligence types.

dowidth.com

dowidth.com