Sale leaseback allows property owners to sell their real estate while simultaneously leasing it back, providing immediate capital without disrupting operations. Ground leases involve leasing land separately from the buildings, enabling tenants to develop or use the property while paying rent to the landowner. Explore more to understand which strategy maximizes your real estate investment.

Why it is important

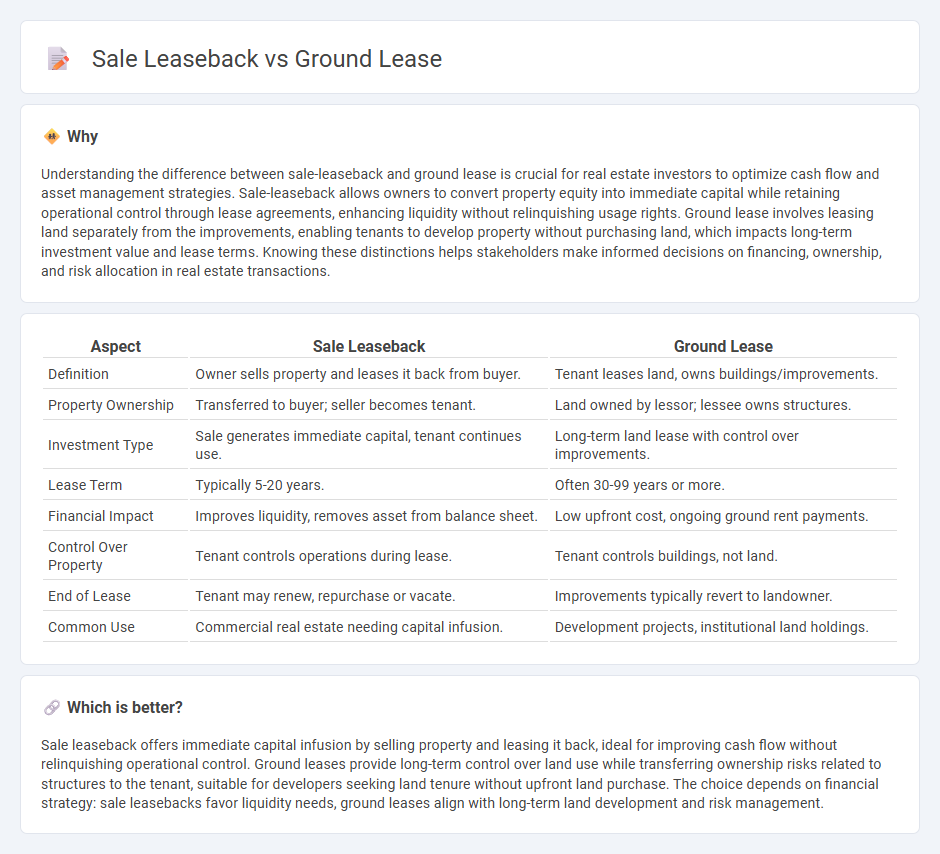

Understanding the difference between sale-leaseback and ground lease is crucial for real estate investors to optimize cash flow and asset management strategies. Sale-leaseback allows owners to convert property equity into immediate capital while retaining operational control through lease agreements, enhancing liquidity without relinquishing usage rights. Ground lease involves leasing land separately from the improvements, enabling tenants to develop property without purchasing land, which impacts long-term investment value and lease terms. Knowing these distinctions helps stakeholders make informed decisions on financing, ownership, and risk allocation in real estate transactions.

Comparison Table

| Aspect | Sale Leaseback | Ground Lease |

|---|---|---|

| Definition | Owner sells property and leases it back from buyer. | Tenant leases land, owns buildings/improvements. |

| Property Ownership | Transferred to buyer; seller becomes tenant. | Land owned by lessor; lessee owns structures. |

| Investment Type | Sale generates immediate capital, tenant continues use. | Long-term land lease with control over improvements. |

| Lease Term | Typically 5-20 years. | Often 30-99 years or more. |

| Financial Impact | Improves liquidity, removes asset from balance sheet. | Low upfront cost, ongoing ground rent payments. |

| Control Over Property | Tenant controls operations during lease. | Tenant controls buildings, not land. |

| End of Lease | Tenant may renew, repurchase or vacate. | Improvements typically revert to landowner. |

| Common Use | Commercial real estate needing capital infusion. | Development projects, institutional land holdings. |

Which is better?

Sale leaseback offers immediate capital infusion by selling property and leasing it back, ideal for improving cash flow without relinquishing operational control. Ground leases provide long-term control over land use while transferring ownership risks related to structures to the tenant, suitable for developers seeking land tenure without upfront land purchase. The choice depends on financial strategy: sale leasebacks favor liquidity needs, ground leases align with long-term land development and risk management.

Connection

Sale leaseback and ground lease are connected through their use of long-term lease agreements that allow property owners to retain operational control while unlocking capital. In both arrangements, the ownership of the land or property changes hands, but the original user continues to occupy the space under lease terms. These financial strategies optimize asset utilization and improve liquidity for businesses and investors in the real estate market.

Key Terms

Ownership

Ground lease allows the tenant to use land owned by the landlord, retaining ownership of the property while the leaseholder gains usage rights for a specified term, typically long-term. Sale leaseback involves the owner selling the property to an investor and simultaneously leasing it back, enabling the seller to retain occupancy without ownership. Discover the key differences in ownership dynamics and financial implications between ground leases and sale leasebacks.

Lease Term

Ground leases typically feature long lease terms ranging from 50 to 99 years, providing stability and control over land use without ownership transfer. Sale leasebacks generally involve shorter lease terms, often 5 to 20 years, aligning with the seller-lessee's operational and financial strategies. Explore detailed comparisons to understand which lease term suits your investment or business needs best.

Capital Structure

Ground leases allow companies to separate ownership of land from improvements, preserving capital and improving balance sheet flexibility by avoiding upfront land acquisition costs. Sale leasebacks convert owned property into liquid capital by selling the asset and leasing it back, which can improve liquidity and adjust debt-to-equity ratios favorably. Explore detailed impacts of ground leases and sale leasebacks on capital structure to optimize financial strategy.

Source and External Links

Key Considerations in a Ground Lease - This article discusses the complexities and key considerations of ground leases, including advantages for both landlords and tenants, and the legal aspects involved in negotiating these agreements.

Ground Lease vs Land Lease: Key Differences - This webpage explains the basics of a ground lease, highlighting its long-term nature and how it differs from other types of leases, allowing for land retention by the owner while enabling tenants to develop properties.

What Is A Ground Lease - This resource defines a ground lease as a formal agreement between a landowner and a property developer, detailing the fundamental inclusions and financial conditions of such leases.

dowidth.com

dowidth.com