ESG due diligence evaluates a company's environmental, social, and governance factors to assess sustainability and ethical impact alongside financial performance. Environmental due diligence focuses specifically on identifying ecological risks and compliance issues related to land, air, and water during transactions. Explore our in-depth analysis to understand the critical distinctions and applications of these due diligence processes.

Why it is important

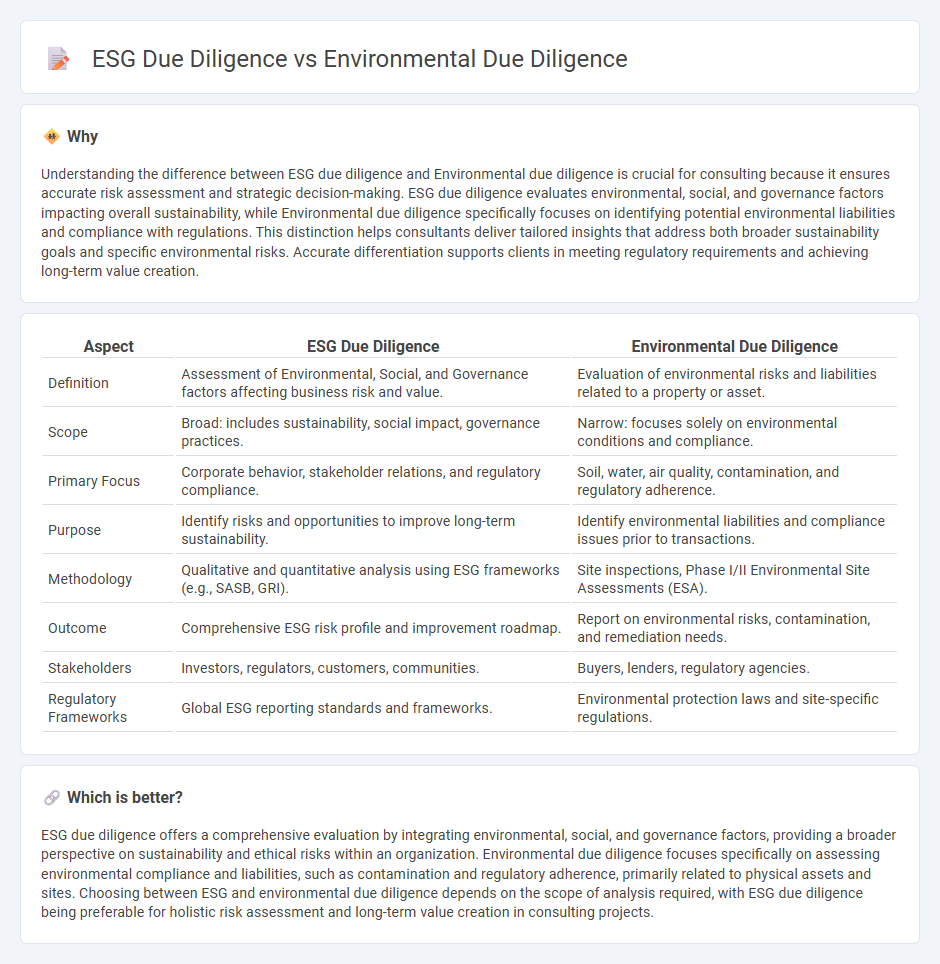

Understanding the difference between ESG due diligence and Environmental due diligence is crucial for consulting because it ensures accurate risk assessment and strategic decision-making. ESG due diligence evaluates environmental, social, and governance factors impacting overall sustainability, while Environmental due diligence specifically focuses on identifying potential environmental liabilities and compliance with regulations. This distinction helps consultants deliver tailored insights that address both broader sustainability goals and specific environmental risks. Accurate differentiation supports clients in meeting regulatory requirements and achieving long-term value creation.

