iBuyer platforms use technology and data analytics to provide instant cash offers on properties, streamlining the selling process without the need for traditional listings. Real estate wholesalers, however, focus on contracting properties at below-market prices and quickly assigning the contracts to investors, often requiring minimal upfront capital. Discover how these innovative approaches are reshaping property transactions by exploring their key differences and benefits.

Why it is important

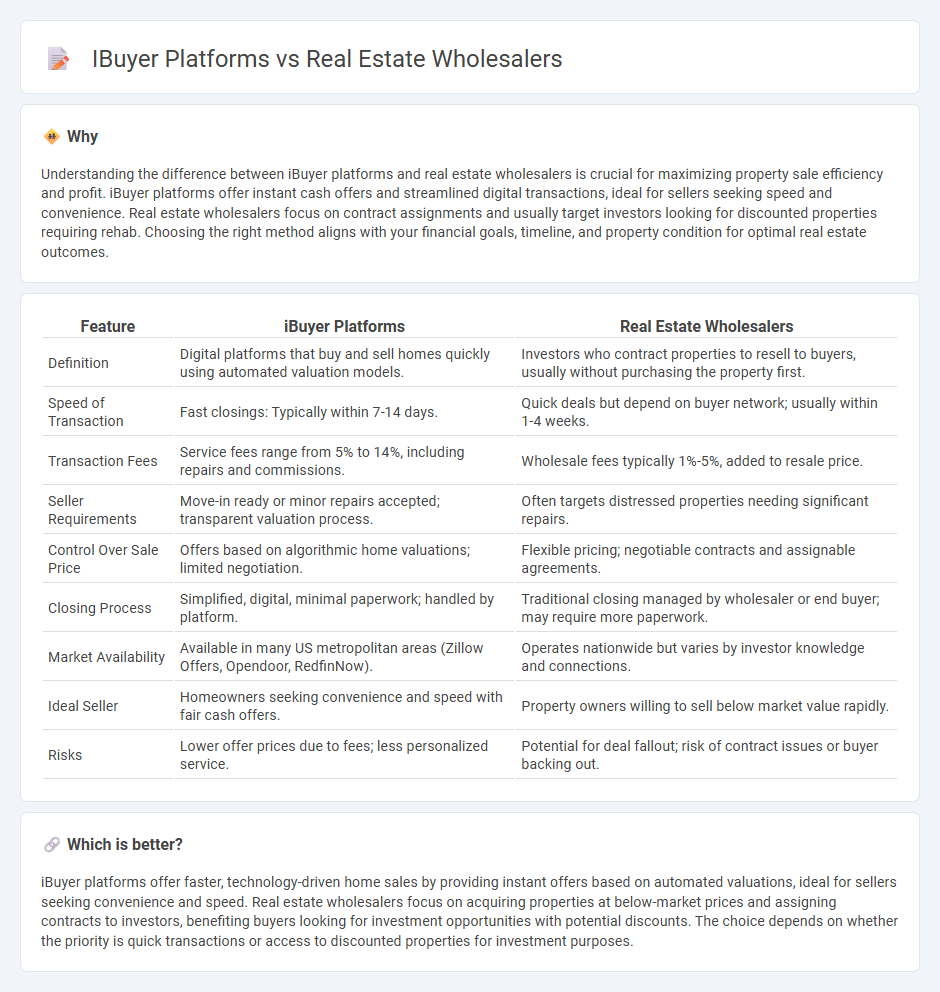

Understanding the difference between iBuyer platforms and real estate wholesalers is crucial for maximizing property sale efficiency and profit. iBuyer platforms offer instant cash offers and streamlined digital transactions, ideal for sellers seeking speed and convenience. Real estate wholesalers focus on contract assignments and usually target investors looking for discounted properties requiring rehab. Choosing the right method aligns with your financial goals, timeline, and property condition for optimal real estate outcomes.

