Single family rentals offer privacy and space, attracting long-term tenants seeking suburban comfort, while duplexes provide dual income potential and lower entry costs in often more urban settings. Investors weigh factors such as maintenance expenses, tenant turnover rates, and scalability when choosing between these property types. Explore the advantages and challenges of each to determine the best fit for your real estate investment goals.

Why it is important

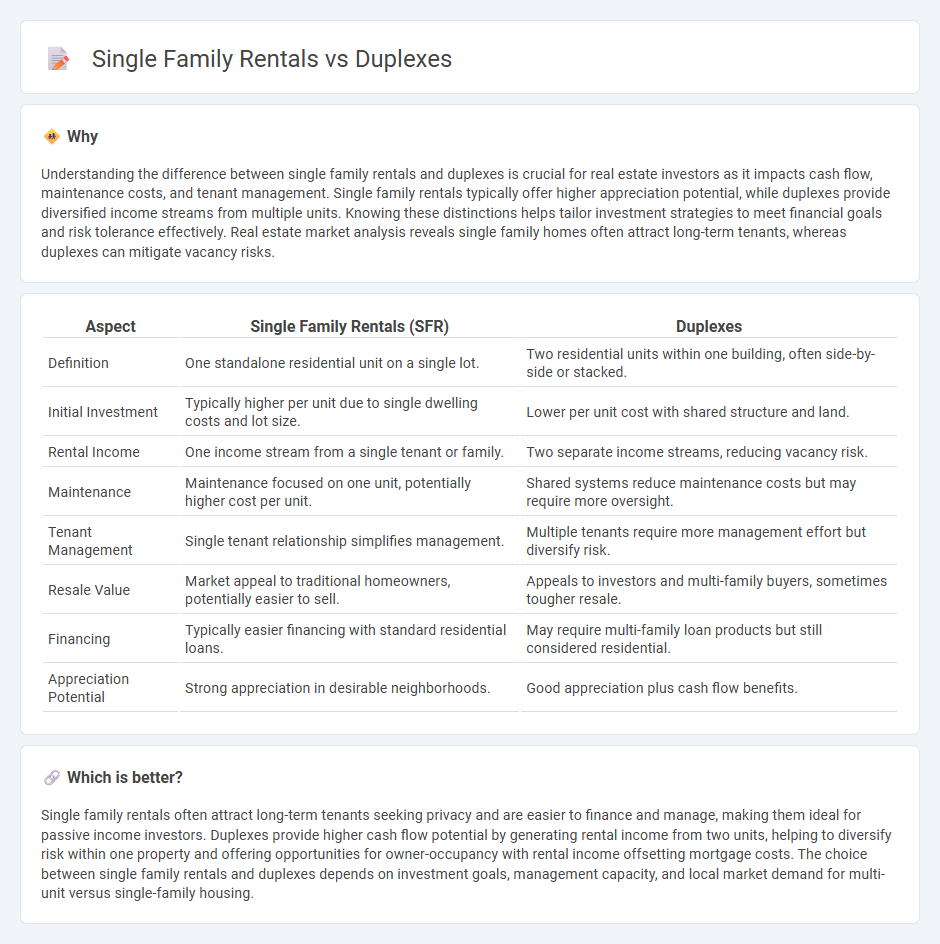

Understanding the difference between single family rentals and duplexes is crucial for real estate investors as it impacts cash flow, maintenance costs, and tenant management. Single family rentals typically offer higher appreciation potential, while duplexes provide diversified income streams from multiple units. Knowing these distinctions helps tailor investment strategies to meet financial goals and risk tolerance effectively. Real estate market analysis reveals single family homes often attract long-term tenants, whereas duplexes can mitigate vacancy risks.

Comparison Table

| Aspect | Single Family Rentals (SFR) | Duplexes |

|---|---|---|

| Definition | One standalone residential unit on a single lot. | Two residential units within one building, often side-by-side or stacked. |

| Initial Investment | Typically higher per unit due to single dwelling costs and lot size. | Lower per unit cost with shared structure and land. |

| Rental Income | One income stream from a single tenant or family. | Two separate income streams, reducing vacancy risk. |

| Maintenance | Maintenance focused on one unit, potentially higher cost per unit. | Shared systems reduce maintenance costs but may require more oversight. |

| Tenant Management | Single tenant relationship simplifies management. | Multiple tenants require more management effort but diversify risk. |

| Resale Value | Market appeal to traditional homeowners, potentially easier to sell. | Appeals to investors and multi-family buyers, sometimes tougher resale. |

| Financing | Typically easier financing with standard residential loans. | May require multi-family loan products but still considered residential. |

| Appreciation Potential | Strong appreciation in desirable neighborhoods. | Good appreciation plus cash flow benefits. |

Which is better?

Single family rentals often attract long-term tenants seeking privacy and are easier to finance and manage, making them ideal for passive income investors. Duplexes provide higher cash flow potential by generating rental income from two units, helping to diversify risk within one property and offering opportunities for owner-occupancy with rental income offsetting mortgage costs. The choice between single family rentals and duplexes depends on investment goals, management capacity, and local market demand for multi-unit versus single-family housing.

Connection

Single family rentals and duplexes both serve as key asset classes in residential real estate, attracting investors seeking stable cash flow and long-term appreciation. Duplexes offer advantages of multi-unit income under one roof, while single family rentals provide tenant stability and easier property management. Both property types benefit from growing rental demand driven by housing affordability challenges and shifting demographic trends.

Key Terms

Cash Flow

Duplexes often provide higher cash flow compared to single-family rentals due to multiple rental units generating simultaneous income streams, reducing vacancy risk, and maximizing property value. Single-family rentals typically offer lower maintenance costs and easier tenant management but may yield less overall monthly cash flow. Explore detailed comparisons to optimize your real estate investment strategy and maximize cash flow potential.

Occupancy Rate

Duplexes typically maintain higher occupancy rates compared to single-family rentals due to their affordability and appeal to a broader range of tenants, including small families and professionals. The dual-unit structure allows landlords to mitigate vacancy risks by generating income from one unit even if the other is vacant. Explore detailed occupancy trends and investment benefits to optimize your rental property strategy.

Maintenance Costs

Maintenance costs for duplexes typically average 10-15% higher than single-family rentals due to the increased number of units requiring repairs and upkeep. Shared walls in duplexes can lead to frequent issues such as noise insulation and plumbing complications, elevating maintenance expenses. Explore detailed comparisons to optimize your rental property investment decisions.

Source and External Links

What is a Duplex? - This article explains the concept of duplexes, including their configurations and differences in various locations.

Duplex: Side-by-Side - This webpage describes the side-by-side duplex type, including its typical specifications and appearance.

What Is A Duplex? - This page provides an overview of duplexes, comparing them to accessory dwelling units and discussing zoning requirements.

dowidth.com

dowidth.com