Comparison Table

| Aspect | ESG Due Diligence | Environmental Due Diligence |

|---|---|---|

| Definition | Assessment of Environmental, Social, and Governance factors affecting business risk and value. | Evaluation of environmental risks and liabilities related to a property or asset. |

| Scope | Broad: includes sustainability, social impact, governance practices. | Narrow: focuses solely on environmental conditions and compliance. |

| Primary Focus | Corporate behavior, stakeholder relations, and regulatory compliance. | Soil, water, air quality, contamination, and regulatory adherence. |

| Purpose | Identify risks and opportunities to improve long-term sustainability. | Identify environmental liabilities and compliance issues prior to transactions. |

| Methodology | Qualitative and quantitative analysis using ESG frameworks (e.g., SASB, GRI). | Site inspections, Phase I/II Environmental Site Assessments (ESA). |

| Outcome | Comprehensive ESG risk profile and improvement roadmap. | Report on environmental risks, contamination, and remediation needs. |

| Stakeholders | Investors, regulators, customers, communities. | Buyers, lenders, regulatory agencies. |

| Regulatory Frameworks | Global ESG reporting standards and frameworks. | Environmental protection laws and site-specific regulations. |

Which is better?

ESG due diligence offers a comprehensive evaluation by integrating environmental, social, and governance factors, providing a broader perspective on sustainability and ethical risks within an organization. Environmental due diligence focuses specifically on assessing environmental compliance and liabilities, such as contamination and regulatory adherence, primarily related to physical assets and sites. Choosing between ESG and environmental due diligence depends on the scope of analysis required, with ESG due diligence being preferable for holistic risk assessment and long-term value creation in consulting projects.

Connection

ESG due diligence and Environmental due diligence are closely connected through their focus on assessing environmental risks and sustainability practices within a company's operations. Environmental due diligence provides critical data on a company's ecological impact, which feeds into the broader ESG framework that includes social and governance factors. This integrated approach helps consultants identify potential compliance issues and investment risks related to environmental performance.

Key Terms

Regulatory Compliance

Environmental due diligence primarily assesses compliance with environmental laws and regulations to identify potential liabilities related to pollution, waste management, and natural resource usage. ESG due diligence expands this focus to include broader criteria such as social impact, governance practices, and sustainability performance alongside regulatory adherence. Explore detailed comparisons to enhance your understanding of how each approach supports risk management and compliance strategies.

Risk Assessment

Environmental due diligence primarily evaluates potential environmental liabilities and compliance risks tied to a specific transaction or asset, including soil contamination, air and water quality, and waste management. ESG due diligence expands this scope by incorporating environmental, social, and governance factors to assess broader operational, reputational, and regulatory risks that could impact long-term sustainability and financial performance. Explore in-depth comparisons and best practices for integrating risk assessment methodologies in both environmental and ESG due diligence frameworks.

Sustainability Metrics

Environmental due diligence primarily assesses a company's compliance with environmental regulations, impact on natural resources, and potential liabilities related to pollution or waste management. ESG due diligence expands beyond environmental factors to include social responsibility and governance practices, providing a comprehensive evaluation of sustainability metrics such as carbon footprint, labor standards, and board diversity. Discover how integrating both due diligence approaches can optimize sustainability performance and risk management.

Source and External Links

What is Environmental Due Diligence? A Step-by-Step Guide - Environmental due diligence is a process to identify and address environmental liabilities in property or business transactions, covering audits, hazardous materials assessments, soil and water testing, regulatory compliance, and stakeholder engagement to minimize risks and prevent costly oversights.

Environmental Due Diligence - Overview, Triggers, Phases - It is a systematic procedure evaluating a property for environmental contamination risks, typically starting with a Phase I environmental site assessment to identify pollution liabilities and ensure compliance with laws like CERCLA.

Environmental Due Diligence: A Guide for Land Developers | Transect - This due diligence includes specialized investigations such as wetland determinations and habitat assessments to evaluate environmental conditions and regulatory requirements impacting land development projects.

dowidth.com

dowidth.com