Comparison Table

| Feature | iBuyer Platforms | Real Estate Wholesalers |

|---|---|---|

| Definition | Digital platforms that buy and sell homes quickly using automated valuation models. | Investors who contract properties to resell to buyers, usually without purchasing the property first. |

| Speed of Transaction | Fast closings: Typically within 7-14 days. | Quick deals but depend on buyer network; usually within 1-4 weeks. |

| Transaction Fees | Service fees range from 5% to 14%, including repairs and commissions. | Wholesale fees typically 1%-5%, added to resale price. |

| Seller Requirements | Move-in ready or minor repairs accepted; transparent valuation process. | Often targets distressed properties needing significant repairs. |

| Control Over Sale Price | Offers based on algorithmic home valuations; limited negotiation. | Flexible pricing; negotiable contracts and assignable agreements. |

| Closing Process | Simplified, digital, minimal paperwork; handled by platform. | Traditional closing managed by wholesaler or end buyer; may require more paperwork. |

| Market Availability | Available in many US metropolitan areas (Zillow Offers, Opendoor, RedfinNow). | Operates nationwide but varies by investor knowledge and connections. |

| Ideal Seller | Homeowners seeking convenience and speed with fair cash offers. | Property owners willing to sell below market value rapidly. |

| Risks | Lower offer prices due to fees; less personalized service. | Potential for deal fallout; risk of contract issues or buyer backing out. |

Which is better?

iBuyer platforms offer faster, technology-driven home sales by providing instant offers based on automated valuations, ideal for sellers seeking convenience and speed. Real estate wholesalers focus on acquiring properties at below-market prices and assigning contracts to investors, benefiting buyers looking for investment opportunities with potential discounts. The choice depends on whether the priority is quick transactions or access to discounted properties for investment purposes.

Connection

iBuyer platforms and real estate wholesalers both facilitate quick property transactions by leveraging technology and market data to streamline sales processes. iBuyers use automated valuation models to offer instant cash offers, while wholesalers secure contracts at below-market prices and assign them to end buyers, creating liquidity in the real estate market. Their connection lies in the shared goal of minimizing time on market and reducing transaction complexities for sellers.

Key Terms

Assignment Contract

Real estate wholesalers use assignment contracts to sell property rights to investors before closing, enabling quick transactions without holding the title, whereas iBuyer platforms purchase properties directly for immediate resale using automated algorithms. Assignment contracts in wholesaling allow flexibility for investors to inspect deals, while iBuyers streamline the process with instant cash offers based on data analytics. Explore the nuances between these models and how assignment contracts impact your real estate investment strategies.

Automated Valuation Model (AVM)

Real estate wholesalers rely on personal networks and direct property negotiations, while iBuyer platforms utilize Automated Valuation Models (AVMs) to instantly estimate home values using algorithms and extensive market data. AVMs assess factors like recent sales, property characteristics, and regional trends to provide quick, data-driven offers, enhancing speed and convenience for sellers. Discover how AVMs transform real estate transactions by exploring detailed comparisons and benefits.

Transaction Speed

Real estate wholesalers typically close deals within 7 to 14 days by connecting motivated sellers with cash buyers, enabling faster transaction speeds compared to traditional sales. iBuyer platforms leverage technology and data analytics to offer near-instant cash offers and often close transactions in as few as 3 to 7 days, enhancing efficiency and convenience for sellers. Discover the key differences in transaction speed and decide which solution fits your real estate goals best.

Source and External Links

How to Wholesale Real Estate in Florida 2025? - Houzeo - This guide provides steps and insights on how to successfully wholesale real estate in Florida, highlighting the low-risk and profitable nature of the business.

Wholesale Real Estate: A Beginner's Guide | Rocket Mortgage - Offers a comprehensive introduction to real estate wholesaling, including strategies and examples for those interested in this investment method.

Wholesale Houses For Sale | New Western - Provides access to a curated inventory of wholesale investment properties, focusing on finding win-win deals for both sellers and investors.

dowidth.com

dowidth.com