Indie hackers build startups independently, focusing on sustainable growth through self-funding and revenue generation. Angel investors provide early-stage capital to promising startups in exchange for equity, often offering mentorship and strategic guidance. Explore the distinct roles and opportunities each offers in the entrepreneurial ecosystem.

Why it is important

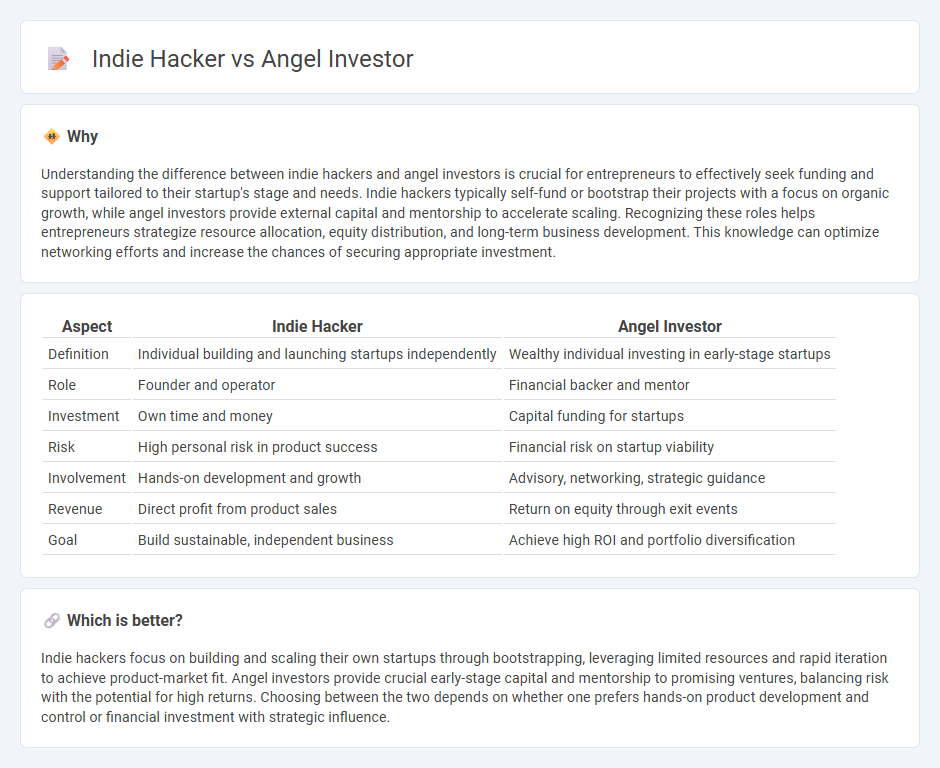

Understanding the difference between indie hackers and angel investors is crucial for entrepreneurs to effectively seek funding and support tailored to their startup's stage and needs. Indie hackers typically self-fund or bootstrap their projects with a focus on organic growth, while angel investors provide external capital and mentorship to accelerate scaling. Recognizing these roles helps entrepreneurs strategize resource allocation, equity distribution, and long-term business development. This knowledge can optimize networking efforts and increase the chances of securing appropriate investment.

Comparison Table

| Aspect | Indie Hacker | Angel Investor |

|---|---|---|

| Definition | Individual building and launching startups independently | Wealthy individual investing in early-stage startups |

| Role | Founder and operator | Financial backer and mentor |

| Investment | Own time and money | Capital funding for startups |

| Risk | High personal risk in product success | Financial risk on startup viability |

| Involvement | Hands-on development and growth | Advisory, networking, strategic guidance |

| Revenue | Direct profit from product sales | Return on equity through exit events |

| Goal | Build sustainable, independent business | Achieve high ROI and portfolio diversification |

Which is better?

Indie hackers focus on building and scaling their own startups through bootstrapping, leveraging limited resources and rapid iteration to achieve product-market fit. Angel investors provide crucial early-stage capital and mentorship to promising ventures, balancing risk with the potential for high returns. Choosing between the two depends on whether one prefers hands-on product development and control or financial investment with strategic influence.

Connection

Indie hackers often attract angel investors who provide early-stage funding to accelerate product development and scale operations. Angel investors bring valuable industry expertise, mentorship, and networking opportunities that enhance indie hackers' chances of success. This symbiotic relationship fuels innovation and drives growth within the entrepreneurial ecosystem.

Key Terms

Funding

Angel investors provide capital to early-stage startups in exchange for equity, offering not only funding but also mentorship and industry connections. Indie hackers primarily rely on self-funding or bootstrapping, focusing on building profitable businesses without external investment to maintain full control. Explore deeper insights into how funding strategies impact growth trajectories and founder autonomy.

Bootstrapping

Angel investors provide early-stage funding to startups, often in exchange for equity, accelerating business growth without immediate revenue dependency. Indie hackers prioritize bootstrapping by leveraging personal resources and revenue from initial sales to sustain and grow their ventures independently. Explore deeper strategies on how bootstrapping impacts startup success and investor relationships.

Equity

Angel investors typically provide capital in exchange for equity stakes, aiming to benefit from the startup's growth and eventual exit valuation. Indie hackers often bootstrap their projects, maintaining full equity ownership to preserve control and maximize long-term returns independently. Explore more insights on equity dynamics between angel investors and indie hackers to optimize your startup strategy.

Source and External Links

Understanding angel financing and investing - An angel investor is an individual who provides early-stage capital to startups in exchange for equity or convertible debt, helping founders progress from initial funding by family and friends to professional institutional rounds, while also offering mentorship and valuable networks.

Angel Investors - Angel investors are wealthy individuals investing their own money in small businesses for equity, often providing smaller, patient investments and mentoring, with an expectation of exit via acquisition or IPO.

Learn how to find and work with angel investors - Angel investors typically seek 10%-30% ownership and can offer strategic value beyond capital by providing guidance, connections, and aiding startups in preparing for larger funding rounds like Series A.

dowidth.com

dowidth.com