Climate risk advisory focuses on identifying, assessing, and mitigating the financial and operational impacts of climate change on businesses and investments, integrating environmental data and regulatory frameworks into risk management strategies. Financial advisory provides comprehensive services including investment analysis, capital raising, mergers and acquisitions, and financial restructuring to optimize organizational financial performance. Explore how expert consulting in these specialized fields drives sustainable growth and risk resilience.

Why it is important

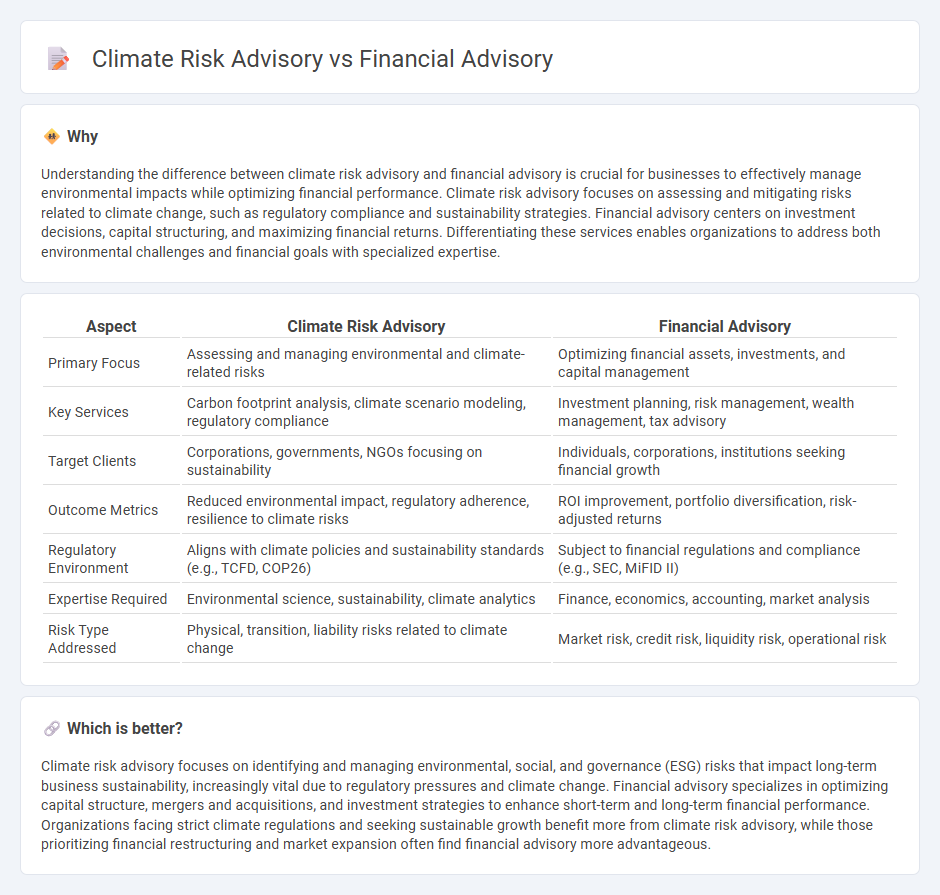

Understanding the difference between climate risk advisory and financial advisory is crucial for businesses to effectively manage environmental impacts while optimizing financial performance. Climate risk advisory focuses on assessing and mitigating risks related to climate change, such as regulatory compliance and sustainability strategies. Financial advisory centers on investment decisions, capital structuring, and maximizing financial returns. Differentiating these services enables organizations to address both environmental challenges and financial goals with specialized expertise.

Comparison Table

| Aspect | Climate Risk Advisory | Financial Advisory |

|---|---|---|

| Primary Focus | Assessing and managing environmental and climate-related risks | Optimizing financial assets, investments, and capital management |

| Key Services | Carbon footprint analysis, climate scenario modeling, regulatory compliance | Investment planning, risk management, wealth management, tax advisory |

| Target Clients | Corporations, governments, NGOs focusing on sustainability | Individuals, corporations, institutions seeking financial growth |

| Outcome Metrics | Reduced environmental impact, regulatory adherence, resilience to climate risks | ROI improvement, portfolio diversification, risk-adjusted returns |

| Regulatory Environment | Aligns with climate policies and sustainability standards (e.g., TCFD, COP26) | Subject to financial regulations and compliance (e.g., SEC, MiFID II) |

| Expertise Required | Environmental science, sustainability, climate analytics | Finance, economics, accounting, market analysis |

| Risk Type Addressed | Physical, transition, liability risks related to climate change | Market risk, credit risk, liquidity risk, operational risk |

Which is better?

Climate risk advisory focuses on identifying and managing environmental, social, and governance (ESG) risks that impact long-term business sustainability, increasingly vital due to regulatory pressures and climate change. Financial advisory specializes in optimizing capital structure, mergers and acquisitions, and investment strategies to enhance short-term and long-term financial performance. Organizations facing strict climate regulations and seeking sustainable growth benefit more from climate risk advisory, while those prioritizing financial restructuring and market expansion often find financial advisory more advantageous.

Connection

Climate risk advisory and financial advisory are interconnected through their focus on evaluating and mitigating risks that impact asset valuations and investment portfolios. Integrating climate risk factors such as regulatory changes, physical climate impacts, and transition risks enables financial advisors to deliver more resilient and forward-looking investment strategies. This synergy supports informed decision-making to enhance long-term financial stability and compliance with emerging ESG standards.

Key Terms

**Financial advisory:**

Financial advisory services provide expert guidance on investments, asset management, mergers, and corporate finance to optimize financial performance and mitigate risks. These services analyze market trends, regulatory compliance, and capital allocation to enhance shareholder value and support strategic business decisions. Discover how tailored financial advisory can drive your company's growth and stability.

Valuation

Financial advisory centers on valuation by assessing company worth through cash flow projections, market comparables, and asset-based approaches, ensuring robust investment decisions. Climate risk advisory integrates environmental impact factors, such as carbon emissions and regulatory risks, into valuation models to capture potential financial repercussions of climate change on asset value. Explore comprehensive strategies combining financial and climate risk insights for precise valuation outcomes.

Mergers & Acquisitions (M&A)

Financial advisory in Mergers & Acquisitions (M&A) prioritizes valuation, due diligence, and deal structuring to maximize shareholder value and ensure regulatory compliance. Climate risk advisory integrates environmental, social, and governance (ESG) factors, assessing potential climate-related financial impacts and transition risks that could influence deal pricing and long-term asset viability. Explore how combining financial and climate risk advisory enhances M&A strategies for sustainable value creation.

Source and External Links

Financial adviser - A financial adviser is a professional who provides financial services such as planning and product sales, compensated through fees or commissions based on qualifications and client needs.

Best Financial Advisors: Top Firms For 2025 - Choosing a financial advisor involves understanding the type of service needed, payment methods, credentials like CFP or CFA, and whether the advisor acts as a fiduciary prioritizing your interests.

Ameriprise Financial: Financial Planning Advice and Financial ... - Ameriprise is a leading financial advisory firm offering personalized advice and tools to help clients achieve their financial goals and maintain financial security.

dowidth.com

dowidth.com