Ghost jobs, positions advertised but not genuinely available, distort employment market data and mislead job seekers. Job misclassification, where employees are incorrectly labeled as independent contractors or temporary staff, undermines labor rights and distorts statistics on workforce composition. Explore the impact of these practices on labor economics and worker protections.

Why it is important

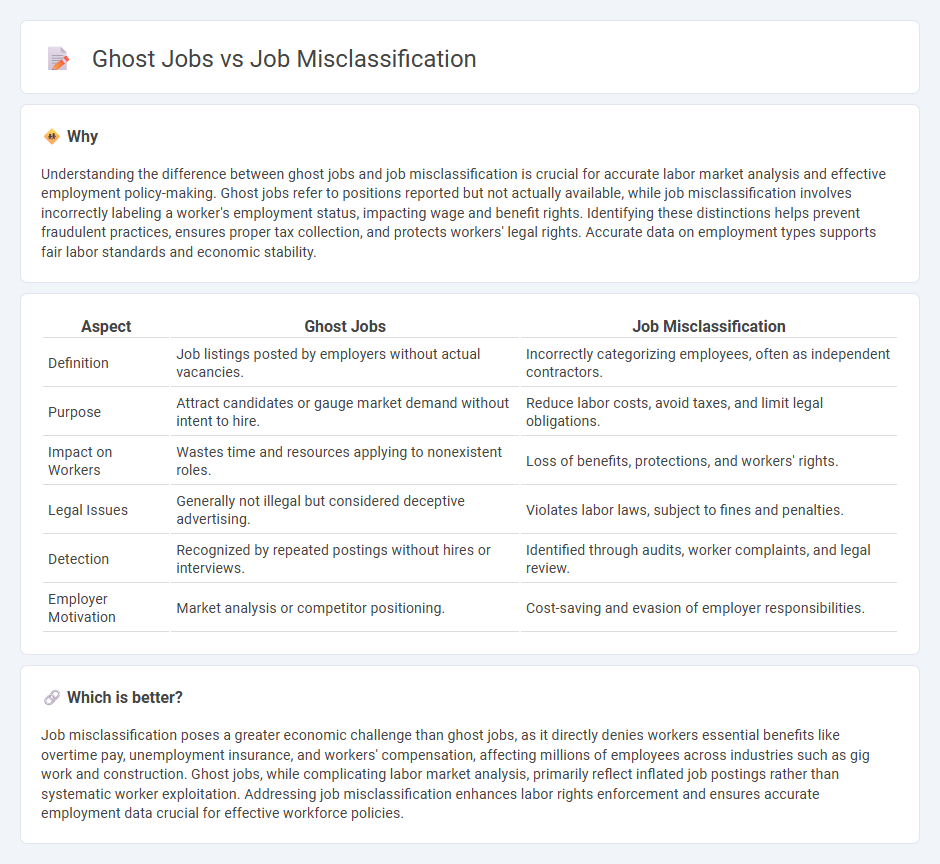

Understanding the difference between ghost jobs and job misclassification is crucial for accurate labor market analysis and effective employment policy-making. Ghost jobs refer to positions reported but not actually available, while job misclassification involves incorrectly labeling a worker's employment status, impacting wage and benefit rights. Identifying these distinctions helps prevent fraudulent practices, ensures proper tax collection, and protects workers' legal rights. Accurate data on employment types supports fair labor standards and economic stability.

Comparison Table

| Aspect | Ghost Jobs | Job Misclassification |

|---|---|---|

| Definition | Job listings posted by employers without actual vacancies. | Incorrectly categorizing employees, often as independent contractors. |

| Purpose | Attract candidates or gauge market demand without intent to hire. | Reduce labor costs, avoid taxes, and limit legal obligations. |

| Impact on Workers | Wastes time and resources applying to nonexistent roles. | Loss of benefits, protections, and workers' rights. |

| Legal Issues | Generally not illegal but considered deceptive advertising. | Violates labor laws, subject to fines and penalties. |

| Detection | Recognized by repeated postings without hires or interviews. | Identified through audits, worker complaints, and legal review. |

| Employer Motivation | Market analysis or competitor positioning. | Cost-saving and evasion of employer responsibilities. |

Which is better?

Job misclassification poses a greater economic challenge than ghost jobs, as it directly denies workers essential benefits like overtime pay, unemployment insurance, and workers' compensation, affecting millions of employees across industries such as gig work and construction. Ghost jobs, while complicating labor market analysis, primarily reflect inflated job postings rather than systematic worker exploitation. Addressing job misclassification enhances labor rights enforcement and ensures accurate employment data crucial for effective workforce policies.

Connection

Ghost jobs, where employers post positions without the intention to fill them, distort labor market data and can lead to job misclassification by creating unrealistic employment expectations. Job misclassification occurs when workers are incorrectly labeled as independent contractors instead of employees, often to evade taxes and labor protections, which is exacerbated by the prevalence of ghost jobs that blur actual labor demand. Both phenomena undermine accurate employment statistics, hinder worker rights, and contribute to economic inefficiencies in the labor market.

Key Terms

Employee vs. Independent Contractor

Job misclassification occurs when workers are incorrectly labeled as independent contractors instead of employees, denying them benefits like overtime pay, workers' compensation, and unemployment insurance. Ghost jobs refer to positions posted by companies that never actually exist, often used to gather resumes or boost employer visibility without intent to hire. Explore more about the implications of employee versus independent contractor status and how to identify misclassification risks.

False Job Postings

False job postings, often referred to as ghost jobs, involve advertisements for roles that do not actually exist or are not currently available, misleading job seekers and wasting valuable time. In contrast, job misclassification pertains to the incorrect categorization of workers, impacting wages, benefits, and legal protections rather than the availability of job opportunities. Explore the differences and implications of false job postings versus job misclassification to better navigate the labor market.

Wage and Hour Violations

Wage and hour violations arise from job misclassification and ghost jobs, with job misclassification involving employees wrongly labeled as independent contractors, denying them overtime pay and benefits under the Fair Labor Standards Act (FLSA). Ghost jobs refer to nonexistent or fraudulent job listings that can mislead applicants and disrupt wage enforcement efforts. Explore how accurate classification and transparency in job postings protect workers' rights and ensure compliance with labor laws.

Source and External Links

Job misclassification | USAGov - Job misclassification happens when a company labels a worker as an independent contractor instead of an employee, affecting pay, benefits, and legal protections, even if the company classifies you by 1099 forms or contractor agreements; you can report this to the Department of Labor for investigation.

Department of Industrial Relations Fraud Prevention Misclassification - Misclassification is when employers wrongly classify employees as independent contractors to avoid payroll taxes, minimum wage, overtime, and benefits, which is considered fraud and deprives workers of protections like workers' compensation and family leave.

Employee Misclassification: Navigating the Legal Landscape - Employee misclassification occurs when businesses falsely classify workers as contractors to evade providing benefits and legal protections, and it affects between 10% and 30% of U.S. employers, prompting stricter laws like the economic reality test to protect workers' rights.

dowidth.com

dowidth.com