Behavioural economics consulting focuses on applying insights from psychology and economics to influence decision-making, improve customer engagement, and drive strategic business outcomes. Regulatory compliance consulting helps organizations navigate complex legal frameworks, mitigating risks and ensuring adherence to industry standards and government regulations. Explore how these consulting specialties can uniquely enhance your organization's success.

Why it is important

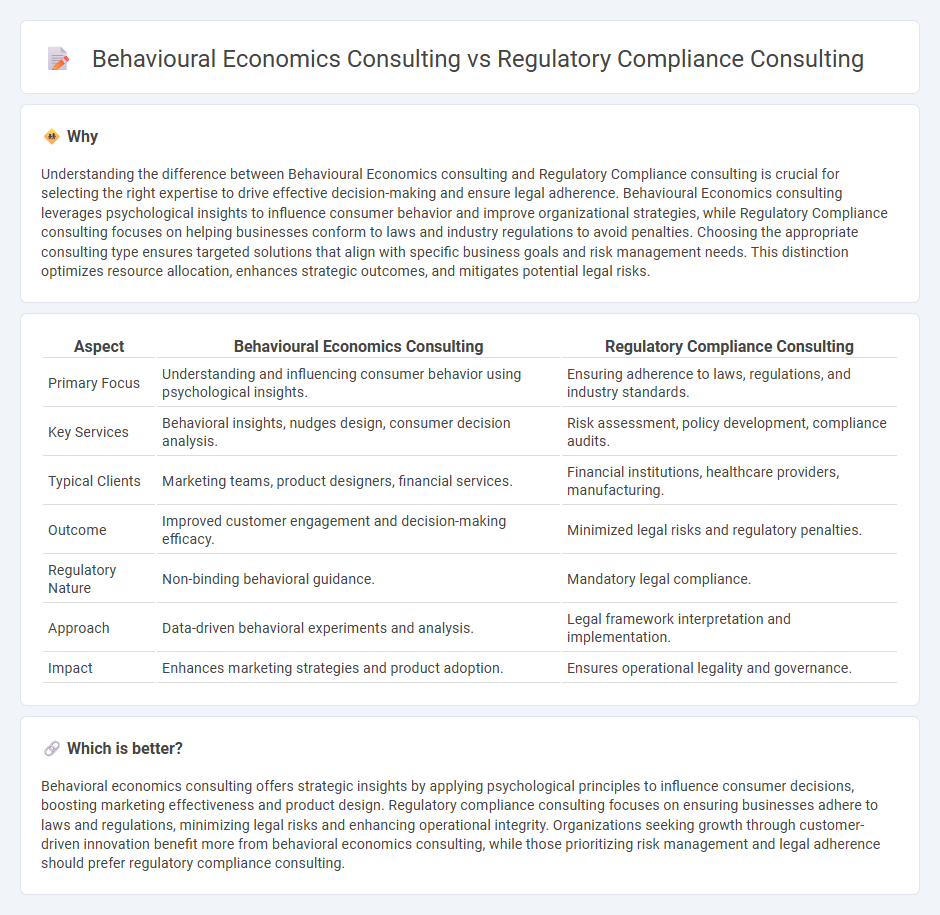

Understanding the difference between Behavioural Economics consulting and Regulatory Compliance consulting is crucial for selecting the right expertise to drive effective decision-making and ensure legal adherence. Behavioural Economics consulting leverages psychological insights to influence consumer behavior and improve organizational strategies, while Regulatory Compliance consulting focuses on helping businesses conform to laws and industry regulations to avoid penalties. Choosing the appropriate consulting type ensures targeted solutions that align with specific business goals and risk management needs. This distinction optimizes resource allocation, enhances strategic outcomes, and mitigates potential legal risks.

Comparison Table

| Aspect | Behavioural Economics Consulting | Regulatory Compliance Consulting |

|---|---|---|

| Primary Focus | Understanding and influencing consumer behavior using psychological insights. | Ensuring adherence to laws, regulations, and industry standards. |

| Key Services | Behavioral insights, nudges design, consumer decision analysis. | Risk assessment, policy development, compliance audits. |

| Typical Clients | Marketing teams, product designers, financial services. | Financial institutions, healthcare providers, manufacturing. |

| Outcome | Improved customer engagement and decision-making efficacy. | Minimized legal risks and regulatory penalties. |

| Regulatory Nature | Non-binding behavioral guidance. | Mandatory legal compliance. |

| Approach | Data-driven behavioral experiments and analysis. | Legal framework interpretation and implementation. |

| Impact | Enhances marketing strategies and product adoption. | Ensures operational legality and governance. |

Which is better?

Behavioral economics consulting offers strategic insights by applying psychological principles to influence consumer decisions, boosting marketing effectiveness and product design. Regulatory compliance consulting focuses on ensuring businesses adhere to laws and regulations, minimizing legal risks and enhancing operational integrity. Organizations seeking growth through customer-driven innovation benefit more from behavioral economics consulting, while those prioritizing risk management and legal adherence should prefer regulatory compliance consulting.

Connection

Behavioural economics consulting and regulatory compliance consulting intersect by leveraging insights into human decision-making to design effective policies and compliance strategies. Understanding cognitive biases and incentives enables consultants to predict regulatory adherence patterns and tailor interventions that enhance conformity with legal frameworks. This synergy improves organizational compliance outcomes while optimizing behavioral outcomes aligned with regulatory objectives.

Key Terms

Regulatory compliance consulting:

Regulatory compliance consulting specializes in helping businesses adhere to industry-specific laws, standards, and regulations to avoid legal penalties and enhance operational efficiency. Key areas include risk assessment, policy development, and continuous monitoring to ensure alignment with evolving regulatory frameworks such as GDPR, HIPAA, or financial compliance mandates. Explore how expert regulatory compliance consulting can safeguard your organization and streamline compliance processes.

Risk Assessment

Regulatory compliance consulting centers on identifying, evaluating, and mitigating legal and industry-specific risks to ensure adherence to rules and standards, utilizing frameworks like ISO 31000 and SOX. Behavioural economics consulting focuses on understanding cognitive biases and decision-making processes to assess and reduce behavioral risks that impact organizational performance and consumer behavior. Explore these approaches in-depth to enhance your risk assessment strategies.

Policy Development

Regulatory compliance consulting ensures that organizations adhere to laws and regulations, minimizing risks and penalties through detailed policy frameworks and monitoring systems. Behavioural economics consulting leverages insights into human decision-making to design policies that effectively influence public behavior and improve outcomes. Discover more about how these consulting approaches uniquely shape policy development strategies.

Source and External Links

Regulatory Compliance Advisory and Consulting Services - ACA provides end-to-end regulatory compliance consulting including program design, training, technology implementation, risk management, and ongoing compliance reviews tailored to firms' needs.

Compliance Consulting Services - COMPLY offers flexible compliance consulting acting as an extension of your team with expertise in SEC, FINRA, and state regulations, delivering tailored, ongoing support and automation tools.

Compliance consulting - IQ-EQ provides comprehensive compliance consulting covering initial regulatory applications, policy development, ongoing advice, and fully outsourced solutions with global regulatory expertise.

dowidth.com

dowidth.com