Embedded finance integrates financial services directly into non-financial platforms, streamlining user experiences by offering payments, lending, or insurance without redirecting to traditional banks. Banking-as-a-Service (BaaS) enables fintech companies to build custom financial products using licensed bank infrastructure through APIs, accelerating innovation and market entry. Explore the nuances between embedded finance and BaaS to harness the best solution for your entrepreneurial venture.

Why it is important

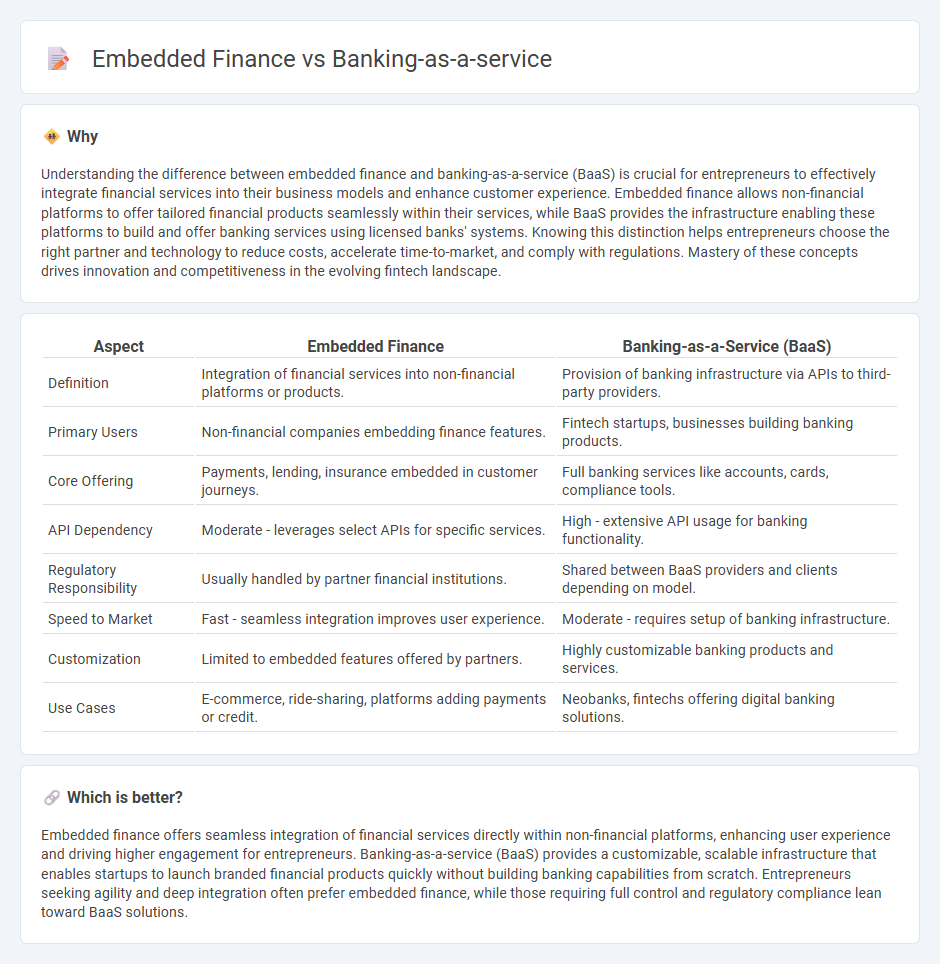

Understanding the difference between embedded finance and banking-as-a-service (BaaS) is crucial for entrepreneurs to effectively integrate financial services into their business models and enhance customer experience. Embedded finance allows non-financial platforms to offer tailored financial products seamlessly within their services, while BaaS provides the infrastructure enabling these platforms to build and offer banking services using licensed banks' systems. Knowing this distinction helps entrepreneurs choose the right partner and technology to reduce costs, accelerate time-to-market, and comply with regulations. Mastery of these concepts drives innovation and competitiveness in the evolving fintech landscape.

