Roll-up acquisitions consolidate multiple smaller companies within the same industry to rapidly scale operations and increase market share, leveraging existing customer bases and established brand reputations. Greenfield investment involves building a new enterprise from the ground up, granting full control over processes and allowing tailored development aligned with specific market needs. Explore the strategic advantages and challenges of each approach to determine the best fit for entrepreneurial growth.

Why it is important

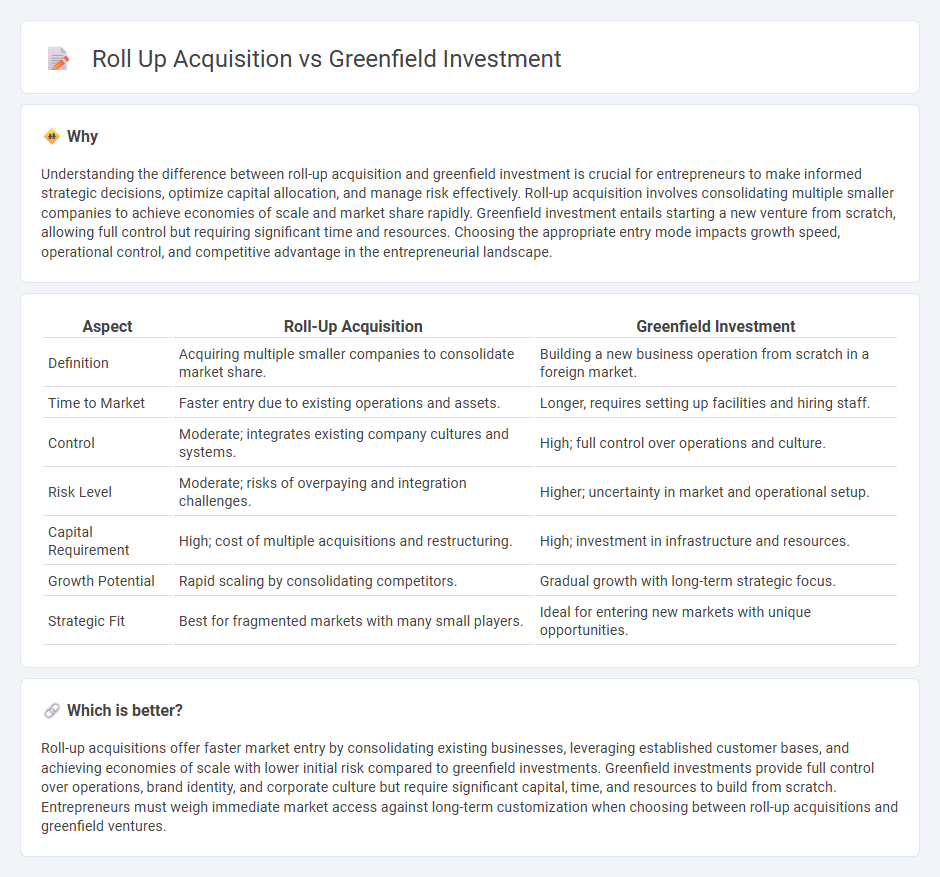

Understanding the difference between roll-up acquisition and greenfield investment is crucial for entrepreneurs to make informed strategic decisions, optimize capital allocation, and manage risk effectively. Roll-up acquisition involves consolidating multiple smaller companies to achieve economies of scale and market share rapidly. Greenfield investment entails starting a new venture from scratch, allowing full control but requiring significant time and resources. Choosing the appropriate entry mode impacts growth speed, operational control, and competitive advantage in the entrepreneurial landscape.

Comparison Table

| Aspect | Roll-Up Acquisition | Greenfield Investment |

|---|---|---|

| Definition | Acquiring multiple smaller companies to consolidate market share. | Building a new business operation from scratch in a foreign market. |

| Time to Market | Faster entry due to existing operations and assets. | Longer, requires setting up facilities and hiring staff. |

| Control | Moderate; integrates existing company cultures and systems. | High; full control over operations and culture. |

| Risk Level | Moderate; risks of overpaying and integration challenges. | Higher; uncertainty in market and operational setup. |

| Capital Requirement | High; cost of multiple acquisitions and restructuring. | High; investment in infrastructure and resources. |

| Growth Potential | Rapid scaling by consolidating competitors. | Gradual growth with long-term strategic focus. |

| Strategic Fit | Best for fragmented markets with many small players. | Ideal for entering new markets with unique opportunities. |

Which is better?

Roll-up acquisitions offer faster market entry by consolidating existing businesses, leveraging established customer bases, and achieving economies of scale with lower initial risk compared to greenfield investments. Greenfield investments provide full control over operations, brand identity, and corporate culture but require significant capital, time, and resources to build from scratch. Entrepreneurs must weigh immediate market access against long-term customization when choosing between roll-up acquisitions and greenfield ventures.

Connection

Roll-up acquisitions and Greenfield investments are connected through their strategic roles in business expansion and market entry. Roll-up acquisitions consolidate smaller companies to achieve economies of scale, while Greenfield investments involve establishing new operations from scratch in foreign markets. Both approaches enable entrepreneurs to scale operations and increase competitive advantage within target industries.

Key Terms

Entry Strategy

Greenfield investment involves establishing new operations from scratch, granting full control over the business environment and customized infrastructure development. Roll-up acquisitions consolidate smaller companies within the same industry to rapidly increase market share and achieve economies of scale. Explore the strategic advantages and risks of both entry strategies to determine the optimal approach for your business expansion.

Integration

Greenfield investment allows companies to build operations from the ground up, ensuring full control over integration processes and organizational culture alignment. Roll-up acquisitions consolidate multiple smaller firms, requiring complex integration strategies to unify systems, processes, and corporate identities efficiently. Explore the best integration practices for both strategies to maximize growth and operational synergy.

Control

Greenfield investment offers full control by establishing operations from scratch, enabling custom-built processes and culture tailored to strategic goals. Roll-up acquisitions provide control through consolidating multiple companies, leveraging existing assets and market presence while integrating diverse systems. Explore deeper insights to understand which control strategy aligns best with your business growth objectives.

Source and External Links

Greenfield Investment - Definition, Advantages and Disadvantages - A greenfield investment (GI) is a type of foreign direct investment where a company builds new operations from the ground up in a foreign country, offering full control over operations and potential tax benefits.

Greenfield vs Brownfield Investing - The Entrust Group - Greenfield investing involves developing new projects on unused land with full design and location flexibility, often leading to greater returns and strategic advantages compared to redeveloping existing sites.

Is Greenfield investment improving welfare: A quantitative analysis ... - Greenfield foreign direct investment has been found to contribute significantly more to economic growth, capital expansion, technology transfer, and employment generation in developing countries compared to mergers and acquisitions.

dowidth.com

dowidth.com