Due diligence deep dive uncovers critical financial, legal, and operational risks to ensure informed investment decisions. Value creation planning focuses on identifying growth opportunities and strategic initiatives to maximize return on investment post-acquisition. Explore our insights to understand how combining both approaches drives successful consulting outcomes.

Why it is important

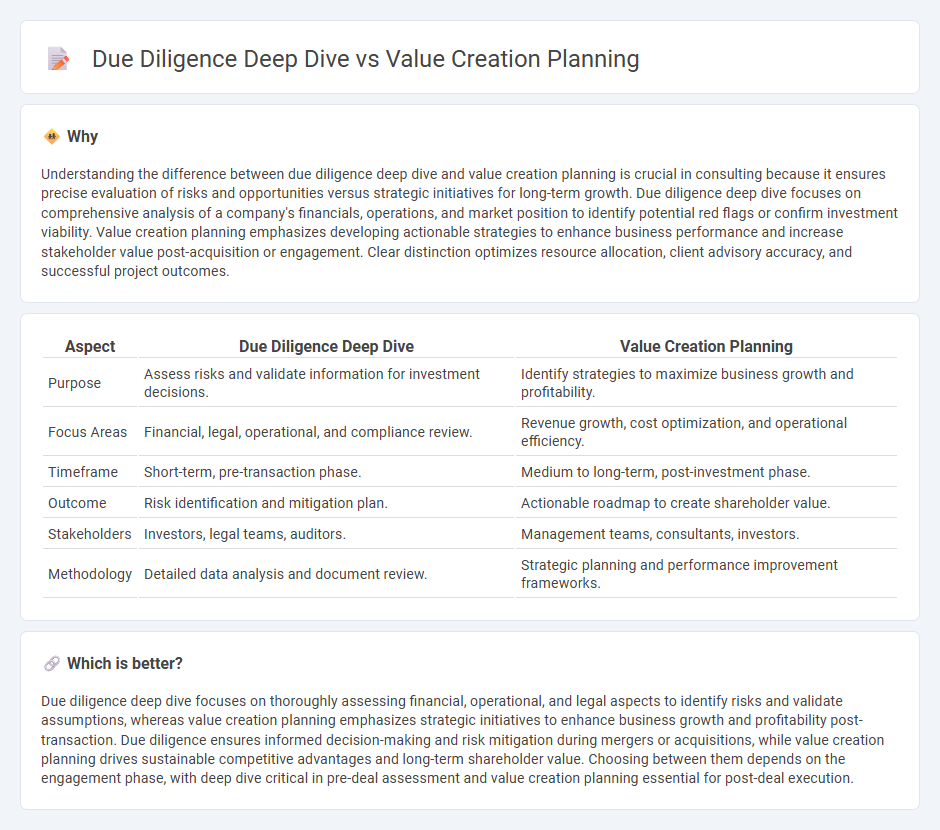

Understanding the difference between due diligence deep dive and value creation planning is crucial in consulting because it ensures precise evaluation of risks and opportunities versus strategic initiatives for long-term growth. Due diligence deep dive focuses on comprehensive analysis of a company's financials, operations, and market position to identify potential red flags or confirm investment viability. Value creation planning emphasizes developing actionable strategies to enhance business performance and increase stakeholder value post-acquisition or engagement. Clear distinction optimizes resource allocation, client advisory accuracy, and successful project outcomes.

Comparison Table

| Aspect | Due Diligence Deep Dive | Value Creation Planning |

|---|---|---|

| Purpose | Assess risks and validate information for investment decisions. | Identify strategies to maximize business growth and profitability. |

| Focus Areas | Financial, legal, operational, and compliance review. | Revenue growth, cost optimization, and operational efficiency. |

| Timeframe | Short-term, pre-transaction phase. | Medium to long-term, post-investment phase. |

| Outcome | Risk identification and mitigation plan. | Actionable roadmap to create shareholder value. |

| Stakeholders | Investors, legal teams, auditors. | Management teams, consultants, investors. |

| Methodology | Detailed data analysis and document review. | Strategic planning and performance improvement frameworks. |

Which is better?

Due diligence deep dive focuses on thoroughly assessing financial, operational, and legal aspects to identify risks and validate assumptions, whereas value creation planning emphasizes strategic initiatives to enhance business growth and profitability post-transaction. Due diligence ensures informed decision-making and risk mitigation during mergers or acquisitions, while value creation planning drives sustainable competitive advantages and long-term shareholder value. Choosing between them depends on the engagement phase, with deep dive critical in pre-deal assessment and value creation planning essential for post-deal execution.

Connection

Due diligence deep dive uncovers critical financial, operational, and market insights essential for identifying risks and growth opportunities within a target company. Value creation planning leverages these insights to design strategic initiatives that enhance profitability, operational efficiency, and competitive advantage. This connection ensures informed decision-making and maximized investment returns throughout the consulting engagement.

Key Terms

Growth Strategy (Value Creation Planning)

Value Creation Planning centers on designing a robust Growth Strategy that leverages market expansion, product innovation, and operational efficiencies to maximize enterprise value. This approach identifies key value drivers and prioritizes initiatives that accelerate revenue and profit growth post-transaction. Discover how aligning Growth Strategy within Value Creation Planning fosters sustainable competitive advantage and enhances investment outcomes.

Risk Assessment (Due Diligence Deep Dive)

Risk assessment in due diligence deep dive rigorously evaluates potential financial, operational, and compliance threats affecting transaction value. This process identifies hidden liabilities and regulatory exposures to mitigate risks before deal closure. Explore detailed methodologies to strengthen risk mitigation strategies in value creation planning.

Implementation Roadmap (Value Creation Planning)

Value creation planning emphasizes developing a detailed implementation roadmap that outlines strategic initiatives, key performance indicators, and resource allocation to optimize post-acquisition growth and operational improvements. Due diligence deep dive primarily focuses on assessing potential risks, financial health, and operational gaps before the transaction closes, rather than detailing execution plans. Explore how a well-structured implementation roadmap accelerates value realization and enhances integration success.

Source and External Links

Value Creation Planning: A Strategic Approach for Success - Metridev - Value creation planning is a strategic process involving identifying value drivers, developing value propositions, implementing strategies, and continuously measuring and optimizing initiatives for sustainable growth and alignment with the organization's vision.

Value Creation Definition, Model and Examples in Business - A value creation plan includes defining clear execution strategies, assigning responsibilities, budgeting resources, setting timelines and milestones, establishing KPIs, and managing risks to bring value creation concepts to life effectively.

How to develop a Value Creation Plan - Untap.pe - Building a successful value creation plan involves creating SMART value drivers, developing objectives and initiatives, setting realistic targets and deadlines, tracking performance, sharing progress, and incorporating feedback to keep the plan current.

dowidth.com

dowidth.com