Alternative funding platforms like crowdfunding, peer-to-peer lending, and angel investors offer startups diverse financing options beyond traditional banks, enabling rapid capital access and market validation. Business incubators provide comprehensive support by offering mentorship, networking opportunities, and resources that foster growth and innovation in early-stage ventures. Explore how these distinct approaches can accelerate your entrepreneurial journey and find the best fit for your business needs.

Why it is important

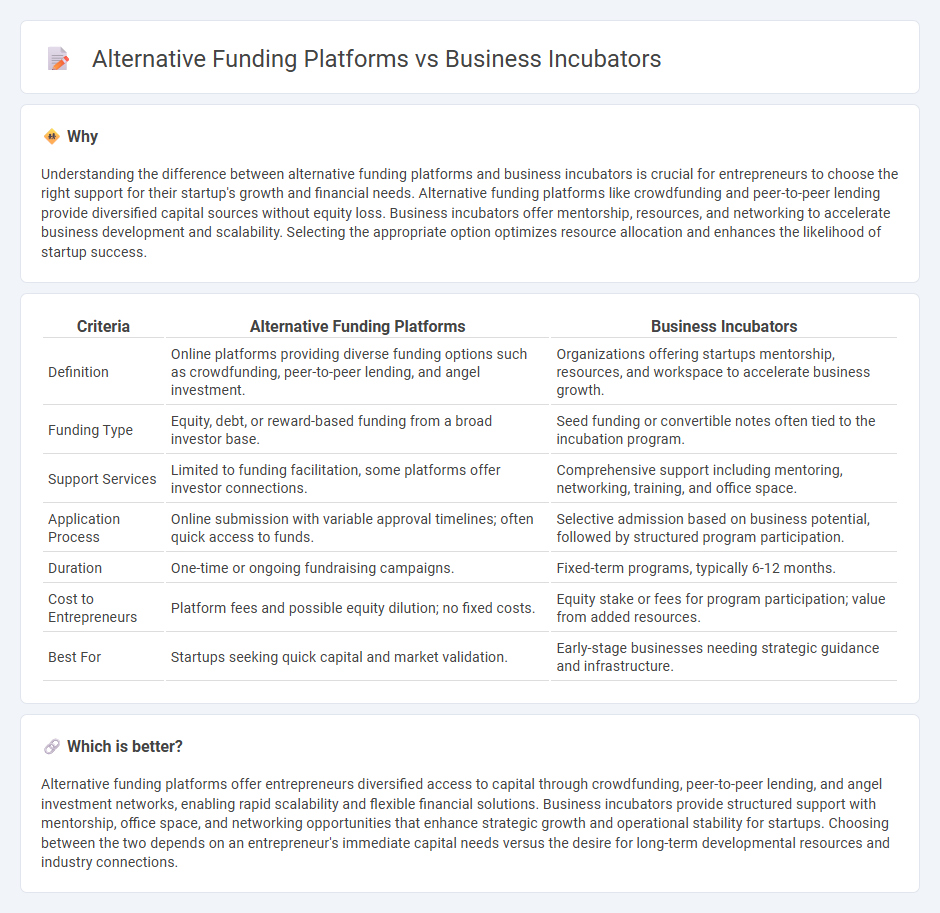

Understanding the difference between alternative funding platforms and business incubators is crucial for entrepreneurs to choose the right support for their startup's growth and financial needs. Alternative funding platforms like crowdfunding and peer-to-peer lending provide diversified capital sources without equity loss. Business incubators offer mentorship, resources, and networking to accelerate business development and scalability. Selecting the appropriate option optimizes resource allocation and enhances the likelihood of startup success.

Comparison Table

| Criteria | Alternative Funding Platforms | Business Incubators |

|---|---|---|

| Definition | Online platforms providing diverse funding options such as crowdfunding, peer-to-peer lending, and angel investment. | Organizations offering startups mentorship, resources, and workspace to accelerate business growth. |

| Funding Type | Equity, debt, or reward-based funding from a broad investor base. | Seed funding or convertible notes often tied to the incubation program. |

| Support Services | Limited to funding facilitation, some platforms offer investor connections. | Comprehensive support including mentoring, networking, training, and office space. |

| Application Process | Online submission with variable approval timelines; often quick access to funds. | Selective admission based on business potential, followed by structured program participation. |

| Duration | One-time or ongoing fundraising campaigns. | Fixed-term programs, typically 6-12 months. |

| Cost to Entrepreneurs | Platform fees and possible equity dilution; no fixed costs. | Equity stake or fees for program participation; value from added resources. |

| Best For | Startups seeking quick capital and market validation. | Early-stage businesses needing strategic guidance and infrastructure. |

Which is better?

Alternative funding platforms offer entrepreneurs diversified access to capital through crowdfunding, peer-to-peer lending, and angel investment networks, enabling rapid scalability and flexible financial solutions. Business incubators provide structured support with mentorship, office space, and networking opportunities that enhance strategic growth and operational stability for startups. Choosing between the two depends on an entrepreneur's immediate capital needs versus the desire for long-term developmental resources and industry connections.

Connection

Alternative funding platforms such as crowdfunding, angel investors, and venture capital play a critical role in fueling startups within business incubators by providing essential capital during early development stages. Business incubators offer structured mentorship, resources, and networking opportunities that enhance startup viability, making them attractive to alternative funding sources seeking high-potential ventures. This symbiotic relationship accelerates innovation and business growth, creating a robust ecosystem where funding platforms and incubators collaboratively reduce entrepreneurial risk and improve success rates.

Key Terms

Mentorship

Business incubators provide structured mentorship programs that connect startups with experienced industry experts, fostering accelerated growth and strategic development. Alternative funding platforms, such as crowdfunding and peer-to-peer lending, primarily focus on capital access with limited mentorship opportunities, often lacking personalized guidance critical to early-stage ventures. Explore the unique benefits of business incubators versus alternative funding platforms to optimize startup success.

Equity Crowdfunding

Business incubators provide startups with mentorship, office space, and access to investor networks, fostering growth through hands-on support and strategic guidance. Equity crowdfunding platforms offer a democratized funding approach, enabling emerging companies to raise capital from a broad base of investors in exchange for equity stakes, often accelerating access to necessary funds without traditional gatekeepers. Explore how equity crowdfunding can complement or substitute business incubator resources to optimize startup financing strategies.

Seed Capital

Business incubators provide startups with seed capital alongside mentorship, networking opportunities, and workspace, fostering early-stage growth through structured support. Alternative funding platforms, such as crowdfunding and angel investors, offer more flexible seed capital options often with fewer resource commitments but potentially higher equity costs. Explore how each seed funding source aligns with your startup's goals and growth strategy to make informed financial decisions.

Source and External Links

Neighborhood Business Incubators - Neighborhood business incubators support entrepreneurs by providing free or low-cost workspace, mentorship, access to investors, and sometimes working capital, with a focus on helping BIPOC- and immigrant-owned small businesses develop sustainable operations and finances.

What is a business incubator? | BDC.ca - Business incubators help very early-stage companies move beyond the idea stage by offering mentorship, investment opportunities, shared office space, and resources to develop a minimum viable product and viable market plan.

How a Business Incubator Program Can Help Your Startup Grow | CO - A business incubator typically offers workspace, seed funding, mentoring, training, and professional services like accounting and legal help, and operates through an application and interview process to assist startups during their infancy.

dowidth.com

dowidth.com