Blockchain technology enhances real estate transactions by ensuring secure, transparent property records and reducing fraud risks. Due diligence automation streamlines verification processes, accelerates title searches, and minimizes human errors. Explore how these innovations revolutionize property ownership and investment for greater confidence and efficiency.

Why it is important

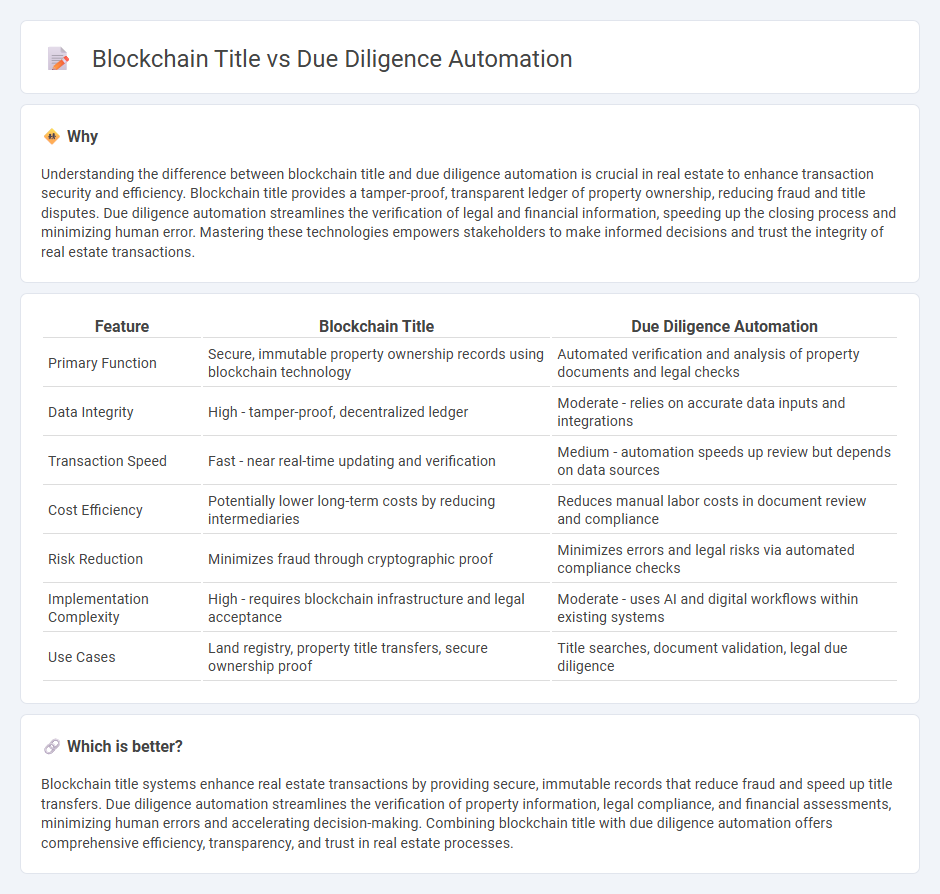

Understanding the difference between blockchain title and due diligence automation is crucial in real estate to enhance transaction security and efficiency. Blockchain title provides a tamper-proof, transparent ledger of property ownership, reducing fraud and title disputes. Due diligence automation streamlines the verification of legal and financial information, speeding up the closing process and minimizing human error. Mastering these technologies empowers stakeholders to make informed decisions and trust the integrity of real estate transactions.

Comparison Table

| Feature | Blockchain Title | Due Diligence Automation |

|---|---|---|

| Primary Function | Secure, immutable property ownership records using blockchain technology | Automated verification and analysis of property documents and legal checks |

| Data Integrity | High - tamper-proof, decentralized ledger | Moderate - relies on accurate data inputs and integrations |

| Transaction Speed | Fast - near real-time updating and verification | Medium - automation speeds up review but depends on data sources |

| Cost Efficiency | Potentially lower long-term costs by reducing intermediaries | Reduces manual labor costs in document review and compliance |

| Risk Reduction | Minimizes fraud through cryptographic proof | Minimizes errors and legal risks via automated compliance checks |

| Implementation Complexity | High - requires blockchain infrastructure and legal acceptance | Moderate - uses AI and digital workflows within existing systems |

| Use Cases | Land registry, property title transfers, secure ownership proof | Title searches, document validation, legal due diligence |

Which is better?

Blockchain title systems enhance real estate transactions by providing secure, immutable records that reduce fraud and speed up title transfers. Due diligence automation streamlines the verification of property information, legal compliance, and financial assessments, minimizing human errors and accelerating decision-making. Combining blockchain title with due diligence automation offers comprehensive efficiency, transparency, and trust in real estate processes.

Connection

Blockchain title technology enhances real estate transactions by creating immutable, transparent property records that streamline due diligence processes. Automated due diligence leverages blockchain's secure data verification to reduce fraud, decrease title search times, and improve accuracy in ownership history. This integration optimizes property verification workflows, leading to faster closings and increased trust among buyers, sellers, and lenders.

Key Terms

Smart Contracts

Smart contracts streamline due diligence automation by enabling self-executing agreements with pre-coded conditions verified on the blockchain, reducing manual errors and enhancing transparency. Blockchain's immutable ledger ensures secure, real-time access to verified transaction histories and compliance records, accelerating decision-making processes. Explore how smart contracts transform due diligence automation by visiting our in-depth resource.

Title Chain Validation

Title Chain Validation enhances due diligence automation by leveraging blockchain's immutable ledger to verify property ownership history accurately and efficiently. This integration reduces the risk of errors and fraud while expediting the verification process for real estate transactions. Explore how Title Chain Validation transforms due diligence with blockchain technology for secure and transparent property records.

Document Verification

Due diligence automation streamlines document verification by using AI and machine learning to quickly analyze and validate identities, contracts, and financial records, reducing human error. Blockchain enhances document verification through its immutable ledger, enabling secure and transparent record-keeping that prevents tampering and ensures authenticity. Explore how combining these technologies can revolutionize your document verification process.

Source and External Links

Why Your Business Needs Due Diligence Automation - Due diligence automation uses technologies like machine learning, optical character recognition, and robotic process automation to dramatically reduce document review time and cost, while increasing accuracy by gathering and analyzing data from multiple sources automatically.

How to Automate the Customer Due Diligence (CDD) Process - Customer Due Diligence automation streamlines onboarding and ongoing monitoring by automating data collection, watchlist screening, risk assessment, and compliance, speeding up processes and reducing operational costs.

Enhanced Due Diligence Made Easy | Fraud & Compliance Efficiency - Enhanced due diligence automation tackles compliance and fraud risks by integrating customer identification, AML monitoring, and case management into a single platform, making customer experience smoother and easing workload on compliance teams.

dowidth.com

dowidth.com