Behavioural economics consulting focuses on applying psychological insights to influence consumer behavior and decision-making processes, while financial advisory consulting emphasizes personalized financial planning, investment strategies, and risk management. Firms specializing in behavioural economics often utilize data-driven experiments and cognitive biases analysis, whereas financial advisors prioritize market trends and portfolio optimization. Discover how these distinct consulting approaches can enhance business outcomes by exploring their unique methodologies.

Why it is important

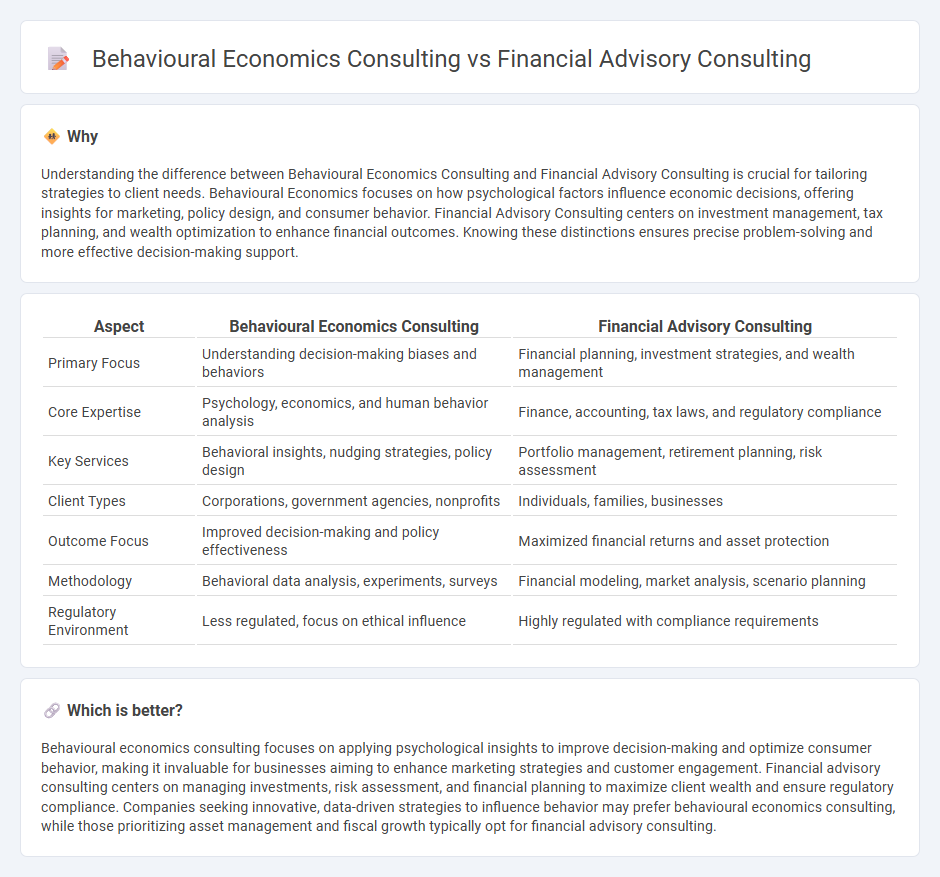

Understanding the difference between Behavioural Economics Consulting and Financial Advisory Consulting is crucial for tailoring strategies to client needs. Behavioural Economics focuses on how psychological factors influence economic decisions, offering insights for marketing, policy design, and consumer behavior. Financial Advisory Consulting centers on investment management, tax planning, and wealth optimization to enhance financial outcomes. Knowing these distinctions ensures precise problem-solving and more effective decision-making support.

Comparison Table

| Aspect | Behavioural Economics Consulting | Financial Advisory Consulting |

|---|---|---|

| Primary Focus | Understanding decision-making biases and behaviors | Financial planning, investment strategies, and wealth management |

| Core Expertise | Psychology, economics, and human behavior analysis | Finance, accounting, tax laws, and regulatory compliance |

| Key Services | Behavioral insights, nudging strategies, policy design | Portfolio management, retirement planning, risk assessment |

| Client Types | Corporations, government agencies, nonprofits | Individuals, families, businesses |

| Outcome Focus | Improved decision-making and policy effectiveness | Maximized financial returns and asset protection |

| Methodology | Behavioral data analysis, experiments, surveys | Financial modeling, market analysis, scenario planning |

| Regulatory Environment | Less regulated, focus on ethical influence | Highly regulated with compliance requirements |

Which is better?

Behavioural economics consulting focuses on applying psychological insights to improve decision-making and optimize consumer behavior, making it invaluable for businesses aiming to enhance marketing strategies and customer engagement. Financial advisory consulting centers on managing investments, risk assessment, and financial planning to maximize client wealth and ensure regulatory compliance. Companies seeking innovative, data-driven strategies to influence behavior may prefer behavioural economics consulting, while those prioritizing asset management and fiscal growth typically opt for financial advisory consulting.

Connection

Behavioural economics consulting and financial advisory consulting intersect through their focus on improving decision-making processes in financial contexts. By applying insights into cognitive biases and human behavior, behavioural economics informs financial advisors on designing strategies that enhance client outcomes and compliance. This connection enables tailored financial advice that aligns with psychological tendencies, optimizing investment decisions and risk management.

Key Terms

**Financial advisory consulting:**

Financial advisory consulting centers on personalized investment strategies, retirement planning, and wealth management to optimize clients' financial outcomes. Experts analyze market trends, risk tolerance, and tax implications to create tailored financial roadmaps. Explore more to understand how these services can enhance your financial security.

Valuation

Financial advisory consulting specializes in valuation by applying quantitative models, market data, and industry benchmarks to determine asset worth and investment potential accurately. Behavioural economics consulting enhances valuation practices by incorporating psychological factors, cognitive biases, and decision-making patterns that influence investor behavior and market anomalies. Explore how integrating financial metrics with behavioral insights can improve valuation accuracy and strategic decision-making.

Risk management

Financial advisory consulting emphasizes quantitative risk management strategies, portfolio diversification, and regulatory compliance to optimize investment performance and protect assets. Behavioural economics consulting focuses on understanding cognitive biases, decision-making heuristics, and emotional influences that affect individual and organizational risk perceptions. Explore how integrating these approaches enhances comprehensive risk management solutions.

Source and External Links

What Is a Financial Consultant and What Do They Do? - SmartAsset - Financial consultants provide personalized advice by analyzing a client's full financial picture, helping with goals like retirement or buying a home, and may specialize in areas such as tax planning, investing, estate and retirement planning depending on their certification.

What Is a Financial Consultant? - NerdWallet - Financial consultants audit clients' financial situations and develop strategies to meet long-term goals, offering services like investment recommendations, tax preparation, and insurance advice, with various certifications such as ChFC indicating additional expertise.

Financial Advisory | Consultancy.org - Financial advisory consulting involves specialized financial analytical services including transaction advisory, risk management, tax and accounting advisory, often provided by large accounting and consulting firms, and focuses on optimizing financial reporting, compliance, and corporate finance functions.

dowidth.com

dowidth.com