Zero-based budgeting requires building every expense from the ground up, ensuring each cost is justified for every new period without relying on prior budgets. Envelope budgeting allocates fixed amounts to specific spending categories, promoting discipline by limiting expenditures to the cash contained within each envelope. Explore detailed comparisons to determine which budgeting method best fits your financial strategy.

Why it is important

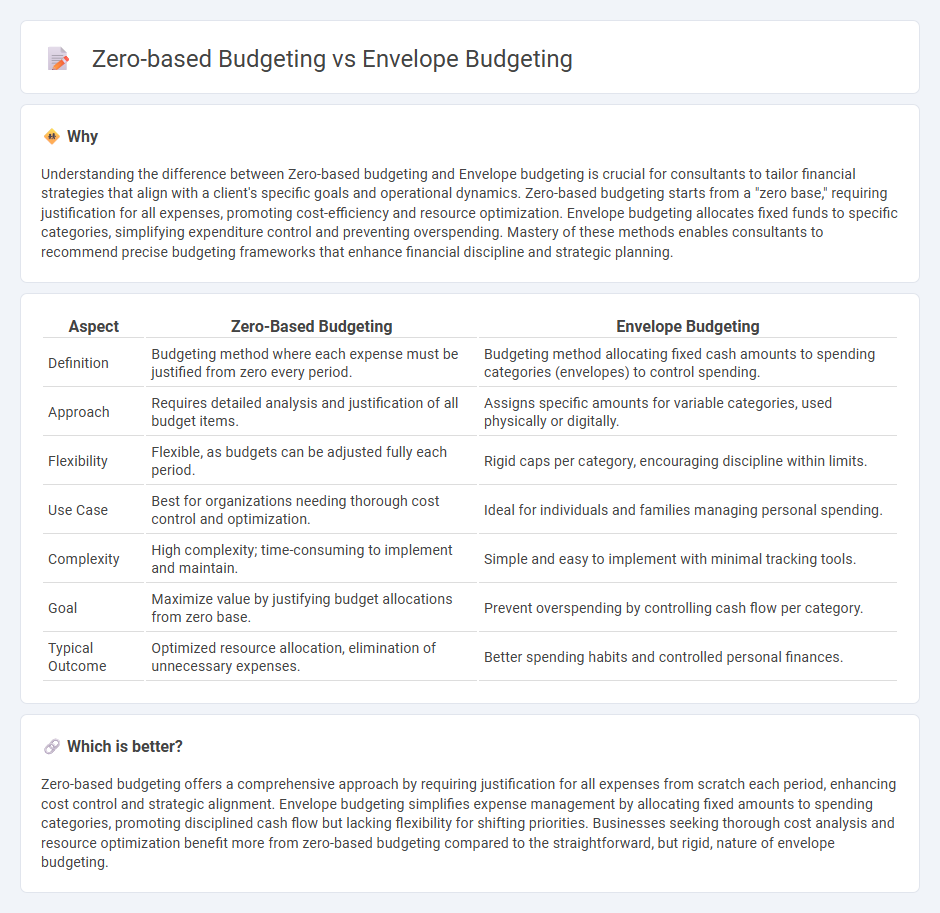

Understanding the difference between Zero-based budgeting and Envelope budgeting is crucial for consultants to tailor financial strategies that align with a client's specific goals and operational dynamics. Zero-based budgeting starts from a "zero base," requiring justification for all expenses, promoting cost-efficiency and resource optimization. Envelope budgeting allocates fixed funds to specific categories, simplifying expenditure control and preventing overspending. Mastery of these methods enables consultants to recommend precise budgeting frameworks that enhance financial discipline and strategic planning.

Comparison Table

| Aspect | Zero-Based Budgeting | Envelope Budgeting |

|---|---|---|

| Definition | Budgeting method where each expense must be justified from zero every period. | Budgeting method allocating fixed cash amounts to spending categories (envelopes) to control spending. |

| Approach | Requires detailed analysis and justification of all budget items. | Assigns specific amounts for variable categories, used physically or digitally. |

| Flexibility | Flexible, as budgets can be adjusted fully each period. | Rigid caps per category, encouraging discipline within limits. |

| Use Case | Best for organizations needing thorough cost control and optimization. | Ideal for individuals and families managing personal spending. |

| Complexity | High complexity; time-consuming to implement and maintain. | Simple and easy to implement with minimal tracking tools. |

| Goal | Maximize value by justifying budget allocations from zero base. | Prevent overspending by controlling cash flow per category. |

| Typical Outcome | Optimized resource allocation, elimination of unnecessary expenses. | Better spending habits and controlled personal finances. |

Which is better?

Zero-based budgeting offers a comprehensive approach by requiring justification for all expenses from scratch each period, enhancing cost control and strategic alignment. Envelope budgeting simplifies expense management by allocating fixed amounts to spending categories, promoting disciplined cash flow but lacking flexibility for shifting priorities. Businesses seeking thorough cost analysis and resource optimization benefit more from zero-based budgeting compared to the straightforward, but rigid, nature of envelope budgeting.

Connection

Zero-based budgeting and Envelope budgeting both focus on allocating resources efficiently by starting from a clean slate each budgeting cycle. Zero-based budgeting requires justifying all expenses anew, while Envelope budgeting divides funds into specific categories or "envelopes" to control spending. Together, they enhance financial discipline and strategic resource management in consulting projects.

Key Terms

Cash allocation

Envelope budgeting allocates cash into physical or digital categories for specific expenses, ensuring spending stays within predefined limits, which enhances control over discretionary spending. Zero-based budgeting requires every expense to be justified from scratch each period, promoting thorough evaluation and efficient allocation of cash based on current needs rather than historical spending. Explore how these methods optimize cash flow management and improve financial discipline in various budgeting contexts.

Expense categorization

Envelope budgeting allocates specific cash amounts to predefined spending categories, ensuring strict control over expenses by using physical or digital envelopes for each category. Zero-based budgeting requires every expense to be justified from scratch for each new period, promoting thorough expense analysis and prioritization without relying on past budgets. Explore the key differences and applications to optimize your budgeting approach effectively.

Incremental planning

Envelope budgeting allocates specific cash amounts to distinct spending categories, enhancing incremental control over expenses and preventing overspending by using physical or digital envelopes. Zero-based budgeting requires building the budget from scratch each period, justifying every expense without reference to prior budgets, which allows for precise allocation of resources based on current priorities rather than historical patterns. Explore how these budgeting strategies impact incremental planning and financial management to optimize your budgeting approach.

Source and External Links

Envelope System - Wikipedia - The envelope system is a budgeting method that involves dividing expenses into separate categories and using physical or virtual envelopes to manage cash for each category.

Envelope Budgeting | Actual Budget Documentation - This guide explains how to set up and use an envelope system to manage both regular and irregular expenses effectively.

Cash Stuffing Envelope Budget System - NerdWallet - The cash stuffing method involves organizing expenses into categories and using marked envelopes to control spending by limiting it to the allocated cash in each envelope.

dowidth.com

dowidth.com