Entrepreneurship offers diverse financial opportunities, with passive income streams generating ongoing revenue through investments, royalties, or automated businesses, contrasting with one-time revenue derived from single sales or projects. Establishing passive income enables sustainable growth and financial stability by continually earning without constant active involvement. Explore effective strategies to balance passive income streams and one-time revenue for entrepreneurial success.

Why it is important

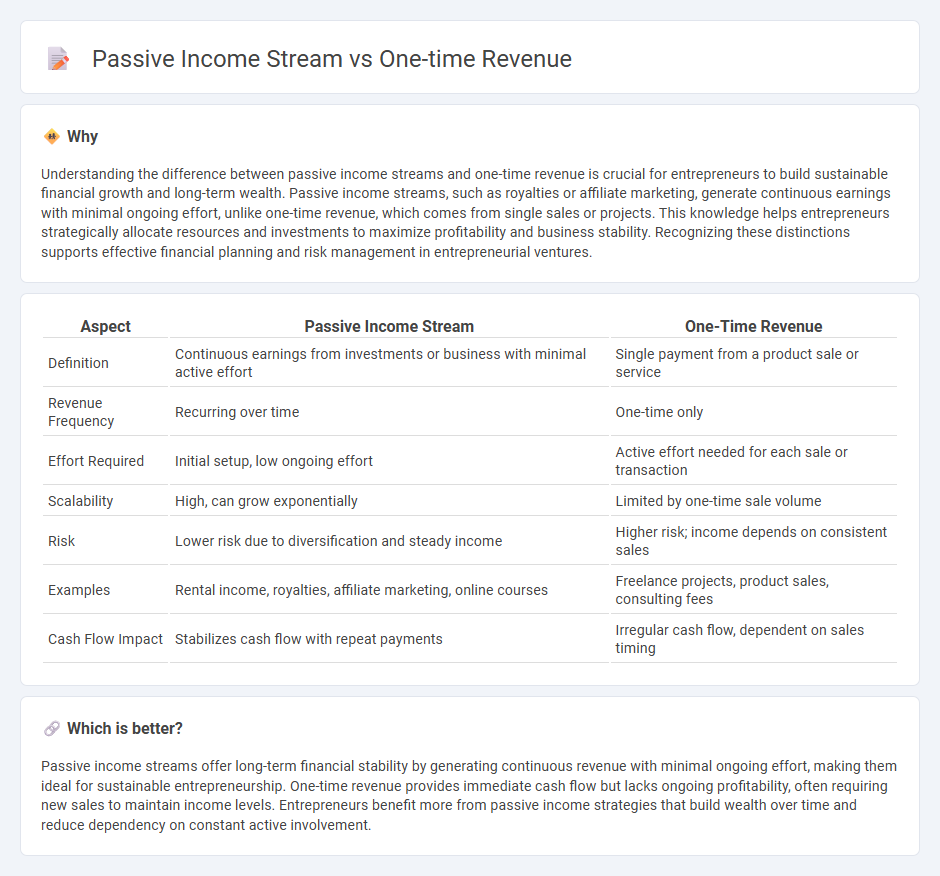

Understanding the difference between passive income streams and one-time revenue is crucial for entrepreneurs to build sustainable financial growth and long-term wealth. Passive income streams, such as royalties or affiliate marketing, generate continuous earnings with minimal ongoing effort, unlike one-time revenue, which comes from single sales or projects. This knowledge helps entrepreneurs strategically allocate resources and investments to maximize profitability and business stability. Recognizing these distinctions supports effective financial planning and risk management in entrepreneurial ventures.

Comparison Table

| Aspect | Passive Income Stream | One-Time Revenue |

|---|---|---|

| Definition | Continuous earnings from investments or business with minimal active effort | Single payment from a product sale or service |

| Revenue Frequency | Recurring over time | One-time only |

| Effort Required | Initial setup, low ongoing effort | Active effort needed for each sale or transaction |

| Scalability | High, can grow exponentially | Limited by one-time sale volume |

| Risk | Lower risk due to diversification and steady income | Higher risk; income depends on consistent sales |

| Examples | Rental income, royalties, affiliate marketing, online courses | Freelance projects, product sales, consulting fees |

| Cash Flow Impact | Stabilizes cash flow with repeat payments | Irregular cash flow, dependent on sales timing |

Which is better?

Passive income streams offer long-term financial stability by generating continuous revenue with minimal ongoing effort, making them ideal for sustainable entrepreneurship. One-time revenue provides immediate cash flow but lacks ongoing profitability, often requiring new sales to maintain income levels. Entrepreneurs benefit more from passive income strategies that build wealth over time and reduce dependency on constant active involvement.

Connection

Passive income streams generate ongoing revenue with minimal active effort, complementing one-time revenue by providing financial stability beyond initial sales or investments. Entrepreneurs leverage one-time revenue to invest in assets like rental properties, stocks, or digital products that create sustained passive income. This synergy enhances cash flow management, allowing for diversified income sources that reduce dependency on constant business activities.

Key Terms

Active Income

One-time revenue refers to a singular monetary gain from a specific transaction, often requiring continuous active involvement to generate new sales or projects. Active income depends on ongoing effort, such as work hours or direct services, contrasting with passive income streams that yield earnings with minimal ongoing effort. Explore effective strategies to maximize active income and balance it with passive revenue opportunities.

Recurring Revenue

One-time revenue generates immediate cash flow but lacks sustainability, while passive income streams, especially those with recurring revenue models such as subscriptions or service contracts, provide consistent and predictable earnings over time. Businesses prioritizing recurring revenue benefit from improved cash flow management, customer retention, and scalable growth opportunities. Explore how implementing effective recurring revenue strategies can transform your financial stability and long-term success.

Scalability

One-time revenue generates income from a single transaction or project without future earnings, while passive income streams provide ongoing revenue with minimal continuous effort. Scalability is higher in passive income models, as digital products, royalties, or investments can grow exponentially without proportional increases in workload. Explore effective strategies to build scalable passive income sources for long-term financial growth.

Source and External Links

One Time Fee Revenue Model - definition & overview - The one-time revenue model involves charging customers a single payment for perpetual access to a product or service, generating significant upfront revenue but requiring continuous customer acquisition to sustain income.

One-time Revenues Definition | Law Insider - One-time revenues are non-recurring income sources received on a one-time basis, often used for budget priorities, capital expenditures, and not included in regular revenue forecasts.

What are one-time expenses/revenues | BDC.ca - One-time revenues refer to financial transactions that do not occur regularly and are excluded from operating income calculations to give an accurate picture of a company's true operating performance.

dowidth.com

dowidth.com