Returnless refunds eliminate the need for customers to send back products, streamlining the refund process and reducing reverse logistics costs for merchants. Chargebacks involve the customer disputing a transaction through their bank, which can lead to fees and potential loss for the seller. Explore more about how these refund methods impact e-commerce profitability and customer experience.

Why it is important

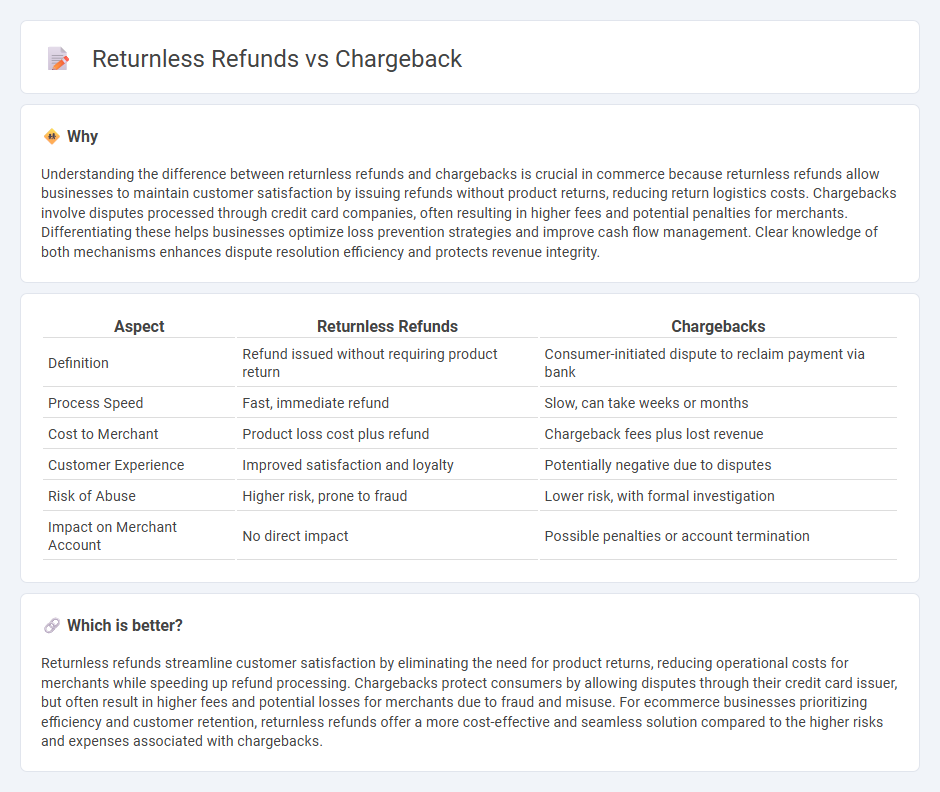

Understanding the difference between returnless refunds and chargebacks is crucial in commerce because returnless refunds allow businesses to maintain customer satisfaction by issuing refunds without product returns, reducing return logistics costs. Chargebacks involve disputes processed through credit card companies, often resulting in higher fees and potential penalties for merchants. Differentiating these helps businesses optimize loss prevention strategies and improve cash flow management. Clear knowledge of both mechanisms enhances dispute resolution efficiency and protects revenue integrity.

Comparison Table

| Aspect | Returnless Refunds | Chargebacks |

|---|---|---|

| Definition | Refund issued without requiring product return | Consumer-initiated dispute to reclaim payment via bank |

| Process Speed | Fast, immediate refund | Slow, can take weeks or months |

| Cost to Merchant | Product loss cost plus refund | Chargeback fees plus lost revenue |

| Customer Experience | Improved satisfaction and loyalty | Potentially negative due to disputes |

| Risk of Abuse | Higher risk, prone to fraud | Lower risk, with formal investigation |

| Impact on Merchant Account | No direct impact | Possible penalties or account termination |

Which is better?

Returnless refunds streamline customer satisfaction by eliminating the need for product returns, reducing operational costs for merchants while speeding up refund processing. Chargebacks protect consumers by allowing disputes through their credit card issuer, but often result in higher fees and potential losses for merchants due to fraud and misuse. For ecommerce businesses prioritizing efficiency and customer retention, returnless refunds offer a more cost-effective and seamless solution compared to the higher risks and expenses associated with chargebacks.

Connection

Returnless refunds and chargebacks both address customer dissatisfaction but operate differently in commerce. Returnless refunds allow merchants to issue refunds without requiring product returns, reducing operational costs and enhancing customer experience. Chargebacks occur when customers dispute a transaction with their bank, often due to unresolved refund issues, leading to potential fees and financial loss for merchants.

Key Terms

Dispute Resolution

Chargebacks involve the cardholder disputing a transaction through their bank, often resulting in a reversal of funds and an investigation into the payment's legitimacy. Returnless refunds allow merchants to issue refunds without requiring the product's return, streamlining dispute resolution and enhancing customer satisfaction while reducing logistical costs. Explore how these dispute resolution methods impact your business's chargeback rates and customer retention strategies.

Customer Retention

Chargeback disputes often lead to high fees and increased merchant risks, negatively impacting customer retention as buyers may feel frustrated or mistrusted. Returnless refunds streamline the process by offering immediate reimbursement without requiring product returns, enhancing customer satisfaction and loyalty through convenience. Discover how leveraging returnless refunds can transform your customer retention strategy.

Payment Reversal

Chargebacks involve the buyer disputing a transaction directly with their bank, triggering a payment reversal that temporarily removes funds from the merchant's account. Returnless refunds allow merchants to issue refunds without requiring the buyer to return the product, speeding up reimbursement while reducing operational costs. Explore detailed comparisons and best practices in managing payment reversals for optimized dispute resolution.

Source and External Links

Chargeback Guidance for Stanford Merchants - Fingate - A chargeback is the reversal of a credit or debit card transaction initiated by a cardholder's bank when a customer disputes a charge, resulting in funds returned to the customer and potential fees for the merchant.

Chargebacks 101: What they are and how businesses can ... - Chargebacks are initiated by the customer's bank reversing a card charge due to customer dispute, unlike refunds which are initiated by the merchant; chargebacks take longer and involve the bank controlling the disputed funds.

Chargeflow: Automated Chargeback Management, Prevention ... - Chargeflow uses AI to help merchants prevent and manage chargebacks, reducing chargeback ratios by up to 90% and recovering lost revenue for businesses worldwide.

dowidth.com

dowidth.com