Micro flipping focuses on rapidly buying and reselling properties with minimal renovations to capitalize on market demand, while fix and flip involves extensive property improvements before selling for a higher profit margin. Micro flipping typically requires less capital and shorter holding periods, appealing to investors seeking quick returns. Explore the advantages and strategies of both micro flipping and fix and flip to determine which real estate investment suits your goals.

Why it is important

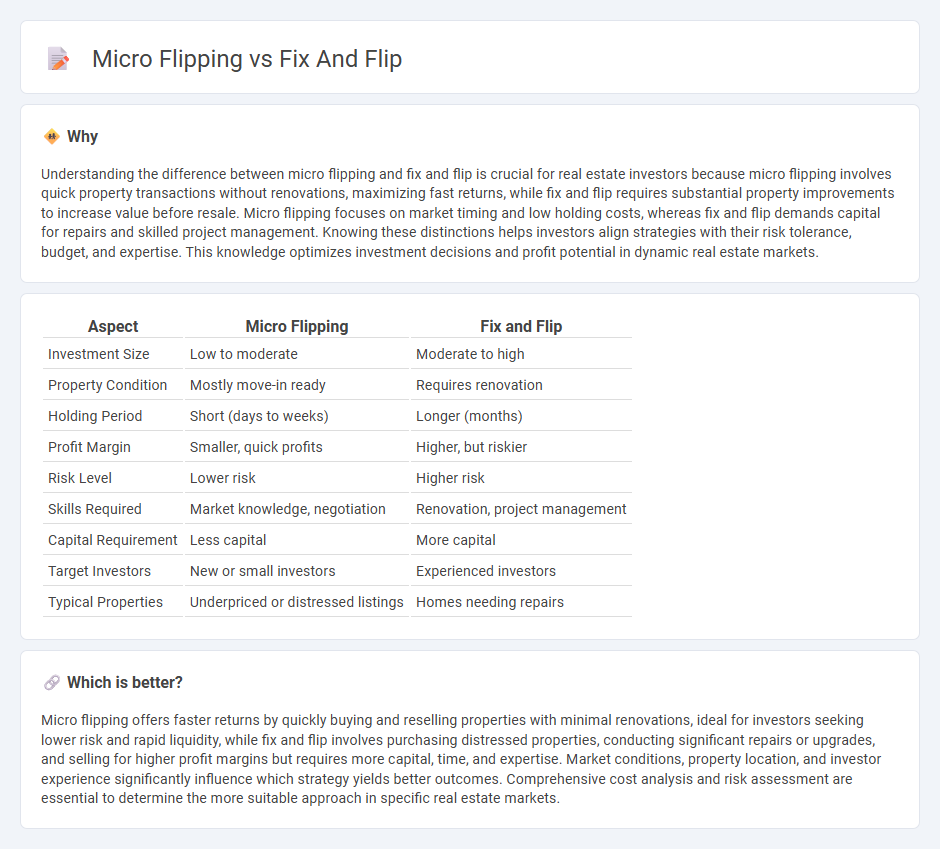

Understanding the difference between micro flipping and fix and flip is crucial for real estate investors because micro flipping involves quick property transactions without renovations, maximizing fast returns, while fix and flip requires substantial property improvements to increase value before resale. Micro flipping focuses on market timing and low holding costs, whereas fix and flip demands capital for repairs and skilled project management. Knowing these distinctions helps investors align strategies with their risk tolerance, budget, and expertise. This knowledge optimizes investment decisions and profit potential in dynamic real estate markets.

Comparison Table

| Aspect | Micro Flipping | Fix and Flip |

|---|---|---|

| Investment Size | Low to moderate | Moderate to high |

| Property Condition | Mostly move-in ready | Requires renovation |

| Holding Period | Short (days to weeks) | Longer (months) |

| Profit Margin | Smaller, quick profits | Higher, but riskier |

| Risk Level | Lower risk | Higher risk |

| Skills Required | Market knowledge, negotiation | Renovation, project management |

| Capital Requirement | Less capital | More capital |

| Target Investors | New or small investors | Experienced investors |

| Typical Properties | Underpriced or distressed listings | Homes needing repairs |

Which is better?

Micro flipping offers faster returns by quickly buying and reselling properties with minimal renovations, ideal for investors seeking lower risk and rapid liquidity, while fix and flip involves purchasing distressed properties, conducting significant repairs or upgrades, and selling for higher profit margins but requires more capital, time, and expertise. Market conditions, property location, and investor experience significantly influence which strategy yields better outcomes. Comprehensive cost analysis and risk assessment are essential to determine the more suitable approach in specific real estate markets.

Connection

Micro flipping and fix and flip both involve purchasing properties below market value to generate profit through resale, but micro flipping focuses on rapid transactions without major renovations, while fix and flip requires substantial property improvements. Investors in micro flipping leverage market trends and quick turnarounds to capitalize on small price differences, whereas fix and flip investors invest time and capital in repairs to significantly increase property value. Both strategies depend on accurate market analysis, property evaluation, and timing to maximize returns in the real estate market.

Key Terms

Renovation

Fix and flip projects involve substantial renovations to underpriced properties, aiming to increase market value significantly before resale. Micro flipping targets quick, low-effort turnovers, often requiring minimal or cosmetic fixes to capitalize on small price differences. Explore detailed strategies and renovation insights to maximize profits in each approach.

Wholesaling

Fix and flip involves purchasing distressed properties, renovating them, and selling for profit, often requiring significant capital and time. Micro flipping centers on quickly reselling contracts or assignments, minimizing investment and risk while leveraging wholesaling techniques. Explore more to understand which strategy aligns with your investment goals.

Holding period

Fix and flip projects typically involve holding periods ranging from several months to a year, allowing investors time to renovate and sell properties for profit. Micro flipping focuses on extremely short holding periods, often just a few days or weeks, by quickly reselling properties with minimal or no improvements. Explore the advantages and strategies of holding periods in fix and flip versus micro flipping to make informed investment decisions.

Source and External Links

Fix-and-Flip Deals: Beginner's Guide to Profitable Property Flipping - A fix-and-flip deal involves purchasing a property, making improvements typically over a few months, and then selling it for a profit by buying below market value and enhancing the property.

Fix & Flip: The Complete Guide to Flipping Houses - Boston Pads - Fix & Flip is a real estate strategy where investors buy properties in need of renovation, fix them up, then resell at a higher price to profit from the added value through refurbishment.

Fix-and-flip - Sharestates - This strategy focuses on buying discounted properties that need repair, renovating them, and selling quickly for as much profit as possible, ensuring that renovation costs add greater value than their expense.

dowidth.com

dowidth.com