Comparison Table

| Aspect | Embedded Finance | Banking-as-a-Service (BaaS) |

|---|---|---|

| Definition | Integration of financial services into non-financial platforms or products. | Provision of banking infrastructure via APIs to third-party providers. |

| Primary Users | Non-financial companies embedding finance features. | Fintech startups, businesses building banking products. |

| Core Offering | Payments, lending, insurance embedded in customer journeys. | Full banking services like accounts, cards, compliance tools. |

| API Dependency | Moderate - leverages select APIs for specific services. | High - extensive API usage for banking functionality. |

| Regulatory Responsibility | Usually handled by partner financial institutions. | Shared between BaaS providers and clients depending on model. |

| Speed to Market | Fast - seamless integration improves user experience. | Moderate - requires setup of banking infrastructure. |

| Customization | Limited to embedded features offered by partners. | Highly customizable banking products and services. |

| Use Cases | E-commerce, ride-sharing, platforms adding payments or credit. | Neobanks, fintechs offering digital banking solutions. |

Which is better?

Embedded finance offers seamless integration of financial services directly within non-financial platforms, enhancing user experience and driving higher engagement for entrepreneurs. Banking-as-a-service (BaaS) provides a customizable, scalable infrastructure that enables startups to launch branded financial products quickly without building banking capabilities from scratch. Entrepreneurs seeking agility and deep integration often prefer embedded finance, while those requiring full control and regulatory compliance lean toward BaaS solutions.

Connection

Embedded finance integrates banking services directly into non-financial platforms, enabling seamless financial transactions within entrepreneurial ecosystems. Banking-as-a-service (BaaS) provides the underlying infrastructure that allows businesses to offer these embedded financial products without traditional banking complexities. Together, they empower entrepreneurs to innovate with customized financial solutions, enhancing customer experience and operational efficiency.

Key Terms

APIs (Application Programming Interfaces)

Banking-as-a-Service (BaaS) platforms deliver comprehensive APIs enabling third-party developers to integrate full banking functionalities, including account management, payments, and compliance services directly into their applications. Embedded finance leverages these APIs to seamlessly incorporate financial services such as lending, insurance, or payment solutions within non-financial platforms, enhancing user experience without redirecting users to traditional banks. Explore how these API-driven models transform financial ecosystems and empower businesses to innovate.

Licensing/Regulatory Compliance

Banking-as-a-Service (BaaS) platforms typically hold the necessary banking licenses or partner with licensed banks to offer services, ensuring full regulatory compliance across jurisdictions. Embedded finance, on the other hand, integrates financial services into non-financial platforms by leveraging these licensed BaaS providers, allowing non-banks to offer banking features without acquiring separate licenses. Explore the nuances of licensing requirements and regulatory compliance to understand how each model manages risk and operational legitimacy.

White-label Solutions

White-label solutions in banking-as-a-service (BaaS) enable businesses to offer fully branded financial products by leveraging third-party infrastructure, allowing quick market entry without building banking systems from scratch. Embedded finance integrates financial services seamlessly within non-financial platforms, enhancing customer experience by embedding payments, lending, or insurance directly into everyday applications. Explore the nuances of white-label solutions in BaaS and embedded finance to understand their strategic impact on fintech innovation and customer engagement.

Source and External Links

Top Banking as a Service Companies in 2025 - SDK.finance - Banking as a Service (BaaS) enables non-banks such as fintechs and startups to provide financial services by accessing traditional banks' infrastructure and capabilities through APIs without holding a banking license themselves.

Banking As a Service (BaaS) Explained & Industry Outlook 2023 - BaaS platforms allow third-party providers to build new banking products by accessing bank APIs; banks monetizing these platforms create new revenue streams while advancing open banking initiatives.

Banking as a Service (BaaS): What It Is + Examples - BaaS is a financial framework enabling non-banks to offer tailored banking products through API integrations with licensed banks, fostering an ecosystem of embedded financial services and financial innovation.

dowidth.com

dowidth.com