Stakeholder capitalism advisory focuses on aligning business strategies with the interests of all parties affected by corporate actions, including employees, communities, and shareholders. ESG advisory emphasizes environmental, social, and governance criteria to enhance sustainable and ethical business practices. Explore more to understand how these advisory services drive corporate responsibility and innovation.

Why it is important

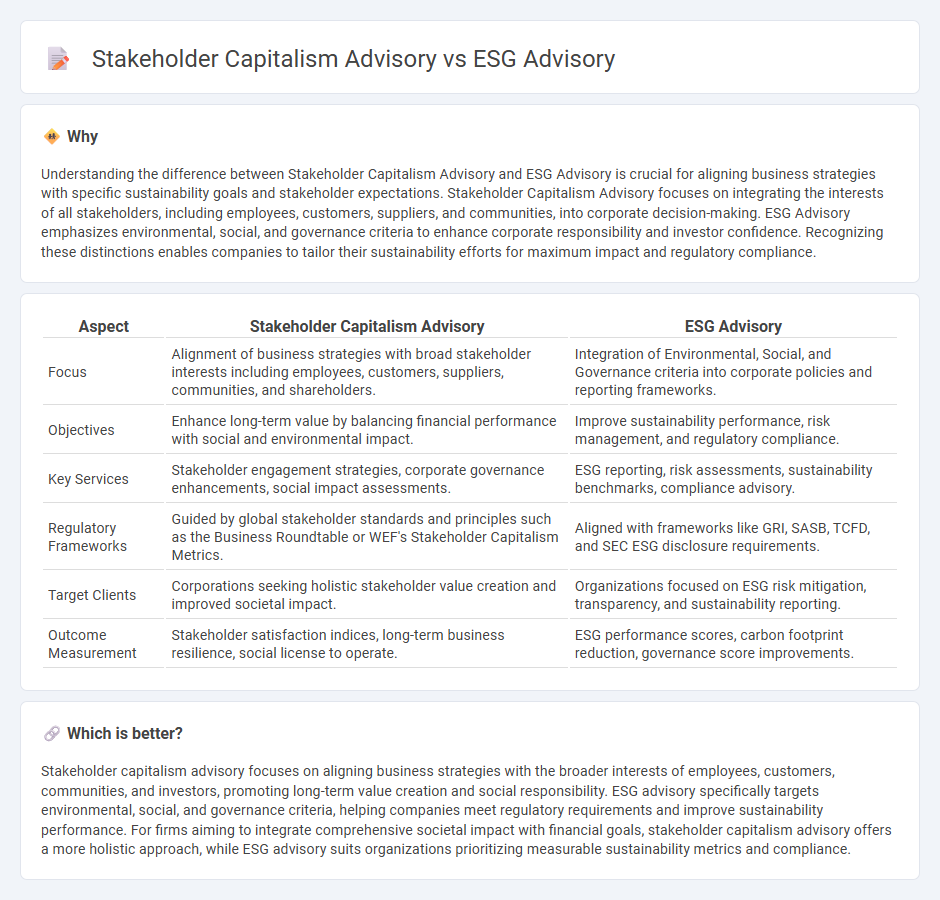

Understanding the difference between Stakeholder Capitalism Advisory and ESG Advisory is crucial for aligning business strategies with specific sustainability goals and stakeholder expectations. Stakeholder Capitalism Advisory focuses on integrating the interests of all stakeholders, including employees, customers, suppliers, and communities, into corporate decision-making. ESG Advisory emphasizes environmental, social, and governance criteria to enhance corporate responsibility and investor confidence. Recognizing these distinctions enables companies to tailor their sustainability efforts for maximum impact and regulatory compliance.

Comparison Table

| Aspect | Stakeholder Capitalism Advisory | ESG Advisory |

|---|---|---|

| Focus | Alignment of business strategies with broad stakeholder interests including employees, customers, suppliers, communities, and shareholders. | Integration of Environmental, Social, and Governance criteria into corporate policies and reporting frameworks. |

| Objectives | Enhance long-term value by balancing financial performance with social and environmental impact. | Improve sustainability performance, risk management, and regulatory compliance. |

| Key Services | Stakeholder engagement strategies, corporate governance enhancements, social impact assessments. | ESG reporting, risk assessments, sustainability benchmarks, compliance advisory. |

| Regulatory Frameworks | Guided by global stakeholder standards and principles such as the Business Roundtable or WEF's Stakeholder Capitalism Metrics. | Aligned with frameworks like GRI, SASB, TCFD, and SEC ESG disclosure requirements. |

| Target Clients | Corporations seeking holistic stakeholder value creation and improved societal impact. | Organizations focused on ESG risk mitigation, transparency, and sustainability reporting. |

| Outcome Measurement | Stakeholder satisfaction indices, long-term business resilience, social license to operate. | ESG performance scores, carbon footprint reduction, governance score improvements. |

Which is better?

Stakeholder capitalism advisory focuses on aligning business strategies with the broader interests of employees, customers, communities, and investors, promoting long-term value creation and social responsibility. ESG advisory specifically targets environmental, social, and governance criteria, helping companies meet regulatory requirements and improve sustainability performance. For firms aiming to integrate comprehensive societal impact with financial goals, stakeholder capitalism advisory offers a more holistic approach, while ESG advisory suits organizations prioritizing measurable sustainability metrics and compliance.

Connection

Stakeholder capitalism advisory and ESG advisory are interconnected through their shared focus on integrating environmental, social, and governance factors into business strategies to create long-term value for all stakeholders. Both advisory services emphasize corporate responsibility, sustainable development, and transparent governance as key drivers of performance and risk management. By aligning business practices with stakeholder interests and ESG principles, companies enhance reputation, compliance, and resilience in evolving regulatory and market landscapes.

Key Terms

**ESG Advisory:**

ESG advisory centers on integrating environmental, social, and governance criteria into corporate strategies to enhance sustainability performance and meet regulatory requirements. It involves assessing risks, identifying improvement opportunities, and reporting ESG metrics to investors and stakeholders. Discover how ESG advisory drives responsible growth and long-term value creation.

Sustainability Reporting

ESG advisory concentrates on Environmental, Social, and Governance metrics to help companies meet sustainability reporting standards such as GRI, SASB, and TCFD frameworks. Stakeholder capitalism advisory emphasizes broader value creation by integrating the interests of employees, customers, communities, and shareholders into sustainability strategy and disclosures. Explore how aligning ESG reporting with stakeholder capitalism principles can enhance transparent and impactful sustainability communication.

Risk Management

ESG advisory focuses on identifying and mitigating environmental, social, and governance risks to enhance corporate sustainability and compliance, while stakeholder capitalism advisory emphasizes balancing diverse stakeholder interests to manage reputational, operational, and regulatory risks. Both approaches integrate risk management frameworks but differ in scope, with ESG targeting specific criteria and stakeholder capitalism addressing broader socio-economic impacts. Explore how tailored risk management strategies in these advisories can drive resilient and responsible business growth.

Source and External Links

IFC ESG Advisory Services - IFC provides expert ESG advisory focused on emerging markets and developing economies, helping clients improve ESG performance and overcome investment barriers using integrated, locally tailored approaches aligned with IFC standards.

Antea Group ESG Advisory Services - Antea Group offers strategic ESG advisory to help businesses proactively manage ESG risks and opportunities through a structured seven-step program development process tailored to business needs and evolving stakeholder expectations.

RSM ESG Consulting Services - RSM advises on ESG readiness, strategy development, and integration of ESG metrics into corporate decision-making, combining sustainability insights with specialized services like governance compliance and sustainable supply chain optimization.

dowidth.com

dowidth.com