AI readiness assessment consulting evaluates an organization's current technological infrastructure, data capabilities, and talent to determine its preparedness for AI integration, focusing on strategic alignment and operational scalability. Merger and acquisition consulting centers on financial analysis, due diligence, and integration planning to ensure seamless transitions and maximize value in corporate consolidations. Explore how specialized consulting services can drive your business transformation by addressing unique strategic priorities.

Why it is important

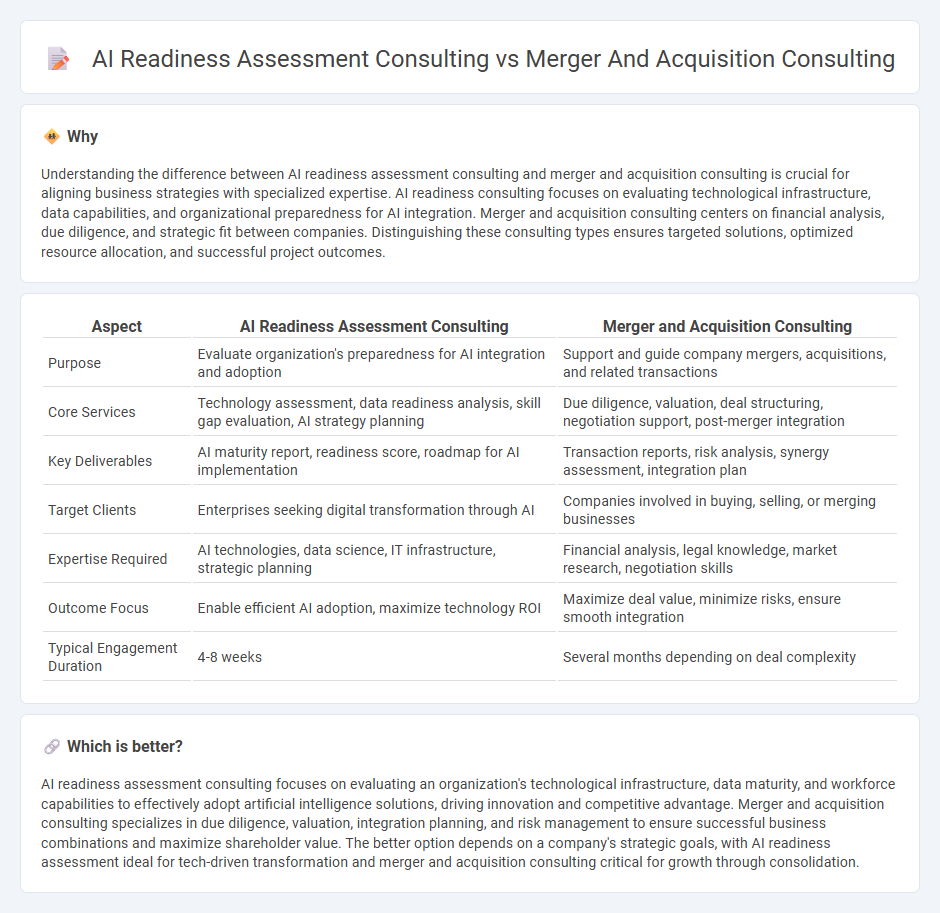

Understanding the difference between AI readiness assessment consulting and merger and acquisition consulting is crucial for aligning business strategies with specialized expertise. AI readiness consulting focuses on evaluating technological infrastructure, data capabilities, and organizational preparedness for AI integration. Merger and acquisition consulting centers on financial analysis, due diligence, and strategic fit between companies. Distinguishing these consulting types ensures targeted solutions, optimized resource allocation, and successful project outcomes.

Comparison Table

| Aspect | AI Readiness Assessment Consulting | Merger and Acquisition Consulting |

|---|---|---|

| Purpose | Evaluate organization's preparedness for AI integration and adoption | Support and guide company mergers, acquisitions, and related transactions |

| Core Services | Technology assessment, data readiness analysis, skill gap evaluation, AI strategy planning | Due diligence, valuation, deal structuring, negotiation support, post-merger integration |

| Key Deliverables | AI maturity report, readiness score, roadmap for AI implementation | Transaction reports, risk analysis, synergy assessment, integration plan |

| Target Clients | Enterprises seeking digital transformation through AI | Companies involved in buying, selling, or merging businesses |

| Expertise Required | AI technologies, data science, IT infrastructure, strategic planning | Financial analysis, legal knowledge, market research, negotiation skills |

| Outcome Focus | Enable efficient AI adoption, maximize technology ROI | Maximize deal value, minimize risks, ensure smooth integration |

| Typical Engagement Duration | 4-8 weeks | Several months depending on deal complexity |

Which is better?

AI readiness assessment consulting focuses on evaluating an organization's technological infrastructure, data maturity, and workforce capabilities to effectively adopt artificial intelligence solutions, driving innovation and competitive advantage. Merger and acquisition consulting specializes in due diligence, valuation, integration planning, and risk management to ensure successful business combinations and maximize shareholder value. The better option depends on a company's strategic goals, with AI readiness assessment ideal for tech-driven transformation and merger and acquisition consulting critical for growth through consolidation.

Connection

AI readiness assessment consulting evaluates an organization's technological infrastructure, data maturity, and workforce capabilities to determine its preparedness for AI integration. This insight is critical during merger and acquisition consulting, where understanding the AI competencies of merging entities influences strategic decisions, risk management, and value creation. Combining these consulting disciplines ensures that post-merger integration leverages AI capabilities effectively, driving innovation and competitive advantage.

Key Terms

Merger and Acquisition Consulting:

Merger and acquisition consulting specializes in guiding companies through the complexities of mergers, acquisitions, and divestitures, ensuring due diligence, valuation, and integration strategies align with business objectives. This consulting type leverages financial analysis, risk assessment, and market evaluation to maximize deal value and smooth post-merger transitions. Discover detailed strategies and benefits of merger and acquisition consulting to optimize your corporate growth journey.

Due Diligence

Merger and acquisition consulting involves comprehensive due diligence processes such as financial analysis, legal compliance, and operational review to evaluate risks and synergies before transaction completion. AI readiness assessment consulting focuses on due diligence by analyzing an organization's data infrastructure, technology stack, and workforce capabilities to determine preparedness for AI integration. Explore how specialized due diligence in each consulting field can drive strategic decision-making and successful transformation outcomes.

Synergy Identification

Merger and acquisition consulting prioritizes synergy identification by evaluating financial, operational, and strategic alignments to ensure value creation between the merging entities. AI readiness assessment consulting focuses on identifying synergies by analyzing technological infrastructure, data capabilities, and organizational culture to integrate AI-driven solutions effectively. Discover how these consulting services uniquely optimize synergy identification to maximize business transformation.

Source and External Links

M&A (Mergers & Acquisitions) Strategy Consulting | BCG - BCG offers strategic M&A consulting that helps clients design replicable merger and acquisition processes, prepare integration in advance, assess fits and synergies, and support all stages from transaction strategy to post-merger integration using global expertise and proprietary tools.

Mergers & Acquisitions Consulting Services - Dryden Group - Dryden Group specializes in procurement-focused M&A consulting, including due diligence, spend and vendor analysis to optimize procurement efficiency and reduce post-M&A costs for smoother transitions.

M&A consulting | EY - US - EY provides comprehensive M&A consulting covering growth strategy, portfolio reshaping, due diligence, post-merger integration and restructuring supported by AI-enabled technologies and advanced analytics to maximize deal value and strategic alignment.

dowidth.com

dowidth.com