Emotional salary encompasses non-monetary benefits such as job satisfaction, recognition, and work-life balance that enhance employee motivation and loyalty, contrasting with retirement plans that focus on long-term financial security post-employment. Companies investing in emotional salary often see improved retention rates and workplace morale, while robust retirement plans attract talent concerned with future stability. Explore deeper insights on integrating emotional salary with retirement planning for optimized human resource strategies.

Why it is important

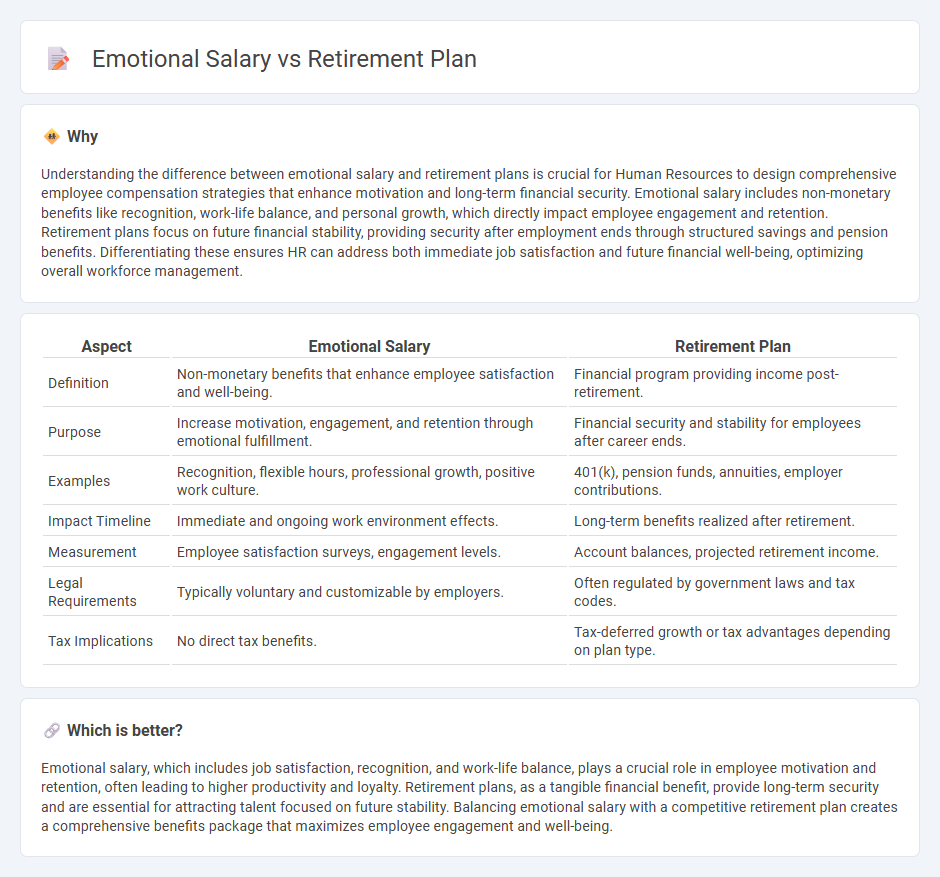

Understanding the difference between emotional salary and retirement plans is crucial for Human Resources to design comprehensive employee compensation strategies that enhance motivation and long-term financial security. Emotional salary includes non-monetary benefits like recognition, work-life balance, and personal growth, which directly impact employee engagement and retention. Retirement plans focus on future financial stability, providing security after employment ends through structured savings and pension benefits. Differentiating these ensures HR can address both immediate job satisfaction and future financial well-being, optimizing overall workforce management.

Comparison Table

| Aspect | Emotional Salary | Retirement Plan |

|---|---|---|

| Definition | Non-monetary benefits that enhance employee satisfaction and well-being. | Financial program providing income post-retirement. |

| Purpose | Increase motivation, engagement, and retention through emotional fulfillment. | Financial security and stability for employees after career ends. |

| Examples | Recognition, flexible hours, professional growth, positive work culture. | 401(k), pension funds, annuities, employer contributions. |

| Impact Timeline | Immediate and ongoing work environment effects. | Long-term benefits realized after retirement. |

| Measurement | Employee satisfaction surveys, engagement levels. | Account balances, projected retirement income. |

| Legal Requirements | Typically voluntary and customizable by employers. | Often regulated by government laws and tax codes. |

| Tax Implications | No direct tax benefits. | Tax-deferred growth or tax advantages depending on plan type. |

Which is better?

Emotional salary, which includes job satisfaction, recognition, and work-life balance, plays a crucial role in employee motivation and retention, often leading to higher productivity and loyalty. Retirement plans, as a tangible financial benefit, provide long-term security and are essential for attracting talent focused on future stability. Balancing emotional salary with a competitive retirement plan creates a comprehensive benefits package that maximizes employee engagement and well-being.

Connection

Emotional salary, encompassing non-monetary benefits like recognition and work-life balance, directly influences employee satisfaction and loyalty, which enhances engagement in retirement planning. A well-structured retirement plan aligned with emotional salary components fosters long-term financial security and psychological well-being. Organizations integrating emotional salary with retirement benefits reduce turnover rates and support sustainable workforce development.

Key Terms

**Retirement Plan:**

A retirement plan is a structured financial strategy designed to provide income and security after leaving the workforce, often including options like 401(k), IRA, or pension schemes tailored to long-term savings and tax benefits. Unlike emotional salary, which emphasizes non-monetary rewards such as recognition and job satisfaction, a retirement plan directly impacts future financial stability and helps safeguard against economic uncertainties in later years. Explore how implementing a robust retirement plan can ensure peace of mind and financial freedom for your post-career life.

Pension Fund

A pension fund serves as a critical component of a retirement plan by systematically accumulating contributions to ensure financial stability for employees in their post-retirement years. Unlike emotional salary, which includes non-monetary benefits such as job satisfaction and work-life balance, the pension fund provides tangible, long-term monetary security through investment growth and risk management. Explore the nuanced advantages of pension funds in securing your financial future and differentiating them from emotional salary benefits.

401(k)

A 401(k) retirement plan offers employees a tax-advantaged way to save for retirement by contributing pre-tax income, often with employer matching to increase savings potential. Emotional salary, on the other hand, encompasses non-monetary benefits such as work-life balance, recognition, and job satisfaction that improve employee well-being and loyalty. Discover how integrating a robust 401(k) plan with emotional salary elements can enhance overall employee compensation strategies.

Source and External Links

9 Best Retirement Plans In July 2025 - Bankrate - Explains different types of retirement plans including defined contribution plans like 401(k), employer pensions, and IRAs, highlighting benefits such as portability and income security.

Retirement planning tools | USAGov - Provides interactive tools and worksheets to create a retirement plan, estimate Social Security benefits, and compare cost of living for retirement locations.

Types of retirement plans | Internal Revenue Service - Lists and describes many retirement plan types including 401(k), SIMPLE IRAs, Roth IRAs, SEP plans, defined benefit plans, and others with guidance on choosing plans.

dowidth.com

dowidth.com