Grey market shipping involves the importation of goods through unauthorized channels, bypassing official distribution networks and often avoiding customs duties. Customs brokerage manages the legal process of clearing shipments through customs by handling documentation, duties, and compliance with regulations to ensure legitimate trade. Explore the key differences and implications of grey market shipping versus customs brokerage for smoother international logistics.

Why it is important

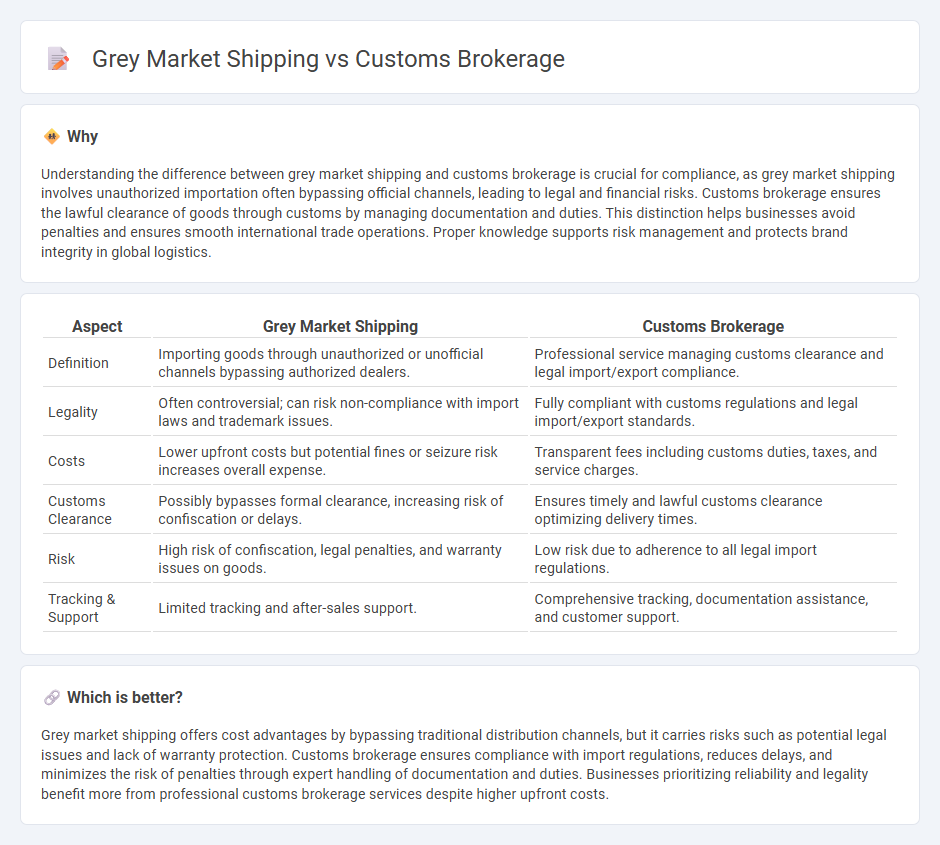

Understanding the difference between grey market shipping and customs brokerage is crucial for compliance, as grey market shipping involves unauthorized importation often bypassing official channels, leading to legal and financial risks. Customs brokerage ensures the lawful clearance of goods through customs by managing documentation and duties. This distinction helps businesses avoid penalties and ensures smooth international trade operations. Proper knowledge supports risk management and protects brand integrity in global logistics.

Comparison Table

| Aspect | Grey Market Shipping | Customs Brokerage |

|---|---|---|

| Definition | Importing goods through unauthorized or unofficial channels bypassing authorized dealers. | Professional service managing customs clearance and legal import/export compliance. |

| Legality | Often controversial; can risk non-compliance with import laws and trademark issues. | Fully compliant with customs regulations and legal import/export standards. |

| Costs | Lower upfront costs but potential fines or seizure risk increases overall expense. | Transparent fees including customs duties, taxes, and service charges. |

| Customs Clearance | Possibly bypasses formal clearance, increasing risk of confiscation or delays. | Ensures timely and lawful customs clearance optimizing delivery times. |

| Risk | High risk of confiscation, legal penalties, and warranty issues on goods. | Low risk due to adherence to all legal import regulations. |

| Tracking & Support | Limited tracking and after-sales support. | Comprehensive tracking, documentation assistance, and customer support. |

Which is better?

Grey market shipping offers cost advantages by bypassing traditional distribution channels, but it carries risks such as potential legal issues and lack of warranty protection. Customs brokerage ensures compliance with import regulations, reduces delays, and minimizes the risk of penalties through expert handling of documentation and duties. Businesses prioritizing reliability and legality benefit more from professional customs brokerage services despite higher upfront costs.

Connection

Grey market shipping involves the unauthorized movement of goods through unofficial channels, often bypassing standard customs procedures. Customs brokerage plays a critical role in regulating legitimate imports and exports by ensuring compliance with trade laws and accurate tariff assessments. The connection lies in customs brokers' efforts to detect and prevent grey market shipments, protecting supply chain integrity and national revenue.

Key Terms

**Customs Brokerage:**

Customs brokerage involves licensed professionals who ensure compliance with import and export regulations, handling duties, taxes, and necessary documentation to facilitate the lawful movement of goods across borders. Grey market shipping refers to the unauthorized importation of genuine products through unofficial channels, often bypassing standard customs procedures and potentially violating intellectual property rights. Explore the key differences and how customs brokerage can safeguard your shipments by learning more about its critical role in international trade.

Tariff Classification

Tariff classification plays a crucial role in customs brokerage by accurately categorizing goods to determine the correct duties and taxes under international trade laws. In grey market shipping, however, misclassification or intentional bypassing of tariff codes often leads to undervalued or improperly declared shipments, risking fines and seizure. Discover how proper tariff classification ensures compliance and smooth customs clearance by exploring key strategies and regulations.

Import/Export Compliance

Customs brokerage ensures strict adherence to import/export compliance by managing documentation, tariff classifications, and regulatory requirements, reducing risks of fines and shipment delays. Grey market shipping, often bypassing authorized channels, can lead to non-compliance, including unapproved product entry, incorrect duties, and potential seizures. Explore best practices in customs brokerage to maintain legal import/export operations and avoid risks associated with grey market shipments.

Source and External Links

Becoming a Customs Broker | U.S. Customs and Border Protection - Customs brokers are licensed individuals or entities authorized by U.S. Customs and Border Protection to assist importers and exporters by handling customs entry procedures, classification, valuation, and payment of duties; firms must have licensed brokers to operate legally.

Customs Broker Definition | UPS Supply Chain Solutions - A customs broker acts as an intermediary who understands import/export requirements, obtains necessary clearances, prepares paperwork, and submits payments to customs authorities on behalf of businesses to facilitate smooth international trade.

What is Customs Brokerage | Farrow - Customs brokerage firms navigate complex and ever-changing import/export regulations worldwide, easing the clearance of goods through customs by acting as translators between clients and government agencies and keeping up with digital advancements to streamline the process.

dowidth.com

dowidth.com