Opportunity zone investing offers significant tax incentives by allowing investors to defer and potentially exclude capital gains taxes when investing in designated economically distressed areas. Buy-and-hold real estate strategies focus on generating steady rental income and long-term property appreciation without the complexity of zones or tax deferrals. Explore the benefits and risks of both approaches to determine which aligns best with your investment goals.

Why it is important

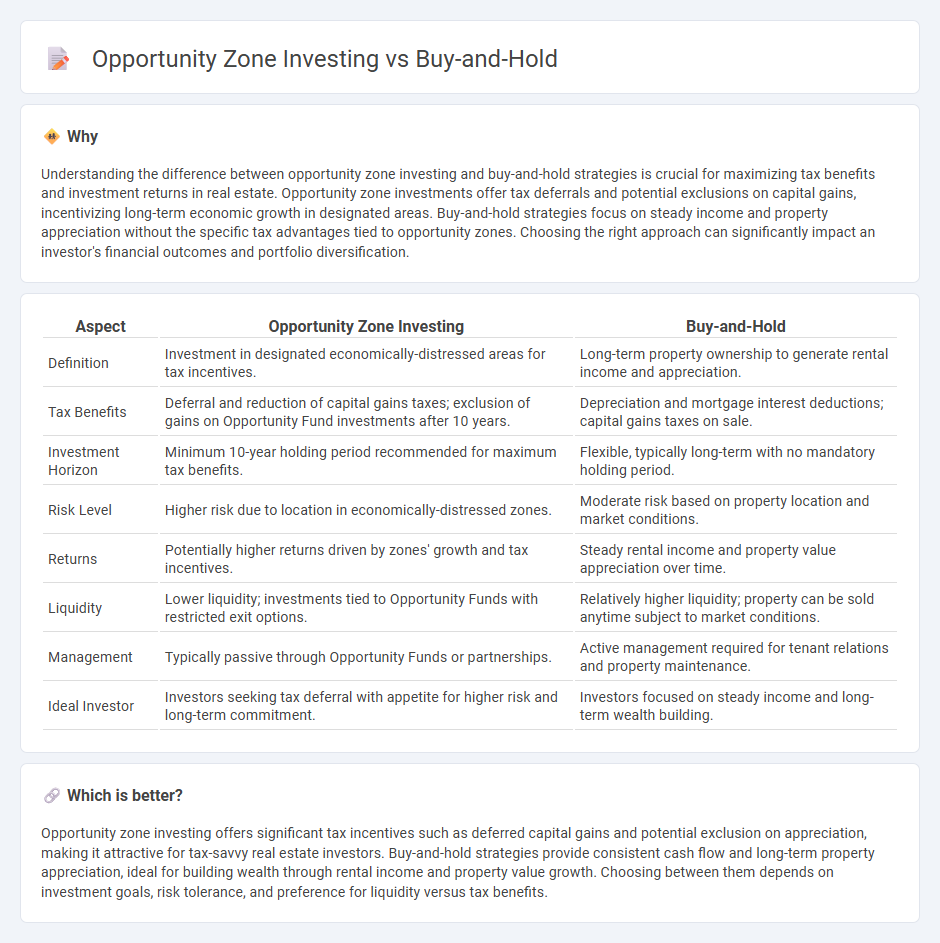

Understanding the difference between opportunity zone investing and buy-and-hold strategies is crucial for maximizing tax benefits and investment returns in real estate. Opportunity zone investments offer tax deferrals and potential exclusions on capital gains, incentivizing long-term economic growth in designated areas. Buy-and-hold strategies focus on steady income and property appreciation without the specific tax advantages tied to opportunity zones. Choosing the right approach can significantly impact an investor's financial outcomes and portfolio diversification.

Comparison Table

| Aspect | Opportunity Zone Investing | Buy-and-Hold |

|---|---|---|

| Definition | Investment in designated economically-distressed areas for tax incentives. | Long-term property ownership to generate rental income and appreciation. |

| Tax Benefits | Deferral and reduction of capital gains taxes; exclusion of gains on Opportunity Fund investments after 10 years. | Depreciation and mortgage interest deductions; capital gains taxes on sale. |

| Investment Horizon | Minimum 10-year holding period recommended for maximum tax benefits. | Flexible, typically long-term with no mandatory holding period. |

| Risk Level | Higher risk due to location in economically-distressed zones. | Moderate risk based on property location and market conditions. |

| Returns | Potentially higher returns driven by zones' growth and tax incentives. | Steady rental income and property value appreciation over time. |

| Liquidity | Lower liquidity; investments tied to Opportunity Funds with restricted exit options. | Relatively higher liquidity; property can be sold anytime subject to market conditions. |

| Management | Typically passive through Opportunity Funds or partnerships. | Active management required for tenant relations and property maintenance. |

| Ideal Investor | Investors seeking tax deferral with appetite for higher risk and long-term commitment. | Investors focused on steady income and long-term wealth building. |

Which is better?

Opportunity zone investing offers significant tax incentives such as deferred capital gains and potential exclusion on appreciation, making it attractive for tax-savvy real estate investors. Buy-and-hold strategies provide consistent cash flow and long-term property appreciation, ideal for building wealth through rental income and property value growth. Choosing between them depends on investment goals, risk tolerance, and preference for liquidity versus tax benefits.

Connection

Opportunity zone investing enhances buy-and-hold strategies by providing significant tax incentives, including deferred capital gains taxes and potential exclusions on profits from long-term investments. Real estate investors leveraging opportunity zones can maximize wealth accumulation while stabilizing communities through long-term property ownership. This synergy makes opportunity zones a powerful tool for portfolio diversification and sustainable real estate growth.

Key Terms

Appreciation

Buy-and-hold investing focuses on long-term property appreciation by holding real estate assets through market fluctuations, leveraging steady growth and compounding returns. Opportunity zone investing targets tax incentives in designated low-income areas, potentially accelerating appreciation through community development and economic revitalization. Explore detailed comparisons to optimize your investment strategy for maximizing property value growth.

Capital Gains Tax

Buy-and-hold investing typically incurs capital gains tax upon the sale of an asset, calculated based on the difference between the purchase price and selling price, with rates varying depending on short-term or long-term classification. Opportunity zone investing offers tax advantages by allowing deferral and potential reduction of capital gains tax if investments are made in designated economically distressed areas and held for specific time periods. Explore more about how opportunity zone regulations can maximize tax benefits for real estate and business investments.

Tax Deferral

Buy-and-hold investing builds wealth through long-term asset appreciation and deferred capital gains taxes until the asset is sold, allowing tax deferral over the holding period. Opportunity zone investing offers investors immediate tax deferral on prior gains and potential exclusion of gains earned from the new investment if held for at least 10 years. Explore how these strategies compare to maximize tax deferral benefits on investment returns.

Source and External Links

Buy and hold - Wikipedia - Buy and hold is an investment strategy where an investor purchases financial or non-financial assets like real estate, holding them long term to realize price appreciation despite market volatility, avoiding market timing and emotional decisions, endorsed by investors like Warren Buffett and considered a form of passive management.

Buy-and-hold as an investing strategy: Weigh the pluses and minuses - This approach is suited for long-term investors who can tolerate market volatility, requires minimal portfolio monitoring, offers tax efficiency on long-term gains, but may be risky when needing to liquidate during market downturns.

What is buy-and-hold real estate investing? | Rocket Mortgage - In real estate, buy and hold refers to purchasing property and holding it for years or decades to generate rental income, build equity, and potentially gain tax benefits while riding out market fluctuations as a way to build long-term wealth.

dowidth.com

dowidth.com