Native checkout processes transactions entirely within a merchant's website, offering seamless user experience and full brand control, while hosted checkout redirects customers to a third-party platform for payment, enhancing security and reducing PCI compliance burden. Native checkout optimizes conversion rates by maintaining design consistency, whereas hosted checkout leverages trusted payment gateways to build consumer trust. Explore the differences between native and hosted checkout to determine the best fit for your e-commerce strategy.

Why it is important

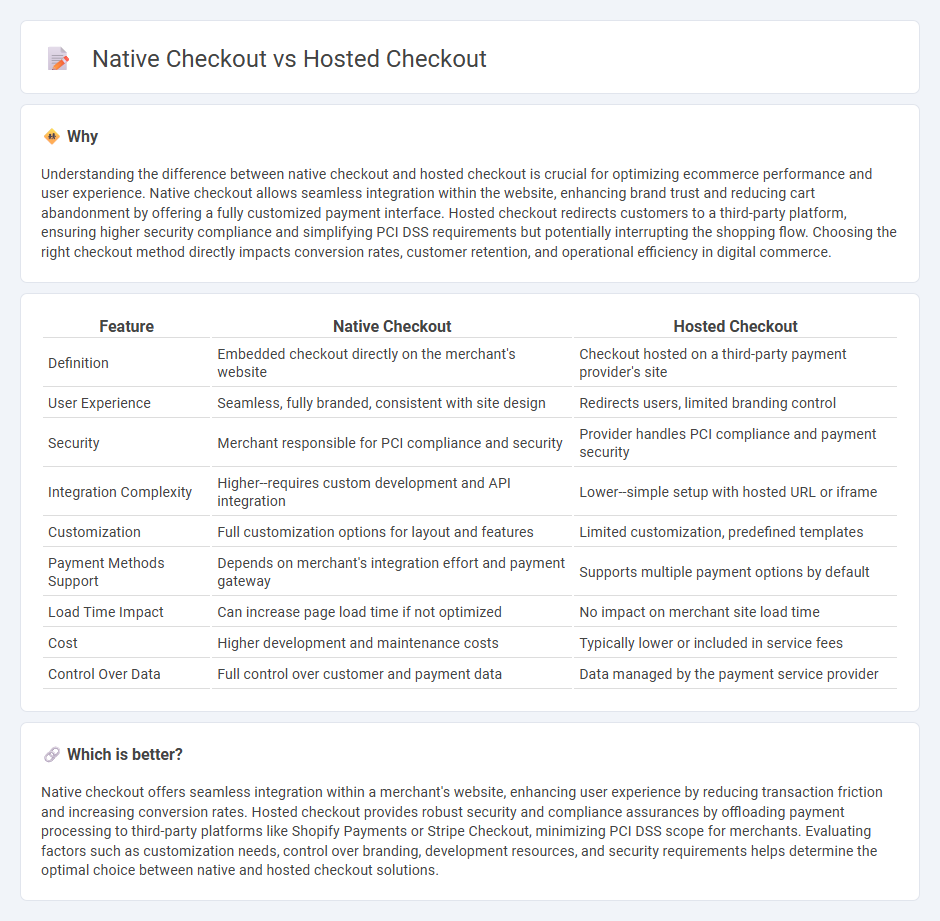

Understanding the difference between native checkout and hosted checkout is crucial for optimizing ecommerce performance and user experience. Native checkout allows seamless integration within the website, enhancing brand trust and reducing cart abandonment by offering a fully customized payment interface. Hosted checkout redirects customers to a third-party platform, ensuring higher security compliance and simplifying PCI DSS requirements but potentially interrupting the shopping flow. Choosing the right checkout method directly impacts conversion rates, customer retention, and operational efficiency in digital commerce.

Comparison Table

| Feature | Native Checkout | Hosted Checkout |

|---|---|---|

| Definition | Embedded checkout directly on the merchant's website | Checkout hosted on a third-party payment provider's site |

| User Experience | Seamless, fully branded, consistent with site design | Redirects users, limited branding control |

| Security | Merchant responsible for PCI compliance and security | Provider handles PCI compliance and payment security |

| Integration Complexity | Higher--requires custom development and API integration | Lower--simple setup with hosted URL or iframe |

| Customization | Full customization options for layout and features | Limited customization, predefined templates |

| Payment Methods Support | Depends on merchant's integration effort and payment gateway | Supports multiple payment options by default |

| Load Time Impact | Can increase page load time if not optimized | No impact on merchant site load time |

| Cost | Higher development and maintenance costs | Typically lower or included in service fees |

| Control Over Data | Full control over customer and payment data | Data managed by the payment service provider |

Which is better?

Native checkout offers seamless integration within a merchant's website, enhancing user experience by reducing transaction friction and increasing conversion rates. Hosted checkout provides robust security and compliance assurances by offloading payment processing to third-party platforms like Shopify Payments or Stripe Checkout, minimizing PCI DSS scope for merchants. Evaluating factors such as customization needs, control over branding, development resources, and security requirements helps determine the optimal choice between native and hosted checkout solutions.

Connection

Native checkout integrates seamlessly within a merchant's app or website, offering a tailored user experience while maintaining complete control over design and functionality. Hosted checkout directs customers to a secure third-party payment page managed by the payment provider, ensuring PCI compliance and reducing the merchant's security burden. Both methods connect through payment gateways that facilitate transaction processing, allowing businesses to choose between customization and simplified security management.

Key Terms

Payment Integration

Hosted checkout simplifies payment integration by redirecting customers to a secure third-party payment page, reducing PCI compliance scope and development effort. Native checkout embeds payment processing directly within the merchant's platform, offering a seamless user experience and greater customization but requiring rigorous security management. Explore detailed comparisons to determine the best payment integration solution for your business.

User Experience

Hosted checkout offers seamless payment processing by redirecting users to a secure third-party page, reducing merchant liability and enhancing trust through established security protocols. Native checkout maintains users within the brand's own interface, providing a customized, consistent experience that can increase conversion rates by minimizing interruptions and loading times. Explore the detailed differences and benefits of each checkout method to optimize your user experience effectively.

Security

Hosted checkout offers enhanced security by offloading payment processing to third-party providers with PCI DSS compliance, reducing the merchant's risk of data breaches. Native checkout involves handling sensitive customer payment data directly, requiring robust security measures and continuous monitoring to prevent fraud and data theft. Explore detailed comparisons to determine which checkout solution best safeguards your transactions.

Source and External Links

Hosted Checkout - Mastercard - Hosted Checkout is an integration where Mastercard Gateway hosts a secure payment page UI collecting payment info, ideal for fast deployment without handling sensitive data directly, though customization of the payment page UI is limited.

What is a hosted payment page? - Checkout.com - A hosted payment page is a secure, PCI-compliant web solution that outsources payment collection to a payment provider, enabling fast, global, customizable, and mobile-responsive transactions without the merchant handling sensitive data.

What Is A Hosted Payment Page and How Do They Work? - North Developer Blog - Hosted Payment Pages keep sensitive payment data away from merchants by directing customers to the payment provider's secure environment, reducing PCI scope and offering flexible options like payment links, iFrames, or hosted forms for easy integration.

dowidth.com

dowidth.com