Scan and go technology revolutionizes retail by allowing customers to scan items with their smartphones while shopping, enabling faster and contactless purchases. Mobile checkout streamlines the payment process by letting shoppers complete transactions via their mobile devices without waiting in traditional checkout lines. Discover how these innovations enhance convenience and efficiency in modern retail experiences.

Why it is important

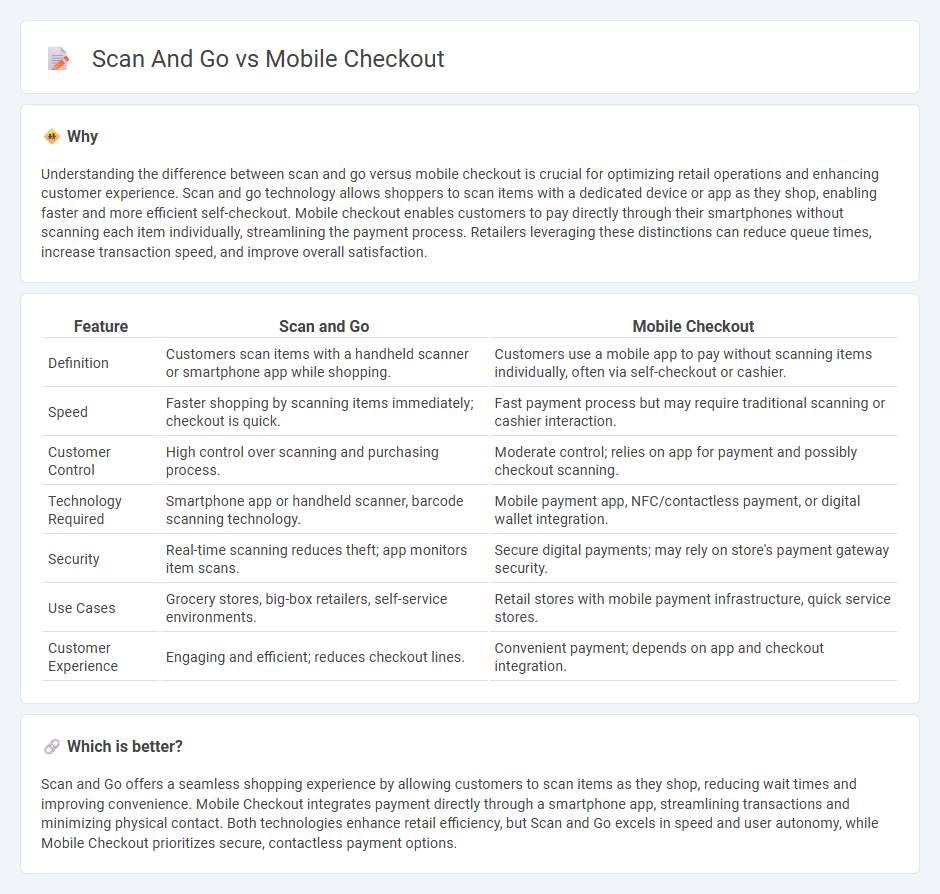

Understanding the difference between scan and go versus mobile checkout is crucial for optimizing retail operations and enhancing customer experience. Scan and go technology allows shoppers to scan items with a dedicated device or app as they shop, enabling faster and more efficient self-checkout. Mobile checkout enables customers to pay directly through their smartphones without scanning each item individually, streamlining the payment process. Retailers leveraging these distinctions can reduce queue times, increase transaction speed, and improve overall satisfaction.

Comparison Table

| Feature | Scan and Go | Mobile Checkout |

|---|---|---|

| Definition | Customers scan items with a handheld scanner or smartphone app while shopping. | Customers use a mobile app to pay without scanning items individually, often via self-checkout or cashier. |

| Speed | Faster shopping by scanning items immediately; checkout is quick. | Fast payment process but may require traditional scanning or cashier interaction. |

| Customer Control | High control over scanning and purchasing process. | Moderate control; relies on app for payment and possibly checkout scanning. |

| Technology Required | Smartphone app or handheld scanner, barcode scanning technology. | Mobile payment app, NFC/contactless payment, or digital wallet integration. |

| Security | Real-time scanning reduces theft; app monitors item scans. | Secure digital payments; may rely on store's payment gateway security. |

| Use Cases | Grocery stores, big-box retailers, self-service environments. | Retail stores with mobile payment infrastructure, quick service stores. |

| Customer Experience | Engaging and efficient; reduces checkout lines. | Convenient payment; depends on app and checkout integration. |

Which is better?

Scan and Go offers a seamless shopping experience by allowing customers to scan items as they shop, reducing wait times and improving convenience. Mobile Checkout integrates payment directly through a smartphone app, streamlining transactions and minimizing physical contact. Both technologies enhance retail efficiency, but Scan and Go excels in speed and user autonomy, while Mobile Checkout prioritizes secure, contactless payment options.

Connection

Scan and go and mobile checkout technologies revolutionize retail by enabling customers to scan items with their smartphones and complete payments digitally, eliminating traditional checkout lines. These systems integrate barcode scanning with mobile payment platforms, enhancing shopping convenience and reducing transaction time. Retailers benefit from streamlined operations and increased customer satisfaction due to faster and contactless purchasing experiences.

Key Terms

POS Integration

Mobile checkout and scan-and-go technologies both revolutionize retail POS integration by enabling seamless, contactless payment experiences that reduce transaction times and enhance customer convenience. Mobile checkout relies heavily on robust POS systems that support mobile wallet integration and real-time inventory updates, whereas scan-and-go demands advanced POS capabilities for instant item scanning and automated cart management. Explore deeper insights into the technical distinctions and benefits of each system to optimize your retail operations.

Self-Scanning

Self-scanning technology enhances mobile checkout by allowing shoppers to scan items directly with their smartphones, streamlining the purchasing process and reducing wait times compared to traditional checkout methods. Scan and go systems often integrate with mobile apps, offering real-time cart updates and instant payment options that improve shopper convenience and store efficiency. Discover how self-scanning innovations are transforming retail experiences and boosting customer satisfaction.

Payment Authentication

Mobile checkout employs advanced biometric authentication such as fingerprint and facial recognition to securely authorize payments, enhancing user convenience and fraud prevention. Scan and Go systems typically rely on barcode or QR code scanning paired with PIN or biometric verification for payment authentication, balancing speed and security at the point of sale. Explore detailed comparisons of payment authentication methods in mobile checkout versus scan and go technologies to understand their impact on retail security and customer experience.

Source and External Links

Mobile Checkout: Drive Sales With a Perfect Checkout Experience - Mobile checkout is the process of completing a purchase on a smartphone or tablet, designed to enhance user experience, reduce cart abandonment, and enable transactions both in-store and online via streamlined, easy-to-navigate payment flows.

Accept payments on-the-go Chase Mobile (r) Checkout - Chase Mobile Checkout lets sellers accept credit card payments anywhere using a smartphone app and contactless card reader, supporting mobile wallets and offering features like tax, tip customization, fast next-day funding, and 24/7 support.

Mobile checkout UI: Best practices for businesses - Mobile checkout UI must be optimized for smaller screens and touch input, requiring simplified forms, easy navigation, and large tap targets to ensure a smooth payment experience distinct from desktop checkout flows.

dowidth.com

dowidth.com