Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions without redirecting users to traditional banks. Platform banking offers comprehensive financial solutions through digital ecosystems, allowing businesses to access a full range of banking services via a unified interface. Explore how these innovations transform entrepreneurial finance and unlock new growth opportunities.

Why it is important

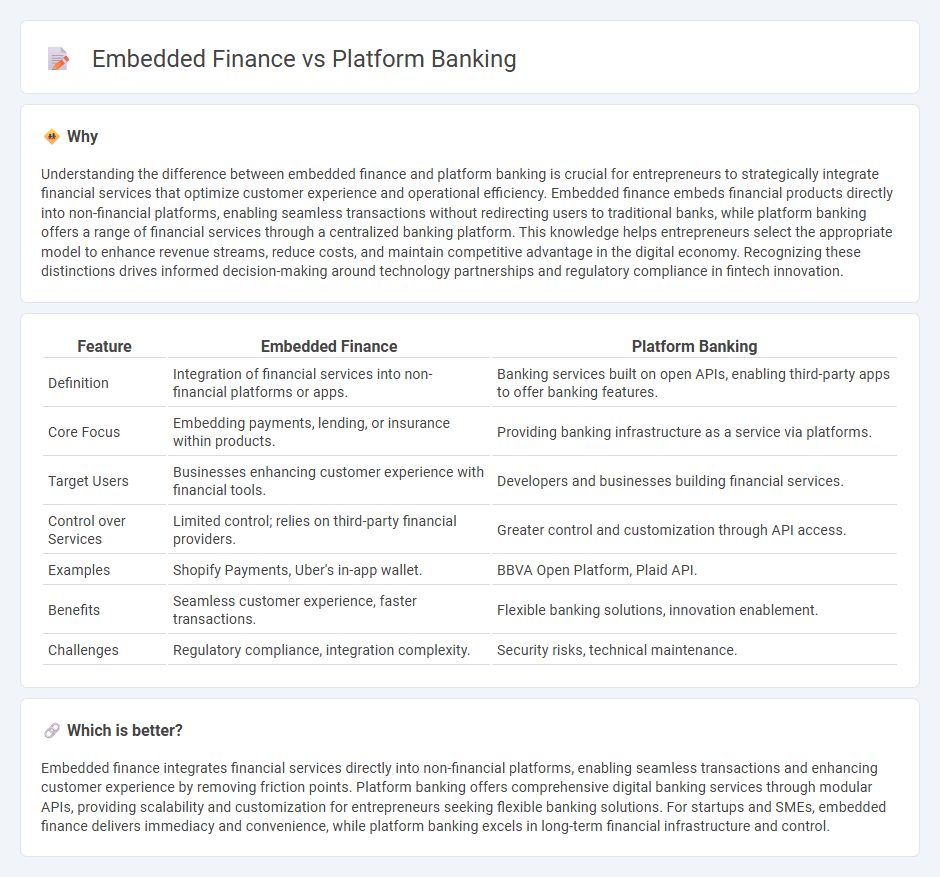

Understanding the difference between embedded finance and platform banking is crucial for entrepreneurs to strategically integrate financial services that optimize customer experience and operational efficiency. Embedded finance embeds financial products directly into non-financial platforms, enabling seamless transactions without redirecting users to traditional banks, while platform banking offers a range of financial services through a centralized banking platform. This knowledge helps entrepreneurs select the appropriate model to enhance revenue streams, reduce costs, and maintain competitive advantage in the digital economy. Recognizing these distinctions drives informed decision-making around technology partnerships and regulatory compliance in fintech innovation.

Comparison Table

| Feature | Embedded Finance | Platform Banking |

|---|---|---|

| Definition | Integration of financial services into non-financial platforms or apps. | Banking services built on open APIs, enabling third-party apps to offer banking features. |

| Core Focus | Embedding payments, lending, or insurance within products. | Providing banking infrastructure as a service via platforms. |

| Target Users | Businesses enhancing customer experience with financial tools. | Developers and businesses building financial services. |

| Control over Services | Limited control; relies on third-party financial providers. | Greater control and customization through API access. |

| Examples | Shopify Payments, Uber's in-app wallet. | BBVA Open Platform, Plaid API. |

| Benefits | Seamless customer experience, faster transactions. | Flexible banking solutions, innovation enablement. |

| Challenges | Regulatory compliance, integration complexity. | Security risks, technical maintenance. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions and enhancing customer experience by removing friction points. Platform banking offers comprehensive digital banking services through modular APIs, providing scalability and customization for entrepreneurs seeking flexible banking solutions. For startups and SMEs, embedded finance delivers immediacy and convenience, while platform banking excels in long-term financial infrastructure and control.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions within entrepreneurial ecosystems. Platform banking leverages this integration by offering modular financial products through digital platforms, enhancing accessibility and scalability for startups. Together, they drive innovation in entrepreneurship by simplifying funding, payments, and financial management processes.

Key Terms

Open APIs

Platform banking leverages Open APIs to enable seamless integration of third-party services within traditional banking infrastructure, enhancing customer experience and operational efficiency. Embedded finance uses Open APIs to insert financial services directly into non-financial platforms, allowing businesses to offer banking-like features without being banks. Explore how Open APIs transform financial ecosystems and drive innovation by learning more about platform banking and embedded finance.

White-label Solutions

White-label solutions in platform banking allow financial institutions to offer fully branded services powered by third-party technology, enhancing customer experience without heavy development costs. Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions within customer journeys while leveraging white-label technology for customization. Explore how white-label solutions drive innovation and scalability in platform banking versus embedded finance.

Financial Integration

Platform banking centralizes financial services via APIs, enabling seamless integration of multiple banking functions within a unified ecosystem. Embedded finance integrates financial services directly into non-banking platforms, offering tailored solutions like payments, lending, or insurance at the point of customer interaction. Explore the nuances of financial integration in platform banking and embedded finance to optimize your business strategy.

Source and External Links

Platform banking...and how it enhances financial services - Platform banking is when banks integrate fintech services via APIs into their own platforms, expanding their financial offerings and creating a broader, more specialized service range for customers.

Platform Banking: Revolutionizing Financial Services in Digital Age - Platform banking transforms banks into digital marketplaces using APIs and open architecture, enabling seamless access to diverse financial products from multiple providers in one unified, customer-centric interface.

What Is a Banking Platform and Why Is It the Key to SME Growth in ... - Platform banking creates a digital ecosystem connecting banks, fintechs, and customers via open APIs to offer personalized, flexible, and tech-enabled financial services, particularly meeting the diverse needs of SMEs with seamless digital experiences.

dowidth.com

dowidth.com