Tiny acquisitions offer entrepreneurs a rapid path to market entry by acquiring established small businesses with existing customer bases, reducing the risks tied to product development and brand building. Solo founder startups rely heavily on the founder's vision and execution skills, often facing longer timelines and higher uncertainty but retaining full control and equity. Explore the strategic advantages and challenges of tiny acquisitions versus solo founder startups to determine the best entrepreneurial approach for your goals.

Why it is important

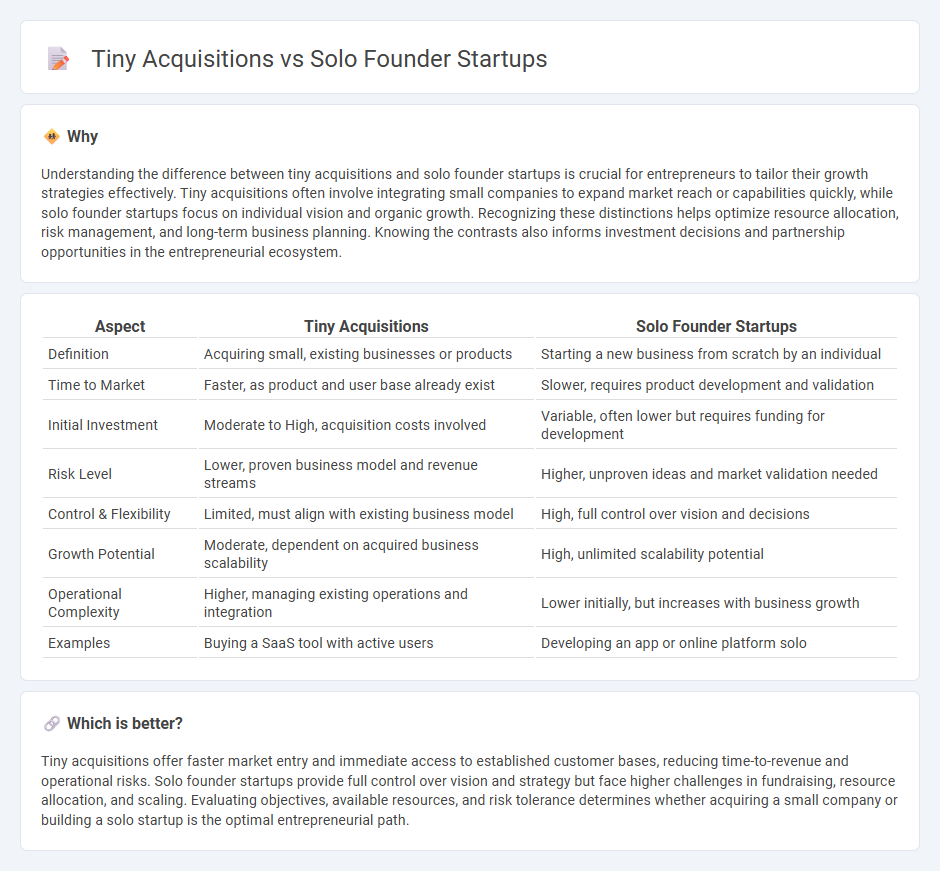

Understanding the difference between tiny acquisitions and solo founder startups is crucial for entrepreneurs to tailor their growth strategies effectively. Tiny acquisitions often involve integrating small companies to expand market reach or capabilities quickly, while solo founder startups focus on individual vision and organic growth. Recognizing these distinctions helps optimize resource allocation, risk management, and long-term business planning. Knowing the contrasts also informs investment decisions and partnership opportunities in the entrepreneurial ecosystem.

Comparison Table

| Aspect | Tiny Acquisitions | Solo Founder Startups |

|---|---|---|

| Definition | Acquiring small, existing businesses or products | Starting a new business from scratch by an individual |

| Time to Market | Faster, as product and user base already exist | Slower, requires product development and validation |

| Initial Investment | Moderate to High, acquisition costs involved | Variable, often lower but requires funding for development |

| Risk Level | Lower, proven business model and revenue streams | Higher, unproven ideas and market validation needed |

| Control & Flexibility | Limited, must align with existing business model | High, full control over vision and decisions |

| Growth Potential | Moderate, dependent on acquired business scalability | High, unlimited scalability potential |

| Operational Complexity | Higher, managing existing operations and integration | Lower initially, but increases with business growth |

| Examples | Buying a SaaS tool with active users | Developing an app or online platform solo |

Which is better?

Tiny acquisitions offer faster market entry and immediate access to established customer bases, reducing time-to-revenue and operational risks. Solo founder startups provide full control over vision and strategy but face higher challenges in fundraising, resource allocation, and scaling. Evaluating objectives, available resources, and risk tolerance determines whether acquiring a small company or building a solo startup is the optimal entrepreneurial path.

Connection

Tiny acquisitions offer solo founder startups a strategic exit by allowing them to sell niche products or intellectual property without extensive restructuring. Solo founders often focus on developing highly specialized solutions, making their startups attractive targets for these small-scale acquisitions. This connection fosters innovation by providing solo entrepreneurs with viable paths to monetize their innovations quickly.

Key Terms

**Solo Founder Startups:**

Solo founder startups often face unique challenges such as limited resources, decision-making pressure, and increased vulnerability to burnout compared to multi-founder ventures. These startups benefit from agility, faster pivoting, and cohesive vision control, which can accelerate innovation and market entry. Explore more insights on overcoming obstacles and maximizing success in solo founder startups.

Bootstrapping

Solo founder startups excel in bootstrapping by leveraging limited resources to achieve sustainable growth without external funding. Tiny acquisitions often provide strategic advantages through quick market entry and resource consolidation but may introduce integration challenges and require initial investment. Explore how bootstrapping strategies empower solo founders to maintain control and scalability in early-stage ventures.

Founder Burnout

Solo founder startups often face intense pressure leading to founder burnout due to sole responsibility for product development, fundraising, and operations. Tiny acquisitions provide a strategic exit, reducing stress while enabling founders to leverage larger company resources for growth and innovation. Explore ways to mitigate burnout and optimize startup success through tiny acquisitions.

Source and External Links

Solo Founders Program - A dedicated program and community supporting solo founders with housing, office space, stipends, and networking to combat the common bias that solo founders are less viable compared to co-founder teams.

The Founder Factor on Startup Success: Solo vs. Co-Founders - Discusses how solo founders, exemplified by Jeff Bezos (Amazon) and Jack Ma (Alibaba), have created significant successful companies driven by vision and perseverance despite conventional preference for co-founders.

Solo-founder startups double but face funding challenges - Notes the rise of solo-founder startups from 17% in 2017 to 35% in 2024, but highlights difficulties they face in securing venture capital compared to teams with multiple founders.

dowidth.com

dowidth.com