Bootstrapped software products rely on personal savings and revenue reinvestment to fuel growth, enabling founders to maintain full control and ownership without external interference. Venture-backed software products secure funding from investors, offering rapid capital injection that accelerates scaling but often requires equity dilution and guidance from venture capitalists. Explore the advantages and challenges of both approaches to determine the best path for your software startup.

Why it is important

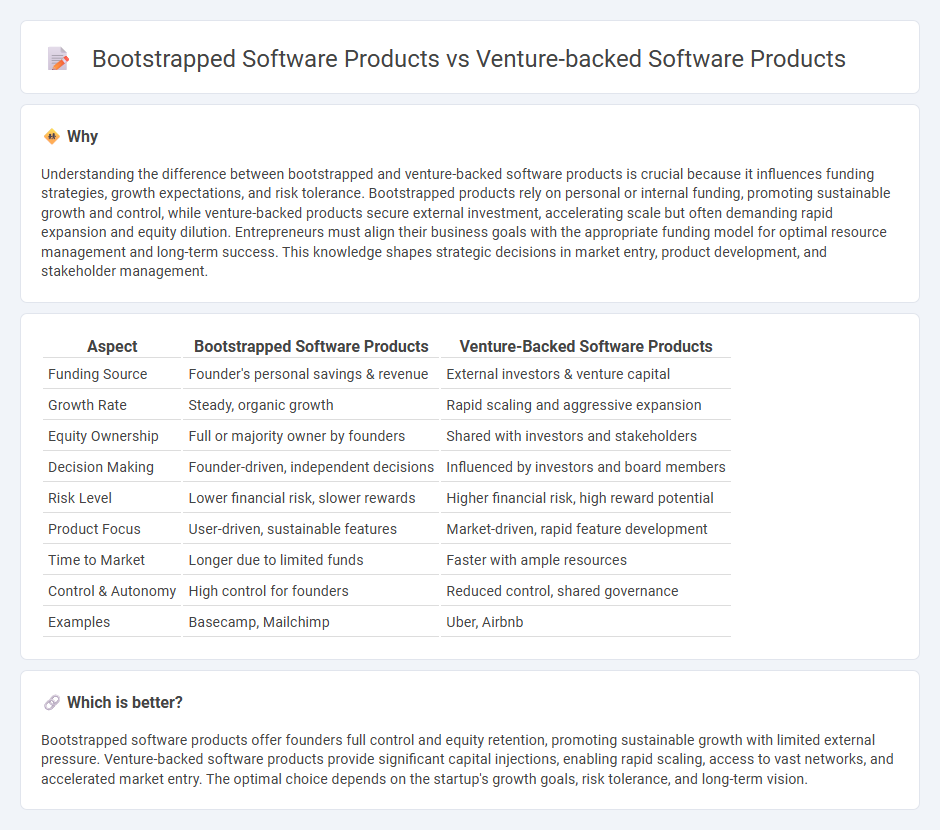

Understanding the difference between bootstrapped and venture-backed software products is crucial because it influences funding strategies, growth expectations, and risk tolerance. Bootstrapped products rely on personal or internal funding, promoting sustainable growth and control, while venture-backed products secure external investment, accelerating scale but often demanding rapid expansion and equity dilution. Entrepreneurs must align their business goals with the appropriate funding model for optimal resource management and long-term success. This knowledge shapes strategic decisions in market entry, product development, and stakeholder management.

Comparison Table

| Aspect | Bootstrapped Software Products | Venture-Backed Software Products |

|---|---|---|

| Funding Source | Founder's personal savings & revenue | External investors & venture capital |

| Growth Rate | Steady, organic growth | Rapid scaling and aggressive expansion |

| Equity Ownership | Full or majority owner by founders | Shared with investors and stakeholders |

| Decision Making | Founder-driven, independent decisions | Influenced by investors and board members |

| Risk Level | Lower financial risk, slower rewards | Higher financial risk, high reward potential |

| Product Focus | User-driven, sustainable features | Market-driven, rapid feature development |

| Time to Market | Longer due to limited funds | Faster with ample resources |

| Control & Autonomy | High control for founders | Reduced control, shared governance |

| Examples | Basecamp, Mailchimp | Uber, Airbnb |

Which is better?

Bootstrapped software products offer founders full control and equity retention, promoting sustainable growth with limited external pressure. Venture-backed software products provide significant capital injections, enabling rapid scaling, access to vast networks, and accelerated market entry. The optimal choice depends on the startup's growth goals, risk tolerance, and long-term vision.

Connection

Bootstrapped software products and venture-backed software products are connected through their shared goal of scaling innovation and market reach in the software industry. Both approaches leverage product-market fit, customer feedback, and agile development to drive growth, though bootstrapped companies rely on internal cash flow while venture-backed firms utilize external capital for rapid expansion. The intersection lies in their ability to transition from early-stage validation to sustainable business models, often influencing how entrepreneurs choose funding strategies based on market conditions and scalability potential.

Key Terms

Source and External Links

Ubiquity Ventures - A seed-stage venture capital firm managing nearly $200 million, investing in software products that extend beyond screens into smart hardware, machine learning, and real-world applications.

Allvue Systems - Venture Capital Software - Provides an integrated venture capital software suite for accounting, portfolio monitoring, and investor management to help VC firms scale efficiently.

15 Most Effective Venture Capital Deal Flow Management Software - Highlights AI-powered software like Venture Insights that streamline deal tracking, analysis, and portfolio monitoring for venture-backed software product investments.

dowidth.com

dowidth.com