Secondment involves temporarily assigning an employee to a different department or organization while retaining their original employment status, allowing for skill development and organizational collaboration. Contracting refers to engaging workers through fixed-term agreements, often offering flexibility and specific project-based expertise without long-term employment commitments. Explore the nuances and benefits of secondment versus contracting to optimize your workforce strategy.

Why it is important

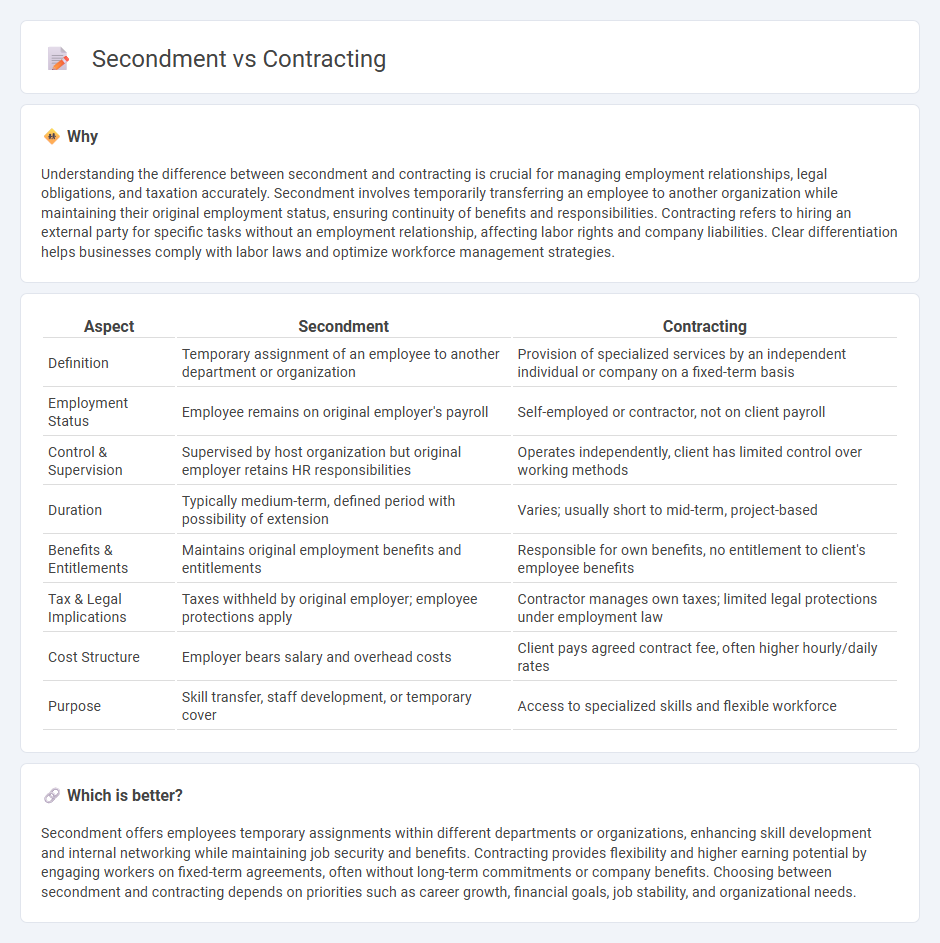

Understanding the difference between secondment and contracting is crucial for managing employment relationships, legal obligations, and taxation accurately. Secondment involves temporarily transferring an employee to another organization while maintaining their original employment status, ensuring continuity of benefits and responsibilities. Contracting refers to hiring an external party for specific tasks without an employment relationship, affecting labor rights and company liabilities. Clear differentiation helps businesses comply with labor laws and optimize workforce management strategies.

Comparison Table

| Aspect | Secondment | Contracting |

|---|---|---|

| Definition | Temporary assignment of an employee to another department or organization | Provision of specialized services by an independent individual or company on a fixed-term basis |

| Employment Status | Employee remains on original employer's payroll | Self-employed or contractor, not on client payroll |

| Control & Supervision | Supervised by host organization but original employer retains HR responsibilities | Operates independently, client has limited control over working methods |

| Duration | Typically medium-term, defined period with possibility of extension | Varies; usually short to mid-term, project-based |

| Benefits & Entitlements | Maintains original employment benefits and entitlements | Responsible for own benefits, no entitlement to client's employee benefits |

| Tax & Legal Implications | Taxes withheld by original employer; employee protections apply | Contractor manages own taxes; limited legal protections under employment law |

| Cost Structure | Employer bears salary and overhead costs | Client pays agreed contract fee, often higher hourly/daily rates |

| Purpose | Skill transfer, staff development, or temporary cover | Access to specialized skills and flexible workforce |

Which is better?

Secondment offers employees temporary assignments within different departments or organizations, enhancing skill development and internal networking while maintaining job security and benefits. Contracting provides flexibility and higher earning potential by engaging workers on fixed-term agreements, often without long-term commitments or company benefits. Choosing between secondment and contracting depends on priorities such as career growth, financial goals, job stability, and organizational needs.

Connection

Secondment and contracting are connected through their roles in flexible employment arrangements that allow organizations to access specialized skills without permanent hiring. Both methods support workforce agility by enabling companies to allocate human resources efficiently across projects or departments. Contracting typically involves external service providers, while secondment often refers to temporarily assigning employees within or between organizations.

Key Terms

Employment Status

Contracting typically classifies an individual as an independent contractor, affecting their employment status, benefits, and tax obligations differently from permanent employees. Secondment involves temporarily transferring an employee to a different role or organization while retaining their original employment status and associated rights. Explore how these distinctions impact legal responsibilities and employee protections in detail.

Legal Liability

Contracting often places legal liability squarely on the contractor, who assumes responsibility for compliance, work quality, and any arising disputes. In contrast, secondment typically maintains a shared or primary liability with the seconding company, as the secondee remains employed and under the original employer's control. Explore the nuances of legal liability in contracting versus secondment to make informed business decisions.

Control and Supervision

Contracting involves an independent contractor operating with significant control over how tasks are completed, whereas secondment places an employee under the direct supervision and control of the host organization, maintaining employment ties to the original employer. In secondment, control and supervision are aligned with the host company's policies and management, while contracting emphasizes autonomy and results-based oversight. Explore detailed differences and legal implications of control and supervision in contracting versus secondment arrangements.

Source and External Links

How to Start a Contracting Business - U.S. Chamber of Commerce - Provides practical guidance on launching and growing a contracting business, including hiring and managing subcontractors with an emphasis on risk management and due diligence.

Contracting assistance programs | U.S. Small Business Administration - Details federal government programs to support small businesses in government contracting, including goals for awarding contracts and requirements for small business subcontracting plans.

Contracting with EPA | US EPA - Offers information on how to do business with the EPA, access contract opportunities, and details about procurement policies and processes including COVID-19 safety protocols.

dowidth.com

dowidth.com