Escrow crowdfunding and real estate syndication are two popular methods of pooling investor funds for property acquisition. Escrow crowdfunding allows multiple investors to contribute smaller amounts through a regulated online platform, while real estate syndication typically involves a smaller group of investors led by a syndicator managing the investment. Explore the benefits and differences between these approaches to maximize your real estate investment strategy.

Why it is important

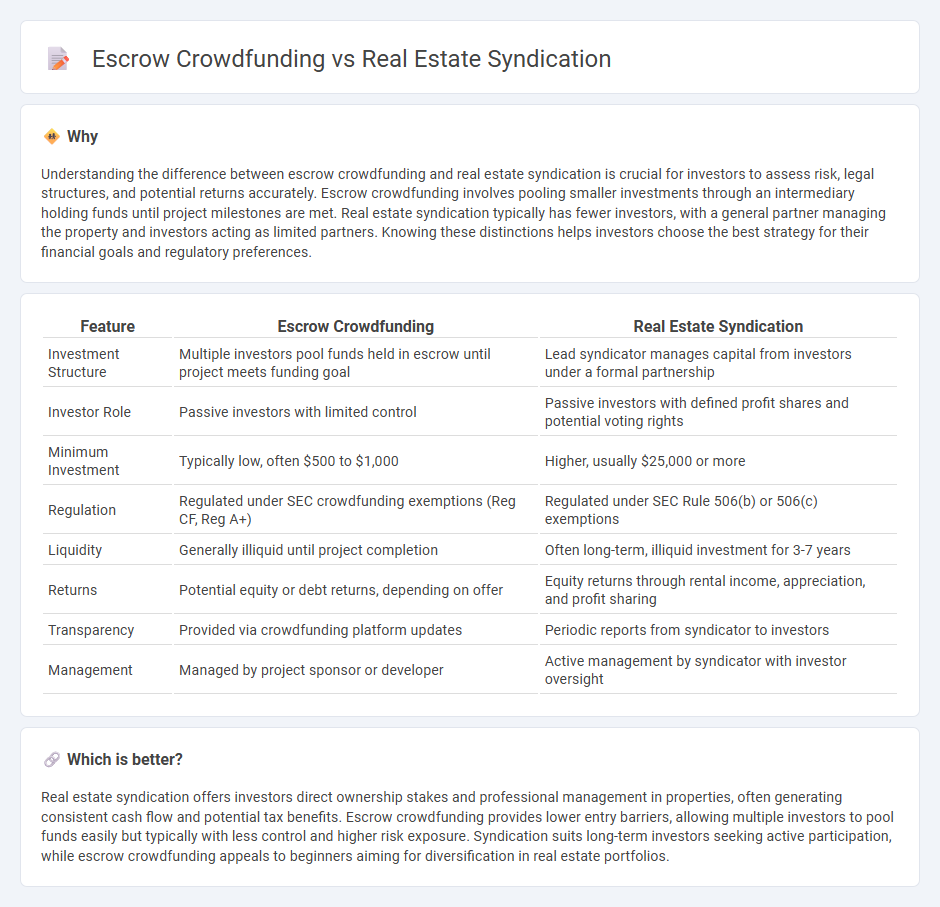

Understanding the difference between escrow crowdfunding and real estate syndication is crucial for investors to assess risk, legal structures, and potential returns accurately. Escrow crowdfunding involves pooling smaller investments through an intermediary holding funds until project milestones are met. Real estate syndication typically has fewer investors, with a general partner managing the property and investors acting as limited partners. Knowing these distinctions helps investors choose the best strategy for their financial goals and regulatory preferences.

Comparison Table

| Feature | Escrow Crowdfunding | Real Estate Syndication |

|---|---|---|

| Investment Structure | Multiple investors pool funds held in escrow until project meets funding goal | Lead syndicator manages capital from investors under a formal partnership |

| Investor Role | Passive investors with limited control | Passive investors with defined profit shares and potential voting rights |

| Minimum Investment | Typically low, often $500 to $1,000 | Higher, usually $25,000 or more |

| Regulation | Regulated under SEC crowdfunding exemptions (Reg CF, Reg A+) | Regulated under SEC Rule 506(b) or 506(c) exemptions |

| Liquidity | Generally illiquid until project completion | Often long-term, illiquid investment for 3-7 years |

| Returns | Potential equity or debt returns, depending on offer | Equity returns through rental income, appreciation, and profit sharing |

| Transparency | Provided via crowdfunding platform updates | Periodic reports from syndicator to investors |

| Management | Managed by project sponsor or developer | Active management by syndicator with investor oversight |

Which is better?

Real estate syndication offers investors direct ownership stakes and professional management in properties, often generating consistent cash flow and potential tax benefits. Escrow crowdfunding provides lower entry barriers, allowing multiple investors to pool funds easily but typically with less control and higher risk exposure. Syndication suits long-term investors seeking active participation, while escrow crowdfunding appeals to beginners aiming for diversification in real estate portfolios.

Connection

Escrow crowdfunding and real estate syndication are connected through their role in pooling investor funds to acquire or develop property, with escrow accounts providing a secure mechanism to hold and manage these funds until transaction conditions are met. Real estate syndication leverages this structure to offer fractional ownership opportunities, allowing multiple investors to participate in larger projects. This synergy ensures transparency, reduces risk, and streamlines capital management in complex real estate investments.

Key Terms

Pooling of Investors

Real estate syndication involves a group of investors pooling capital to purchase and manage properties collectively, typically led by a syndicator who handles asset management and decision-making. Escrow crowdfunding aggregates funds from numerous investors into an escrow account until reaching a funding target, ensuring secure transaction flow and compliance before property acquisition. Explore the distinctions in investor pooling methods to determine which strategy aligns best with your investment goals.

Third-Party Custodian

Real estate syndication and escrow crowdfunding both involve pooling investor funds but differ primarily in fund management; syndication often relies on a third-party custodian to securely hold and manage capital, ensuring compliance and investor protection. Escrow crowdfunding uses an escrow agent to temporarily hold funds until the funding target is met, minimizing risk but limiting capital flexibility. Explore the nuances of custodial roles and investor safeguards to make informed decisions in real estate investing.

Joint Ownership

Real estate syndication involves multiple investors pooling resources to jointly own and manage a property, typically under a structured partnership led by a sponsor or syndicator. Escrow crowdfunding allows investors to collectively fund a property purchase, but ownership is usually divided based on individual contributions held in escrow until closing, without direct joint management responsibilities. Explore the nuances of joint ownership in both models to determine the best fit for your investment goals.

Source and External Links

Real Estate Syndicates and Investment Trusts - This document describes real estate syndication as a method for pooling private savings into real estate investments, often involving multiple investors and a sponsor for management.

Introduction to Real Estate Syndication - It explains that real estate syndication involves aggregating funds from multiple investors to invest in specific real estate opportunities, often organized by experienced sponsors.

Real Estate Syndications vs. REITs - This article compares real estate syndications, which offer direct property ownership, with REITs, highlighting their differences in investment structure and risk.

dowidth.com

dowidth.com