Pre-loved luxury resale offers authenticated high-end fashion items at significantly reduced prices compared to new luxury retail, appealing to budget-conscious and sustainability-minded consumers. The resale market benefits from a growing demand for circular commerce and eco-friendly shopping alternatives, challenging traditional retail models. Explore how this dynamic shift is transforming the luxury commerce landscape.

Why it is important

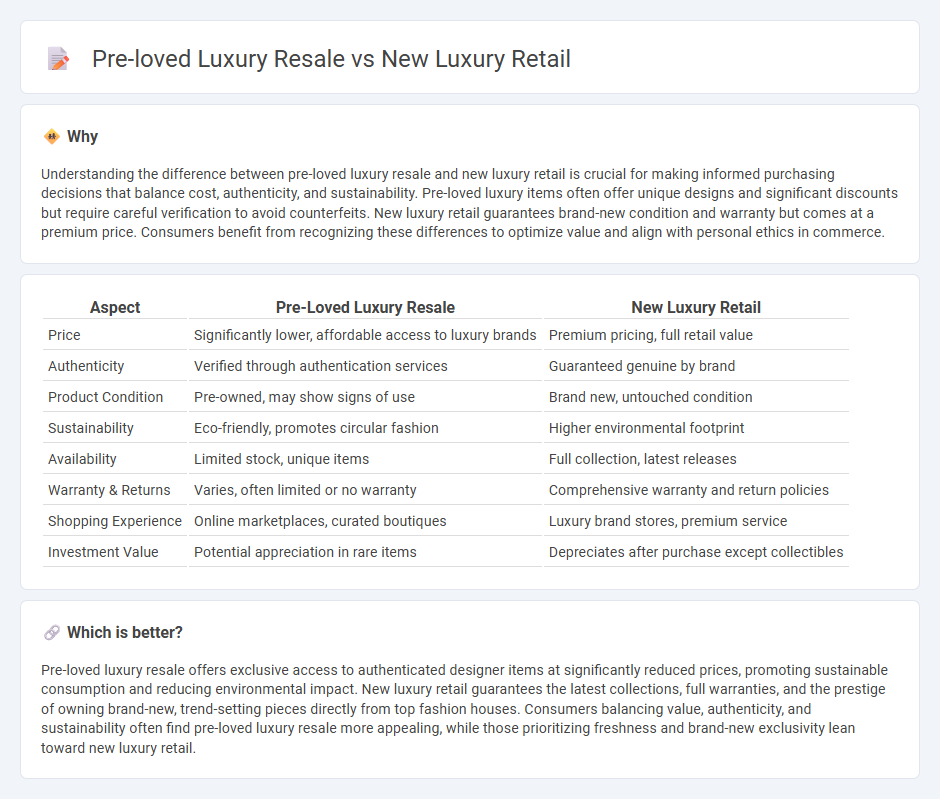

Understanding the difference between pre-loved luxury resale and new luxury retail is crucial for making informed purchasing decisions that balance cost, authenticity, and sustainability. Pre-loved luxury items often offer unique designs and significant discounts but require careful verification to avoid counterfeits. New luxury retail guarantees brand-new condition and warranty but comes at a premium price. Consumers benefit from recognizing these differences to optimize value and align with personal ethics in commerce.

Comparison Table

| Aspect | Pre-Loved Luxury Resale | New Luxury Retail |

|---|---|---|

| Price | Significantly lower, affordable access to luxury brands | Premium pricing, full retail value |

| Authenticity | Verified through authentication services | Guaranteed genuine by brand |

| Product Condition | Pre-owned, may show signs of use | Brand new, untouched condition |

| Sustainability | Eco-friendly, promotes circular fashion | Higher environmental footprint |

| Availability | Limited stock, unique items | Full collection, latest releases |

| Warranty & Returns | Varies, often limited or no warranty | Comprehensive warranty and return policies |

| Shopping Experience | Online marketplaces, curated boutiques | Luxury brand stores, premium service |

| Investment Value | Potential appreciation in rare items | Depreciates after purchase except collectibles |

Which is better?

Pre-loved luxury resale offers exclusive access to authenticated designer items at significantly reduced prices, promoting sustainable consumption and reducing environmental impact. New luxury retail guarantees the latest collections, full warranties, and the prestige of owning brand-new, trend-setting pieces directly from top fashion houses. Consumers balancing value, authenticity, and sustainability often find pre-loved luxury resale more appealing, while those prioritizing freshness and brand-new exclusivity lean toward new luxury retail.

Connection

Pre-loved luxury resale and new luxury retail are interconnected through consumer demand for exclusivity and sustainability, influencing market dynamics in the luxury sector. Resale platforms extend the lifecycle of luxury goods, appealing to eco-conscious buyers while supporting brand prestige by maintaining product desirability. Both sectors leverage digital innovation and data analytics to enhance customer experience and drive growth within the evolving commerce landscape.

Key Terms

Brand Authenticity

Brand authenticity remains a crucial factor distinguishing new luxury retail from pre-loved luxury resale, with original boutiques offering guaranteed provenance and untouched quality. Pre-loved luxury resale platforms increasingly implement rigorous authentication processes, leveraging expert verification and AI technology to ensure genuine products. Explore the evolving standards and consumer trust mechanisms driving authenticity in these luxury markets.

Circular Economy

New luxury retail generates significant environmental impact due to resource-intensive production and high carbon emissions. Pre-loved luxury resale promotes circular economy principles by extending product life cycles, reducing waste, and minimizing resource extraction. Explore how embracing resale can transform fashion sustainability and boost responsible consumerism.

Consumer Demographics

New luxury retail primarily attracts younger, affluent consumers aged 25-40 who prioritize the latest trends and exclusivity, often found in urban metropolitan areas. Pre-loved luxury resale appeals to a broader demographic including eco-conscious millennials and Gen Z shoppers seeking sustainable fashion options at reduced prices. Explore in-depth insights into consumer demographics driving these evolving luxury markets.

Source and External Links

Saks on Amazon: Shop luxury brands like Fear of God and Stella ... - Saks on Amazon offers a curated luxury shopping experience featuring top brands like Dolce&Gabbana and Balmain, combining Saks Fifth Avenue exclusivity with Amazon's convenience and fast shipping, expanding luxury retail digitally in 2025.

Luxury Retail Trends: The State of Luxury Retail in 2025 - Shopify - Luxury retail in 2025 is marked by growing online sales projected at $91 billion, with trends including cross-border ecommerce, personalized experiences, sustainability, immersive augmented reality, and exclusive product drops enhancing the new luxury retail landscape.

Luxury Daily - Luxury Daily reports on luxury industry developments such as brand acquisitions by LVMH, exclusive perks tied to spending thresholds, new marketing campaigns, and sustainability challenges, reflecting the evolving strategies and cultural positioning in luxury retail today.

dowidth.com

dowidth.com