Digital nomadism offers flexible, location-independent work opportunities driven by advancements in remote technology, contrasting with expatriate employment that typically involves long-term relocation and integration within foreign corporate structures. While digital nomads leverage co-working spaces and global connectivity, expatriates often receive company-sponsored relocation benefits and engage in local cultural immersion. Explore the evolving dynamics between these employment models and their impact on global workforce trends.

Why it is important

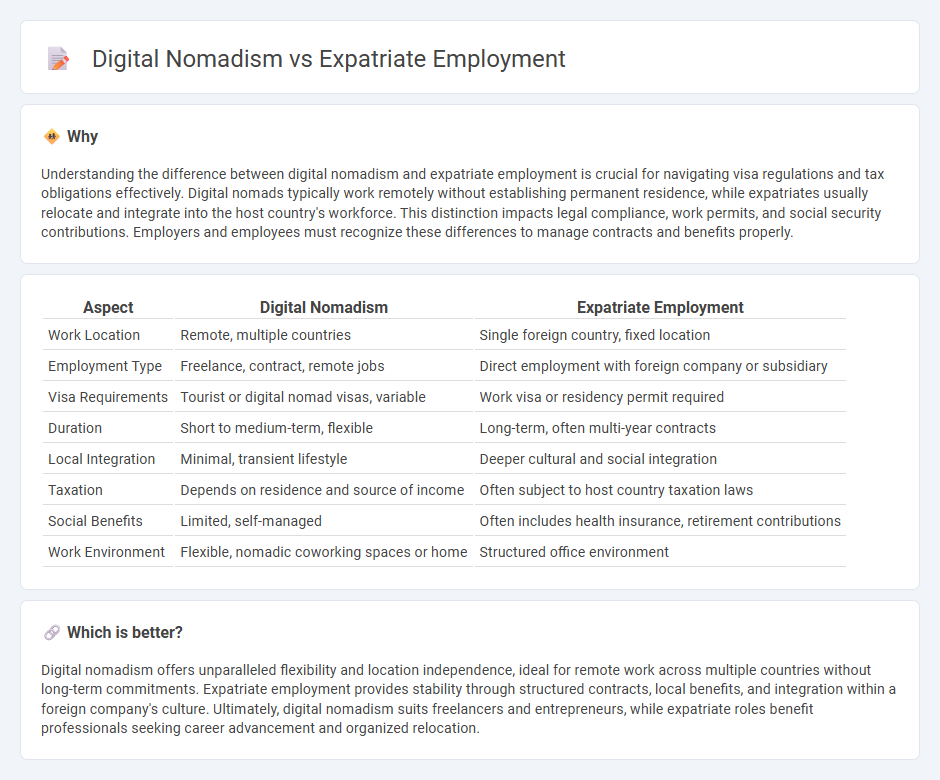

Understanding the difference between digital nomadism and expatriate employment is crucial for navigating visa regulations and tax obligations effectively. Digital nomads typically work remotely without establishing permanent residence, while expatriates usually relocate and integrate into the host country's workforce. This distinction impacts legal compliance, work permits, and social security contributions. Employers and employees must recognize these differences to manage contracts and benefits properly.

Comparison Table

| Aspect | Digital Nomadism | Expatriate Employment |

|---|---|---|

| Work Location | Remote, multiple countries | Single foreign country, fixed location |

| Employment Type | Freelance, contract, remote jobs | Direct employment with foreign company or subsidiary |

| Visa Requirements | Tourist or digital nomad visas, variable | Work visa or residency permit required |

| Duration | Short to medium-term, flexible | Long-term, often multi-year contracts |

| Local Integration | Minimal, transient lifestyle | Deeper cultural and social integration |

| Taxation | Depends on residence and source of income | Often subject to host country taxation laws |

| Social Benefits | Limited, self-managed | Often includes health insurance, retirement contributions |

| Work Environment | Flexible, nomadic coworking spaces or home | Structured office environment |

Which is better?

Digital nomadism offers unparalleled flexibility and location independence, ideal for remote work across multiple countries without long-term commitments. Expatriate employment provides stability through structured contracts, local benefits, and integration within a foreign company's culture. Ultimately, digital nomadism suits freelancers and entrepreneurs, while expatriate roles benefit professionals seeking career advancement and organized relocation.

Connection

Digital nomadism and expatriate employment are interconnected through the increasing demand for location-independent work facilitated by remote job opportunities and global mobility. Both digital nomads and expatriates leverage technology to maintain productivity while relocating internationally, impacting global labor markets and creating new employment paradigms. This connection drives the growth of support services, such as international coworking spaces and cross-border tax consulting, enhancing the flexibility of modern employment.

Key Terms

Work Visa

Work visas for expatriates typically require sponsorship from a company and involve longer-term commitments tied to a specific location and role. In contrast, digital nomads often rely on specialized remote work visas or tourist permits that allow flexibility to live and work in multiple countries without traditional employment sponsorship. Explore the key differences in visa requirements and legal considerations to optimize your global work strategy.

Remote Work

Expatriate employment typically involves relocating to a foreign country for an extended period under a formal work contract, often with employer-sponsored visas and local tax compliance, whereas digital nomadism centers on location-independent remote work, allowing individuals to operate from various global destinations without long-term commitments. Emerging tools like VPNs, cloud collaboration platforms, and international tax advisors support both work models, but legal residency and employment rights remain critical distinctions. Explore comprehensive guides on remote work strategies, legal frameworks, and lifestyle adaptations to optimize your global career approach.

Tax Residency

Expatriate employment typically involves relocating to a foreign country with a long-term work contract, which triggers tax residency rules based on the host country's regulations and bilateral tax treaties. Digital nomadism allows remote work from multiple locations without establishing permanent tax residency, though each country's presence can influence tax obligations. Explore detailed tax residency criteria to optimize your employment status and compliance.

Source and External Links

What Is an Expatriate Employee? Pros & Cons - Velocity Global - An expatriate employee is a professional temporarily working in a foreign country for their employer, with varying regulations and opportunities depending on the host country, including the U.S., Germany, UAE, Singapore, Japan, and Australia.

The 10 Best Jobs For Expats Who Want To Work Abroad - Popular expatriate jobs include AI specialist, healthcare worker, finance professional, cybersecurity expert, and language teacher, with demand and salary depending on the country and industry growth.

Expatriate: HR Terms Explained - Pelago - Expatriate assignments benefit both employees and employers by offering career growth, cultural experiences, and potential tax benefits, but require comprehensive selection, training, and support systems.

dowidth.com

dowidth.com