Exit planning focuses on preparing a business owner's departure by maximizing company value and ensuring a smooth transition, while harvest strategy emphasizes extracting financial returns through selling or liquidating assets. Effective exit planning requires strategic foresight, valuation analysis, and succession planning to preserve wealth and business legacy. Explore how these approaches can shape your entrepreneurial journey and secure your financial future.

Why it is important

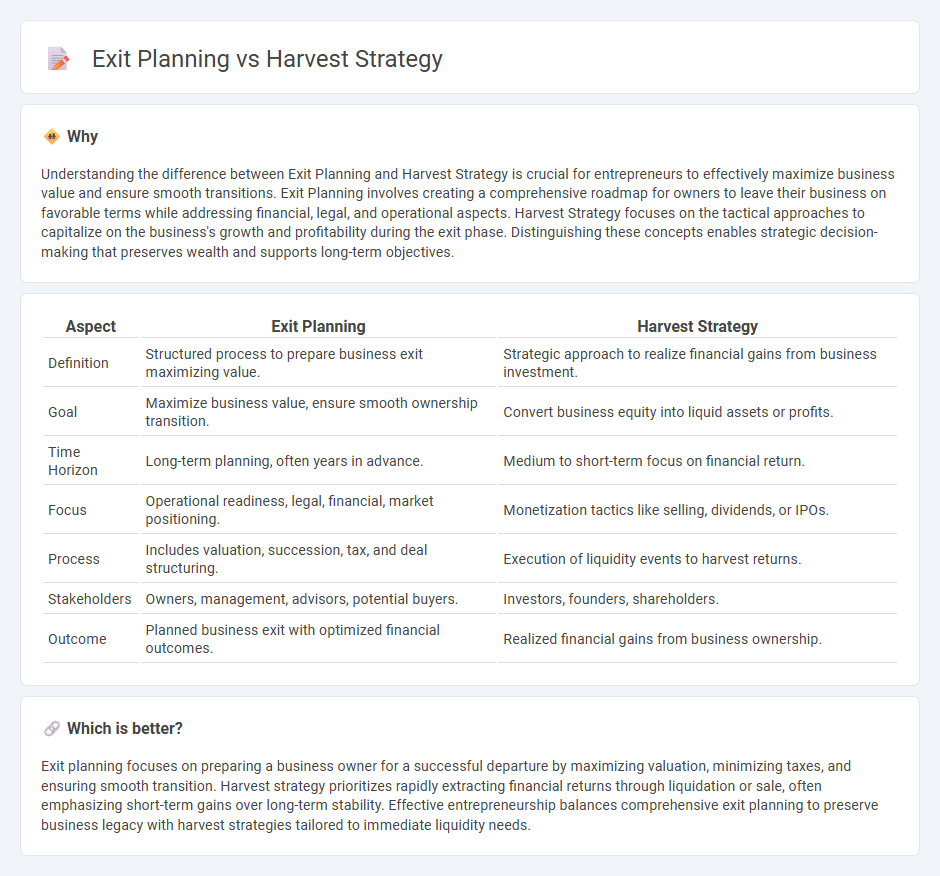

Understanding the difference between Exit Planning and Harvest Strategy is crucial for entrepreneurs to effectively maximize business value and ensure smooth transitions. Exit Planning involves creating a comprehensive roadmap for owners to leave their business on favorable terms while addressing financial, legal, and operational aspects. Harvest Strategy focuses on the tactical approaches to capitalize on the business's growth and profitability during the exit phase. Distinguishing these concepts enables strategic decision-making that preserves wealth and supports long-term objectives.

Comparison Table

| Aspect | Exit Planning | Harvest Strategy |

|---|---|---|

| Definition | Structured process to prepare business exit maximizing value. | Strategic approach to realize financial gains from business investment. |

| Goal | Maximize business value, ensure smooth ownership transition. | Convert business equity into liquid assets or profits. |

| Time Horizon | Long-term planning, often years in advance. | Medium to short-term focus on financial return. |

| Focus | Operational readiness, legal, financial, market positioning. | Monetization tactics like selling, dividends, or IPOs. |

| Process | Includes valuation, succession, tax, and deal structuring. | Execution of liquidity events to harvest returns. |

| Stakeholders | Owners, management, advisors, potential buyers. | Investors, founders, shareholders. |

| Outcome | Planned business exit with optimized financial outcomes. | Realized financial gains from business ownership. |

Which is better?

Exit planning focuses on preparing a business owner for a successful departure by maximizing valuation, minimizing taxes, and ensuring smooth transition. Harvest strategy prioritizes rapidly extracting financial returns through liquidation or sale, often emphasizing short-term gains over long-term stability. Effective entrepreneurship balances comprehensive exit planning to preserve business legacy with harvest strategies tailored to immediate liquidity needs.

Connection

Exit planning and harvest strategy are interconnected frameworks within entrepreneurship that focus on maximizing the value entrepreneurs can extract from their business ventures. Exit planning involves preparing a company for transition through methods like selling, merging, or passing ownership to heirs, while a harvest strategy specifically targets ways to realize financial gains, such as dividends, buyouts, or public offerings. Both processes require strategic evaluation of market conditions, company valuation, and timing to optimize returns and ensure sustainable business continuity or personal wealth realization.

Key Terms

Liquidity Event

Harvest strategy centers on maximizing returns through a planned liquidity event, often involving the sale or transfer of business ownership to realize financial gains. Exit planning encompasses a broader approach, integrating personal goals, tax considerations, and timing to ensure a smooth transition and optimal liquidity outcome. Explore comprehensive methods to align your harvest strategy with effective exit planning for a successful liquidity event.

Valuation

Harvest strategy maximizes business valuation by optimizing cash flow and profitability during the firm's maturity phase, ensuring sustained revenue streams and market position. Exit planning emphasizes preparing the business for sale or transfer, increasing valuation through succession readiness, financial transparency, and strategic growth initiatives. Explore detailed insights on aligning harvest strategy and exit planning to enhance your business valuation.

Succession

Harvest strategy involves maximizing returns from investments or business growth through methods like selling assets, initiating IPOs, or distributing dividends, while exit planning concentrates on preparing a business owner's departure with a structured succession plan to ensure continuity and value preservation. Succession planning specifically addresses the transfer of leadership and ownership to qualified successors, minimizing risks associated with sudden exits and maintaining operational stability. Explore more about aligning harvest strategies with effective succession plans to secure long-term business sustainability.

Source and External Links

Harvest Strategy - What Is It, Example, Types, Reasons, Pros/Cons - A harvest strategy is a business approach to extract maximum profit from a product shortly before discontinuing it, with various types such as passive, active, partial, delayed, selective, liquidation, divestment, gradual harvest, mergers, and ESOPs.

Harvest Strategies: Definition, Benefits and Types | Indeed.com - Harvest strategies are plans to maximize profit before decline or obsolescence, including selling (exit), gradual harvest focusing on profit rather than growth, and buyouts that transfer ownership control.

Harvest Strategy - Overview, Reason, Examples - A harvest strategy involves minimizing spending on a product to maximize profitability even if market share declines, often used toward the end of the product lifecycle as an exit plan.

dowidth.com

dowidth.com