Automated valuation models (AVMs) use algorithms and large data sets to quickly estimate property values with consistent accuracy, relying on recent sales, property characteristics, and market trends. Full appraisals involve certified appraisers conducting in-depth property inspections and market analyses, ensuring detailed valuation tailored to unique property features and conditions. Explore the advantages and limitations of AVMs and full appraisals to make informed real estate decisions.

Why it is important

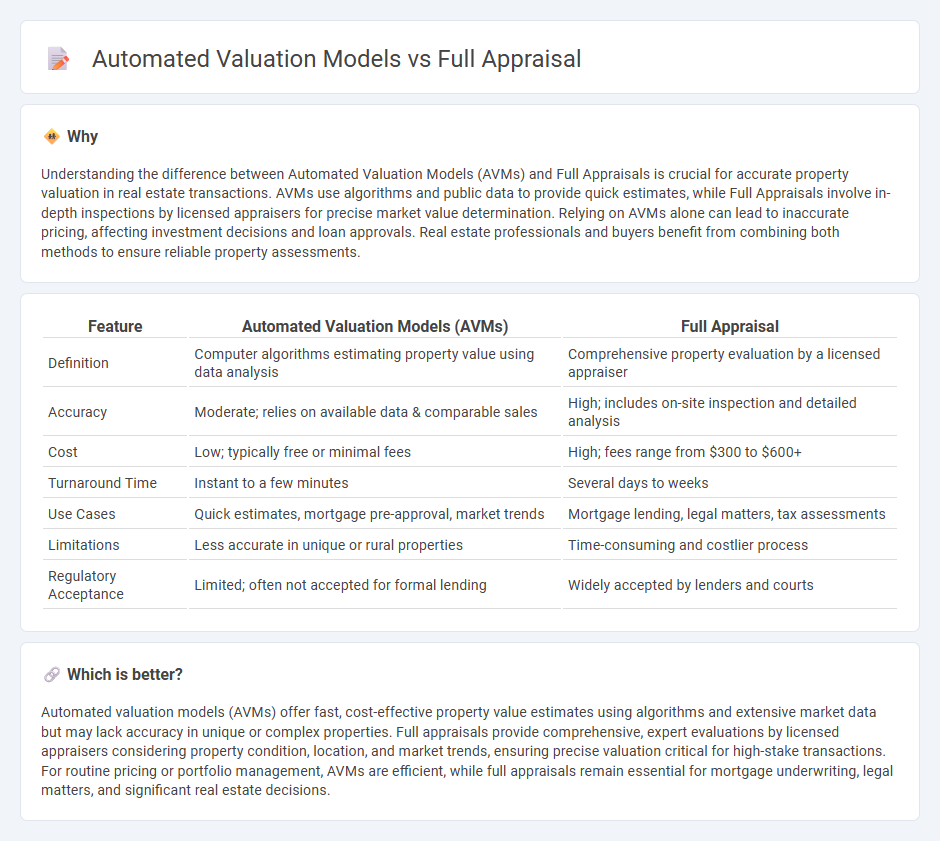

Understanding the difference between Automated Valuation Models (AVMs) and Full Appraisals is crucial for accurate property valuation in real estate transactions. AVMs use algorithms and public data to provide quick estimates, while Full Appraisals involve in-depth inspections by licensed appraisers for precise market value determination. Relying on AVMs alone can lead to inaccurate pricing, affecting investment decisions and loan approvals. Real estate professionals and buyers benefit from combining both methods to ensure reliable property assessments.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Full Appraisal |

|---|---|---|

| Definition | Computer algorithms estimating property value using data analysis | Comprehensive property evaluation by a licensed appraiser |

| Accuracy | Moderate; relies on available data & comparable sales | High; includes on-site inspection and detailed analysis |

| Cost | Low; typically free or minimal fees | High; fees range from $300 to $600+ |

| Turnaround Time | Instant to a few minutes | Several days to weeks |

| Use Cases | Quick estimates, mortgage pre-approval, market trends | Mortgage lending, legal matters, tax assessments |

| Limitations | Less accurate in unique or rural properties | Time-consuming and costlier process |

| Regulatory Acceptance | Limited; often not accepted for formal lending | Widely accepted by lenders and courts |

Which is better?

Automated valuation models (AVMs) offer fast, cost-effective property value estimates using algorithms and extensive market data but may lack accuracy in unique or complex properties. Full appraisals provide comprehensive, expert evaluations by licensed appraisers considering property condition, location, and market trends, ensuring precise valuation critical for high-stake transactions. For routine pricing or portfolio management, AVMs are efficient, while full appraisals remain essential for mortgage underwriting, legal matters, and significant real estate decisions.

Connection

Automated Valuation Models (AVMs) and full appraisals both provide property value estimates, with AVMs leveraging algorithms and big data for rapid, cost-effective valuations. Full appraisals involve detailed physical inspections and expert analysis, offering comprehensive and precise market value assessments. Combining AVMs with full appraisals enhances accuracy and efficiency in real estate valuation processes.

Key Terms

Market Value

Full appraisals provide a comprehensive market value estimate by incorporating detailed property inspections, neighborhood analysis, and current market trends, ensuring accuracy and consideration of unique property features. Automated valuation models (AVMs) utilize algorithms and large datasets, such as recent sales and tax assessments, to quickly estimate market value but may lack the nuanced insight of a professional appraiser. Explore further to understand which valuation method best suits your real estate needs and goals.

Comparable Sales (Comps)

Full appraisals use Comparable Sales (Comps) data analyzed by expert appraisers who evaluate property conditions, market trends, and unique features, offering a comprehensive and precise valuation. Automated Valuation Models (AVMs) rely on algorithms that process public property records and recent sales prices quickly but may lack nuance in adjusting for property-specific factors. Discover how leveraging both methods can optimize property valuation accuracy.

Algorithm

Full Appraisals rely on expert appraisers who analyze property details, market trends, and comparable sales to deliver accurate valuations. Automated Valuation Models (AVMs) use sophisticated algorithms processing vast datasets, including recent sales, property characteristics, and neighborhood statistics, to estimate property values rapidly. Explore the distinct algorithmic methodologies behind these valuation approaches to understand their accuracy and application.

Source and External Links

What are the different types of real estate appraisals? - A full appraisal is a comprehensive evaluation involving both interior and exterior inspections of a property to determine its fair market value.

Understanding the Different Types of Home Appraisals - A full home appraisal involves a thorough inspection by a licensed appraiser to assess the property's condition and compare it to similar properties.

Desktop Appraisal vs. Full Appraisal - A full appraisal is an onsite physical valuation that includes detailed assessments of both the interior and exterior of a property.

dowidth.com

dowidth.com