Ghost listings in real estate refer to properties marketed privately without public MLS exposure, often to maintain exclusivity or test market interest, while commercial listings openly advertise properties targeting business or investment buyers. Understanding the strategic benefits and risks of ghost listings versus traditional commercial listings can influence how quickly and profitably a property sells. Explore these listing types further to determine the best approach for your real estate goals.

Why it is important

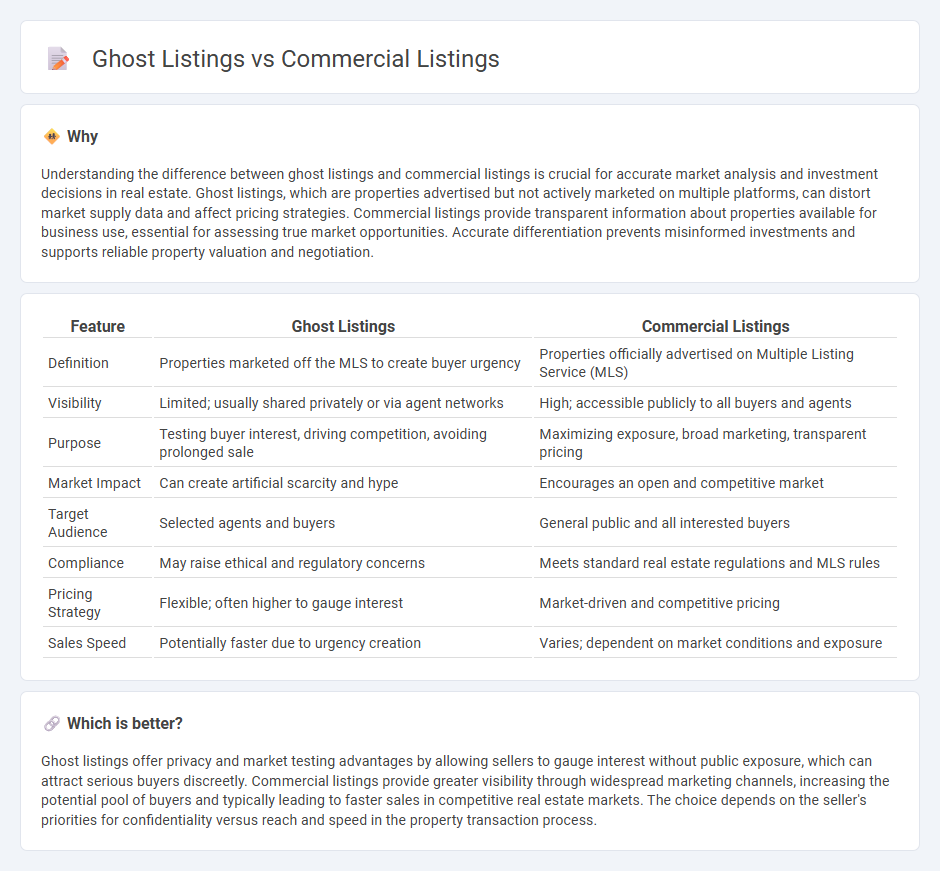

Understanding the difference between ghost listings and commercial listings is crucial for accurate market analysis and investment decisions in real estate. Ghost listings, which are properties advertised but not actively marketed on multiple platforms, can distort market supply data and affect pricing strategies. Commercial listings provide transparent information about properties available for business use, essential for assessing true market opportunities. Accurate differentiation prevents misinformed investments and supports reliable property valuation and negotiation.

Comparison Table

| Feature | Ghost Listings | Commercial Listings |

|---|---|---|

| Definition | Properties marketed off the MLS to create buyer urgency | Properties officially advertised on Multiple Listing Service (MLS) |

| Visibility | Limited; usually shared privately or via agent networks | High; accessible publicly to all buyers and agents |

| Purpose | Testing buyer interest, driving competition, avoiding prolonged sale | Maximizing exposure, broad marketing, transparent pricing |

| Market Impact | Can create artificial scarcity and hype | Encourages an open and competitive market |

| Target Audience | Selected agents and buyers | General public and all interested buyers |

| Compliance | May raise ethical and regulatory concerns | Meets standard real estate regulations and MLS rules |

| Pricing Strategy | Flexible; often higher to gauge interest | Market-driven and competitive pricing |

| Sales Speed | Potentially faster due to urgency creation | Varies; dependent on market conditions and exposure |

Which is better?

Ghost listings offer privacy and market testing advantages by allowing sellers to gauge interest without public exposure, which can attract serious buyers discreetly. Commercial listings provide greater visibility through widespread marketing channels, increasing the potential pool of buyers and typically leading to faster sales in competitive real estate markets. The choice depends on the seller's priorities for confidentiality versus reach and speed in the property transaction process.

Connection

Ghost listings in real estate often involve commercial listings where properties are advertised without the intent to sell immediately, creating artificial market demand. This practice can distort market data and obscure the true availability of commercial real estate, impacting pricing and investment decisions. Commercial listings affected by ghost listings may result in reduced transparency and inefficiencies in property valuation and brokerage processes.

Key Terms

Occupancy

Commercial listings directly impact occupancy rates by providing visible, accessible properties that attract tenants and investors. Ghost listings, which are properties advertised without intent to lease, often create false impressions of market availability and can distort occupancy statistics. Discover how understanding the dynamics between commercial and ghost listings can optimize occupancy strategies.

Transparency

Commercial listings provide detailed, verifiable information about properties available for sale or lease, enhancing market transparency and trust among buyers, sellers, and agents. Ghost listings, on the other hand, obscure true market data by presenting misleading or non-existent properties, undermining transparency and potentially leading to unfair market conditions. Explore how prioritizing honest, transparent commercial listings can improve your real estate decisions.

Due Diligence

Commercial listings provide transparent property details, verified ownership, and accurate pricing, facilitating thorough due diligence for buyers and investors. Ghost listings lack official representation, creating risks such as hidden liabilities and unverifiable property conditions, which complicate the evaluation process. Explore comprehensive strategies to safeguard your investments through effective due diligence practices.

Source and External Links

Commercial Real Estate & Office Space Listings - Offers a comprehensive platform with 365,000 listings of various commercial properties across major U.S. markets.

LoopNet - Provides a leading marketplace for commercial real estate listings, including sales, leases, and auctions across multiple property types.

Search Properties | Commercial Real Estate for Sale - Allows users to search for commercial real estate properties for sale, featuring a wide range of listings across different markets and property types.

dowidth.com

dowidth.com