Exit planning focuses on strategically preparing a business owner's departure to maximize financial returns and ensure a smooth transition. Business succession planning involves identifying and grooming successors to maintain operational continuity and preserve company culture. Explore more to understand how both approaches impact long-term business viability.

Why it is important

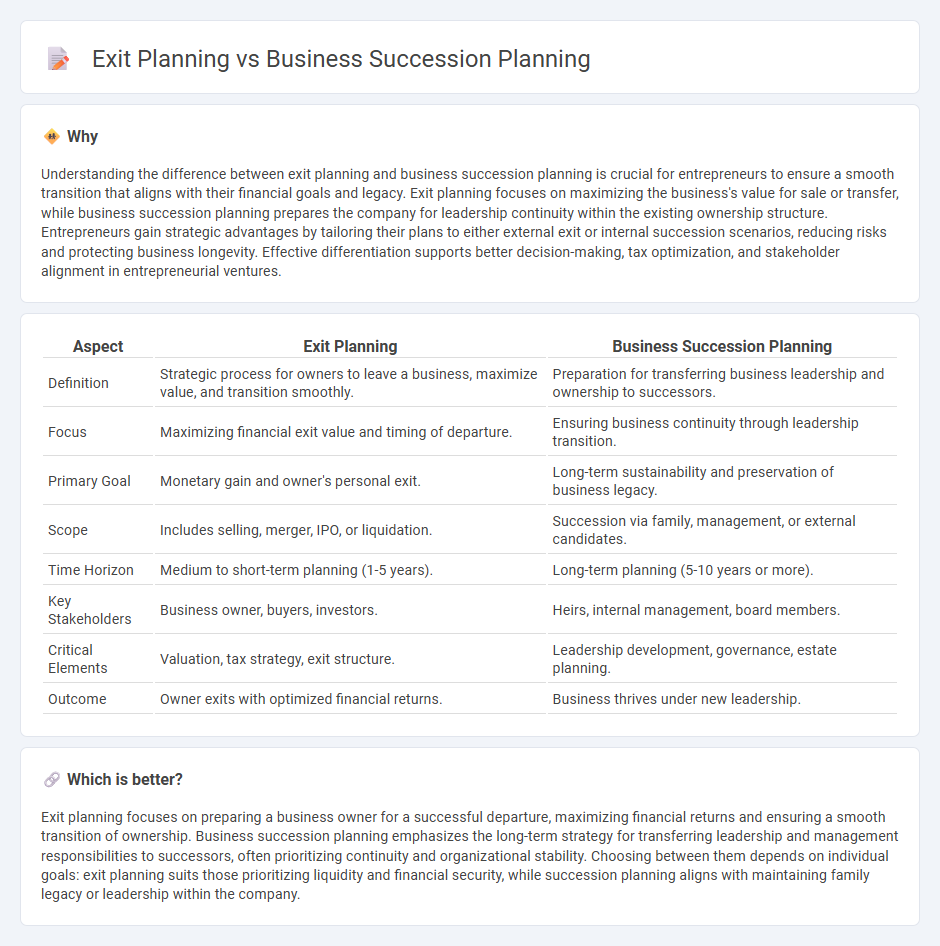

Understanding the difference between exit planning and business succession planning is crucial for entrepreneurs to ensure a smooth transition that aligns with their financial goals and legacy. Exit planning focuses on maximizing the business's value for sale or transfer, while business succession planning prepares the company for leadership continuity within the existing ownership structure. Entrepreneurs gain strategic advantages by tailoring their plans to either external exit or internal succession scenarios, reducing risks and protecting business longevity. Effective differentiation supports better decision-making, tax optimization, and stakeholder alignment in entrepreneurial ventures.

Comparison Table

| Aspect | Exit Planning | Business Succession Planning |

|---|---|---|

| Definition | Strategic process for owners to leave a business, maximize value, and transition smoothly. | Preparation for transferring business leadership and ownership to successors. |

| Focus | Maximizing financial exit value and timing of departure. | Ensuring business continuity through leadership transition. |

| Primary Goal | Monetary gain and owner's personal exit. | Long-term sustainability and preservation of business legacy. |

| Scope | Includes selling, merger, IPO, or liquidation. | Succession via family, management, or external candidates. |

| Time Horizon | Medium to short-term planning (1-5 years). | Long-term planning (5-10 years or more). |

| Key Stakeholders | Business owner, buyers, investors. | Heirs, internal management, board members. |

| Critical Elements | Valuation, tax strategy, exit structure. | Leadership development, governance, estate planning. |

| Outcome | Owner exits with optimized financial returns. | Business thrives under new leadership. |

Which is better?

Exit planning focuses on preparing a business owner for a successful departure, maximizing financial returns and ensuring a smooth transition of ownership. Business succession planning emphasizes the long-term strategy for transferring leadership and management responsibilities to successors, often prioritizing continuity and organizational stability. Choosing between them depends on individual goals: exit planning suits those prioritizing liquidity and financial security, while succession planning aligns with maintaining family legacy or leadership within the company.

Connection

Exit planning and business succession planning are closely connected as both focus on the strategic transition of ownership and leadership to ensure business continuity and maximize value. Exit planning involves preparing the business for sale or transfer, while succession planning specifically addresses identifying and developing internal talent to assume control. Effective integration of these processes mitigates risks, preserves company culture, and secures financial returns for stakeholders.

Key Terms

Ownership Transfer

Business succession planning centers on the strategic transfer of ownership and management responsibilities to ensure seamless continuity and preserve company value. Exit planning involves comprehensive preparation for the owner's departure, encompassing financial, legal, and tax considerations to maximize the business's worth and the owner's benefits. Explore detailed strategies and insights to effectively navigate ownership transfer in both succession and exit planning contexts.

Continuity Strategy

Business succession planning centers on ensuring leadership continuity by identifying and preparing internal candidates to take over key roles, preserving the organization's long-term stability. Exit planning involves strategic steps for owners to efficiently transfer ownership, maximize value, and facilitate smooth transitions, whether through sale, merger, or family succession. Explore comprehensive strategies for seamless business continuity and optimal exit outcomes.

Value Realization

Business succession planning centers on transferring leadership and ownership within an organization to ensure continuity and preserve long-term value. Exit planning emphasizes maximizing financial returns by strategically preparing the business for a sale or transfer, focusing on value realization and personal wealth goals. Explore comprehensive strategies to optimize both succession and exit planning for sustained business success and enhanced value realization.

Source and External Links

Succession Planning for Business Owners | Estate Planning | Fidelity - A business succession plan should systematically address the transfer of management and ownership with attention to training successors, delegating authority, coordinating ownership and management, considering family interests, and timing the transfer during the owner's lifetime.

Small Business Transition Planning Tips & Strategies - Business succession planning is a strategic action plan outlining the logistical and financial steps for transferring leadership, including identifying successors, formalizing operating procedures, business valuation, and succession funding options such as insurance or loans.

A Beginner's Guide to Business Succession Planning for Small - ADP - Succession planning focuses on replacing key leadership roles by developing internal talent and documenting operational exit plans to ensure smooth leadership transitions and business continuity.

dowidth.com

dowidth.com