Embedded finance integrates financial services directly into non-financial platforms, streamlining customer experiences and enabling seamless transactions within apps or websites. Wealthtech leverages technology to enhance investment management, offering automated advisory services, personalized portfolio management, and real-time financial data analysis. Explore how embedded finance and wealthtech are transforming entrepreneurship by driving innovation and accessibility in financial solutions.

Why it is important

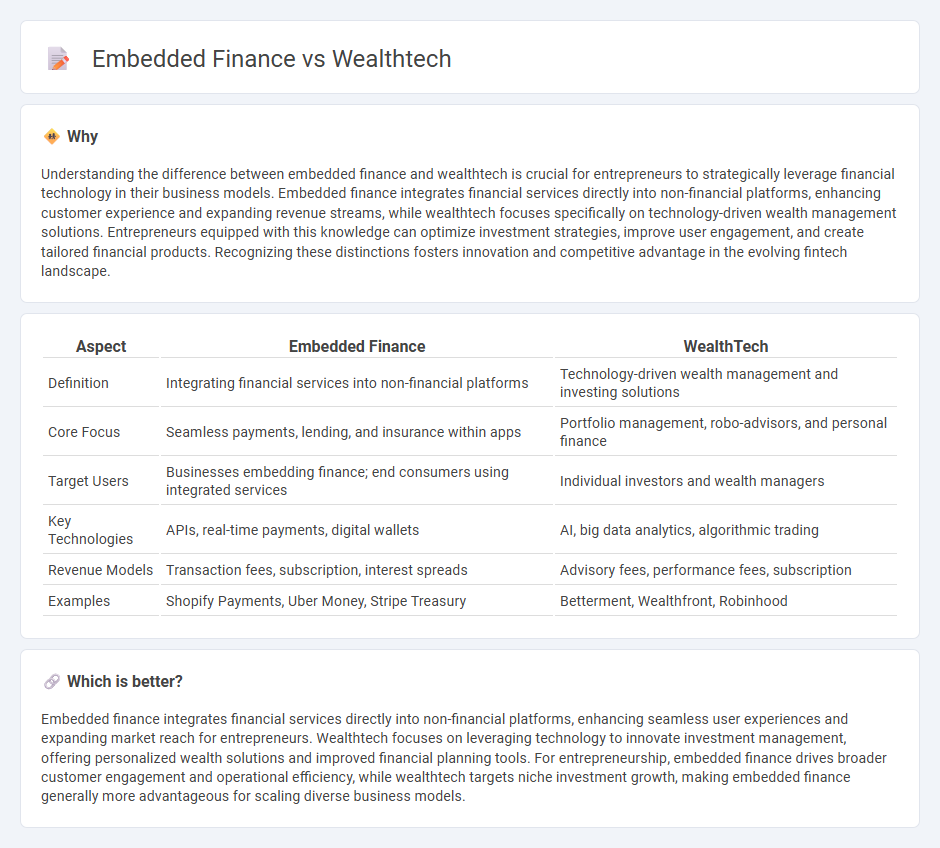

Understanding the difference between embedded finance and wealthtech is crucial for entrepreneurs to strategically leverage financial technology in their business models. Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience and expanding revenue streams, while wealthtech focuses specifically on technology-driven wealth management solutions. Entrepreneurs equipped with this knowledge can optimize investment strategies, improve user engagement, and create tailored financial products. Recognizing these distinctions fosters innovation and competitive advantage in the evolving fintech landscape.

Comparison Table

| Aspect | Embedded Finance | WealthTech |

|---|---|---|

| Definition | Integrating financial services into non-financial platforms | Technology-driven wealth management and investing solutions |

| Core Focus | Seamless payments, lending, and insurance within apps | Portfolio management, robo-advisors, and personal finance |

| Target Users | Businesses embedding finance; end consumers using integrated services | Individual investors and wealth managers |

| Key Technologies | APIs, real-time payments, digital wallets | AI, big data analytics, algorithmic trading |

| Revenue Models | Transaction fees, subscription, interest spreads | Advisory fees, performance fees, subscription |

| Examples | Shopify Payments, Uber Money, Stripe Treasury | Betterment, Wealthfront, Robinhood |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing seamless user experiences and expanding market reach for entrepreneurs. Wealthtech focuses on leveraging technology to innovate investment management, offering personalized wealth solutions and improved financial planning tools. For entrepreneurship, embedded finance drives broader customer engagement and operational efficiency, while wealthtech targets niche investment growth, making embedded finance generally more advantageous for scaling diverse business models.

Connection

Embedded finance integrates financial services directly into non-financial platforms, enabling entrepreneurs to seamlessly access and manage capital. Wealthtech leverages technology to optimize investment management, risk assessment, and portfolio diversification through digital tools. Their connection lies in enhancing entrepreneurial financial decision-making by embedding automated wealth management solutions within everyday business operations.

Key Terms

Robo-advisors (Wealthtech)

Wealthtech leverages Robo-advisors to provide automated, algorithm-driven investment management services, enhancing portfolio diversification and risk assessment through AI and machine learning. Embedded finance integrates these Robo-advisory capabilities directly into non-financial platforms, enabling seamless access to investment solutions without leaving the user's primary app environment. Discover how embedding Robo-advisors transforms customer engagement and wealth management efficiency.

API Integration (Embedded Finance)

Wealthtech platforms leverage advanced API integrations to offer seamless financial services like investment management, enhancing user experience and operational efficiency. Embedded finance integrates APIs directly into non-financial platforms, enabling features like payments, lending, or insurance within apps without redirecting users. Explore how API-driven embedded finance transforms customer engagement and broadens financial service accessibility.

Digital Asset Management (Wealthtech)

Wealthtech platforms leverage advanced algorithms and AI-driven insights to optimize Digital Asset Management, enabling personalized investment strategies and real-time portfolio adjustments. Embedded finance integrates financial services directly into non-financial platforms, providing seamless access but often lacking the specialized tools for in-depth asset management found in dedicated wealthtech solutions. Explore how these technologies transform digital asset management and investment experiences.

Source and External Links

What is Wealthtech? Top Wealthtech Companies to Watch in 2025 - Wealthtech is a technology-driven approach that enhances wealth management by automating complex tasks, providing AI-driven financial advice, and enabling smarter investment and budget decisions, making wealth management more efficient and accessible.

WealthTech in Asia-Pacific: Financial innovation - WealthTech solution providers support financial institutions and advisers with digital tools that improve wealth management processes, enhance efficiency, and offer clients digital investment tracking, focusing on integration, scalability, and innovation in the sector.

What is Wealthtech? Technology Tools for Advisors and Wealth Management Firms - Wealthtech companies develop digital tools to streamline client data, optimize portfolios, and increase efficiency and growth for financial advisors and wealth management firms, addressing the evolving needs of the financial services industry.

dowidth.com

dowidth.com