Acquihires involve companies purchasing startups primarily to acquire talent rather than products or services, offering a strategic way to boost human capital quickly. Management buyouts (MBOs) occur when a company's existing management team buys the business, often to gain control and align interests with long-term goals. Explore the differences between acquihires and management buyouts to understand which approach best suits various entrepreneurial strategies.

Why it is important

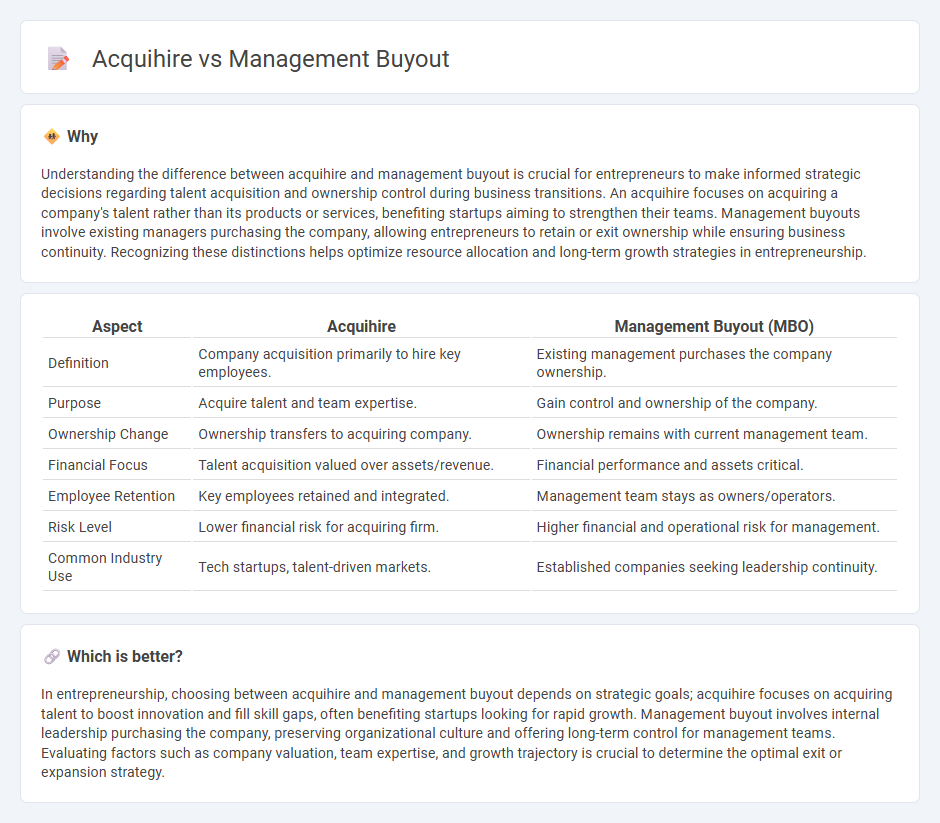

Understanding the difference between acquihire and management buyout is crucial for entrepreneurs to make informed strategic decisions regarding talent acquisition and ownership control during business transitions. An acquihire focuses on acquiring a company's talent rather than its products or services, benefiting startups aiming to strengthen their teams. Management buyouts involve existing managers purchasing the company, allowing entrepreneurs to retain or exit ownership while ensuring business continuity. Recognizing these distinctions helps optimize resource allocation and long-term growth strategies in entrepreneurship.

Comparison Table

| Aspect | Acquihire | Management Buyout (MBO) |

|---|---|---|

| Definition | Company acquisition primarily to hire key employees. | Existing management purchases the company ownership. |

| Purpose | Acquire talent and team expertise. | Gain control and ownership of the company. |

| Ownership Change | Ownership transfers to acquiring company. | Ownership remains with current management team. |

| Financial Focus | Talent acquisition valued over assets/revenue. | Financial performance and assets critical. |

| Employee Retention | Key employees retained and integrated. | Management team stays as owners/operators. |

| Risk Level | Lower financial risk for acquiring firm. | Higher financial and operational risk for management. |

| Common Industry Use | Tech startups, talent-driven markets. | Established companies seeking leadership continuity. |

Which is better?

In entrepreneurship, choosing between acquihire and management buyout depends on strategic goals; acquihire focuses on acquiring talent to boost innovation and fill skill gaps, often benefiting startups looking for rapid growth. Management buyout involves internal leadership purchasing the company, preserving organizational culture and offering long-term control for management teams. Evaluating factors such as company valuation, team expertise, and growth trajectory is crucial to determine the optimal exit or expansion strategy.

Connection

Acquihires and management buyouts are connected through their focus on leadership and talent acquisition during corporate transitions. Acquihires prioritize acquiring a startup primarily for its skilled team rather than its products, while management buyouts involve existing managers purchasing the company to retain control and leverage their expertise. Both strategies emphasize the critical role of experienced management in driving future business success.

Key Terms

Ownership Transfer

A management buyout (MBO) involves existing managers purchasing the company to gain full ownership and operational control, ensuring continuity and aligning leadership incentives. An acquihire focuses primarily on acquiring a startup's talent rather than its assets or ownership, with the parent company absorbing employees while ownership remains with the acquirer. Explore further to understand how ownership transfer impacts strategic goals and company culture in each scenario.

Talent Acquisition

Management buyouts (MBOs) involve existing management purchasing a company's assets to gain control, emphasizing sustained operational leadership and talent retention. Acquihires prioritize acquiring a startup primarily for its skilled workforce, integrating key talent into the buyer's existing structure rather than the company itself. Explore deeper insights into how MBOs and acquihires strategically differ in talent acquisition and organizational growth.

Strategic Integration

Management buyouts (MBOs) involve existing management acquiring a significant or controlling stake in the company, enabling seamless strategic integration through insider knowledge and operational continuity. Acquihires focus on acquiring talent rather than assets, emphasizing immediate team integration to accelerate innovation and product development within the acquiring firm. Explore further distinctions to optimize your strategic approach in mergers and acquisitions.

Source and External Links

What Is a Management Buyout and How to Finance One? - A management buyout (MBO) is when the current management team of a company purchases the business through a process involving valuing the business, due diligence, and securing funding from banks, private equity, or other lenders.

Management Buyout (MBO) | Transaction Structure + Examples - An MBO is a leveraged buyout where the management team contributes equity alongside debt financing, often using senior debt, subordinated debt, and equity contributions to acquire the company they manage.

Key considerations when choosing a management buy-in or buyout - MBOs typically involve feasibility assessment, appointing advisors, tax planning, negotiating deals, due diligence, and legal work, requiring the management team to have strong operational and financial skills to run the business post-buyout.

dowidth.com

dowidth.com