Entrepreneurship offers diverse revenue opportunities, with passive income streams generating earnings through minimal ongoing effort, such as royalties or rental income. Subscription income provides a consistent cash flow by charging customers recurring fees for access to products or services, ensuring predictable financial growth. Explore these income models to discover the best fit for your entrepreneurial goals.

Why it is important

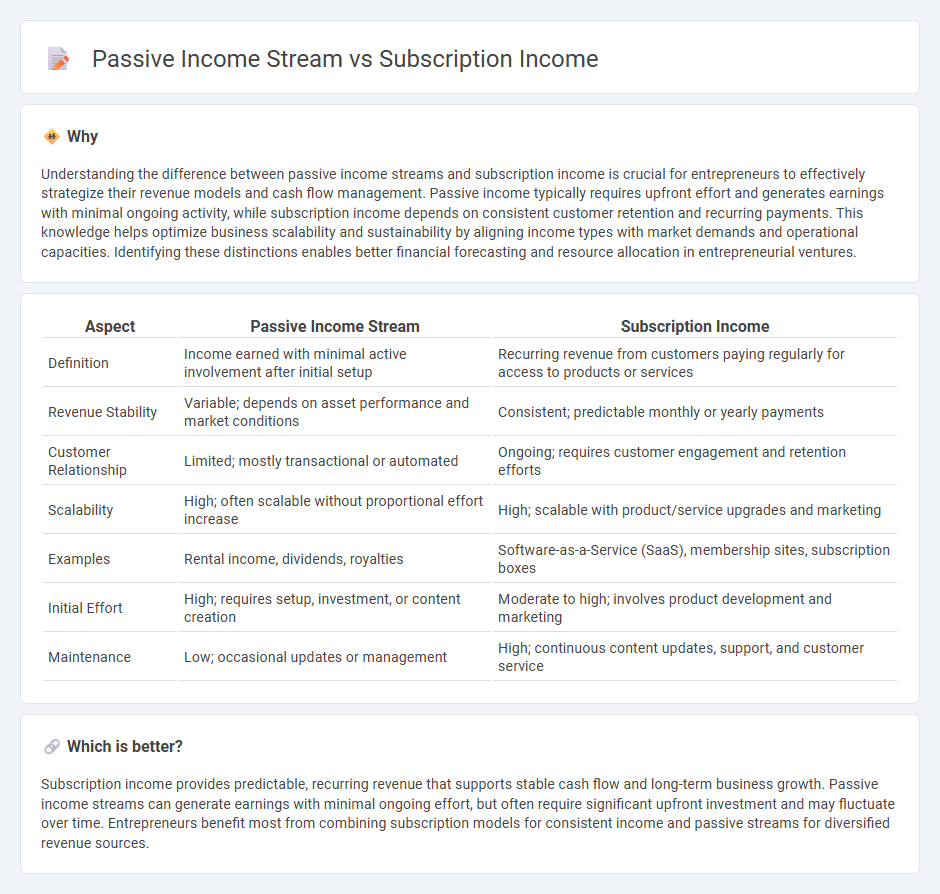

Understanding the difference between passive income streams and subscription income is crucial for entrepreneurs to effectively strategize their revenue models and cash flow management. Passive income typically requires upfront effort and generates earnings with minimal ongoing activity, while subscription income depends on consistent customer retention and recurring payments. This knowledge helps optimize business scalability and sustainability by aligning income types with market demands and operational capacities. Identifying these distinctions enables better financial forecasting and resource allocation in entrepreneurial ventures.

Comparison Table

| Aspect | Passive Income Stream | Subscription Income |

|---|---|---|

| Definition | Income earned with minimal active involvement after initial setup | Recurring revenue from customers paying regularly for access to products or services |

| Revenue Stability | Variable; depends on asset performance and market conditions | Consistent; predictable monthly or yearly payments |

| Customer Relationship | Limited; mostly transactional or automated | Ongoing; requires customer engagement and retention efforts |

| Scalability | High; often scalable without proportional effort increase | High; scalable with product/service upgrades and marketing |

| Examples | Rental income, dividends, royalties | Software-as-a-Service (SaaS), membership sites, subscription boxes |

| Initial Effort | High; requires setup, investment, or content creation | Moderate to high; involves product development and marketing |

| Maintenance | Low; occasional updates or management | High; continuous content updates, support, and customer service |

Which is better?

Subscription income provides predictable, recurring revenue that supports stable cash flow and long-term business growth. Passive income streams can generate earnings with minimal ongoing effort, but often require significant upfront investment and may fluctuate over time. Entrepreneurs benefit most from combining subscription models for consistent income and passive streams for diversified revenue sources.

Connection

Passive income streams often rely on subscription income models because recurring payments provide consistent cash flow without continuous active effort. Entrepreneurs leverage subscription services to automate revenue generation while maintaining customer engagement and retention. This connection enhances financial stability and scalability in entrepreneurial ventures.

Key Terms

Recurring Revenue

Subscription income generates recurring revenue through scheduled payments for products or services, ensuring consistent cash flow. Passive income streams also create ongoing revenue but often require less direct engagement after initial effort, such as rental properties or dividend investments. Discover how to maximize your financial growth by leveraging these recurring revenue models effectively.

Active Management

Subscription income requires active management, involving continuous engagement with customers and regular content or product updates to maintain value and retention. Passive income streams, by contrast, typically generate revenue with minimal ongoing effort once initial setup is complete, such as through investments or automated sales. Explore how balancing subscription income with passive strategies can optimize your overall revenue model.

Scalability

Subscription income offers scalable revenue by providing predictable, recurring payments from a growing customer base, allowing businesses to expand without proportionally increasing costs. Passive income streams, such as investments or royalties, scale based on asset performance and market conditions but may require significant upfront capital or time investment. Explore further insights on optimizing these income models for maximum scalability.

Source and External Links

What is Subscription Revenue? - DealHub - Subscription revenue is a company's income from customers who make recurring payments for ongoing access to a product or service, typically calculated by multiplying active subscribers by subscription fees, with revenue recognized over time as services are delivered according to ASC 606 accounting standards.

How Subscription Revenue Increases Customer Relationships - Subscription revenue is the sum of all successful subscription transactions over a period, allowing businesses to track metrics like average revenue per user, churn rate, and lifetime value to strengthen customer relationships and predict income.

A guide to subscription revenue models - Subscription revenue models generate steady income through recurring payments for access to services or products, emphasizing long-term customer relationships, automated billing, and continuous service adjustments based on subscriber data.

dowidth.com

dowidth.com