Zero-based budgeting requires each expense to be justified from scratch, enabling precise cost control and resource allocation in consulting projects. Value-based management focuses on maximizing value creation by aligning strategic goals with performance metrics, driving long-term business success. Explore how integrating zero-based budgeting and value-based management can enhance your consulting outcomes and financial strategy.

Why it is important

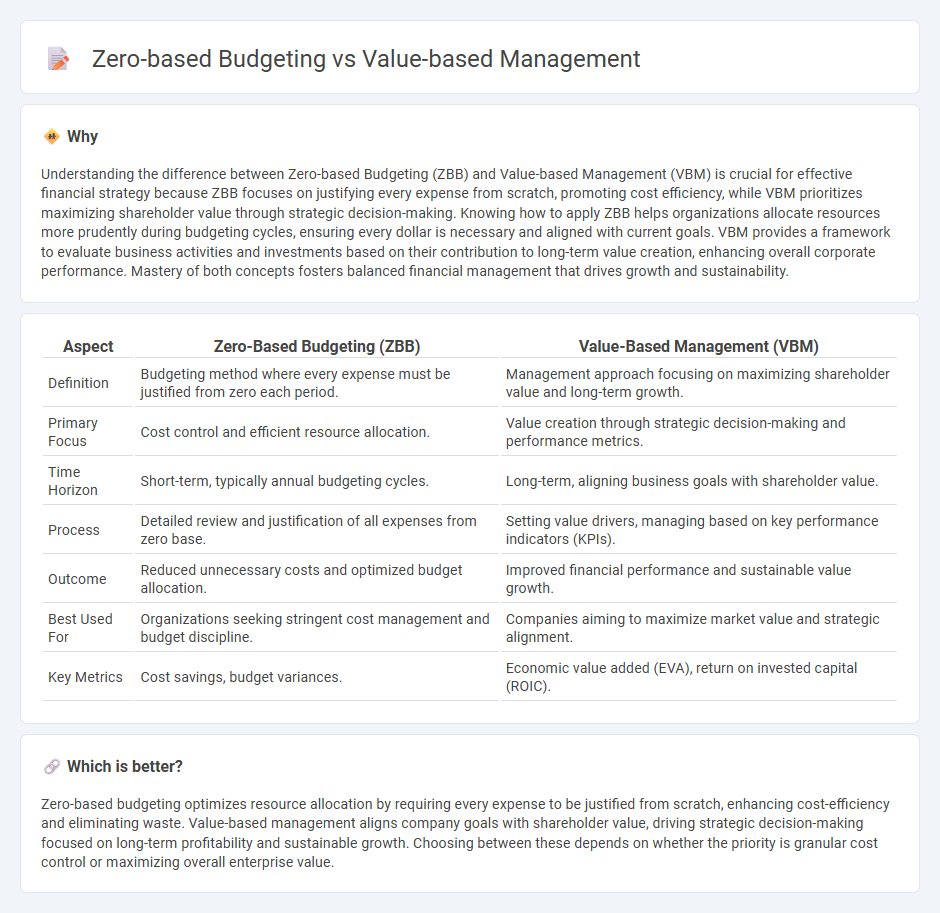

Understanding the difference between Zero-based Budgeting (ZBB) and Value-based Management (VBM) is crucial for effective financial strategy because ZBB focuses on justifying every expense from scratch, promoting cost efficiency, while VBM prioritizes maximizing shareholder value through strategic decision-making. Knowing how to apply ZBB helps organizations allocate resources more prudently during budgeting cycles, ensuring every dollar is necessary and aligned with current goals. VBM provides a framework to evaluate business activities and investments based on their contribution to long-term value creation, enhancing overall corporate performance. Mastery of both concepts fosters balanced financial management that drives growth and sustainability.

Comparison Table

| Aspect | Zero-Based Budgeting (ZBB) | Value-Based Management (VBM) |

|---|---|---|

| Definition | Budgeting method where every expense must be justified from zero each period. | Management approach focusing on maximizing shareholder value and long-term growth. |

| Primary Focus | Cost control and efficient resource allocation. | Value creation through strategic decision-making and performance metrics. |

| Time Horizon | Short-term, typically annual budgeting cycles. | Long-term, aligning business goals with shareholder value. |

| Process | Detailed review and justification of all expenses from zero base. | Setting value drivers, managing based on key performance indicators (KPIs). |

| Outcome | Reduced unnecessary costs and optimized budget allocation. | Improved financial performance and sustainable value growth. |

| Best Used For | Organizations seeking stringent cost management and budget discipline. | Companies aiming to maximize market value and strategic alignment. |

| Key Metrics | Cost savings, budget variances. | Economic value added (EVA), return on invested capital (ROIC). |

Which is better?

Zero-based budgeting optimizes resource allocation by requiring every expense to be justified from scratch, enhancing cost-efficiency and eliminating waste. Value-based management aligns company goals with shareholder value, driving strategic decision-making focused on long-term profitability and sustainable growth. Choosing between these depends on whether the priority is granular cost control or maximizing overall enterprise value.

Connection

Zero-based budgeting and value-based management are interconnected financial strategies that focus on optimizing resource allocation and enhancing organizational value. Zero-based budgeting requires building budgets from the ground up, ensuring every expense contributes to business objectives, while value-based management prioritizes decision-making that maximizes shareholder value. Together, they enable firms to align budgeting processes with strategic value creation, improving financial discipline and performance measurement.

Key Terms

Performance Metrics

Value-based management emphasizes aligning organizational goals with stakeholder value by using key performance metrics such as Economic Value Added (EVA) and Return on Invested Capital (ROIC) to drive decision-making and long-term growth. Zero-based budgeting focuses on justifying every expense from zero each period, using cost-efficiency metrics like Cost per Unit and Budget Variance to optimize resource allocation and control spending. Explore in-depth comparisons and practical applications of these approaches to enhance your financial strategy.

Resource Allocation

Value-based management prioritizes aligning resources with activities that maximize shareholder value by continuously assessing and reallocating funds based on business objectives and performance metrics. Zero-based budgeting requires justifying all expenses from scratch each period, promoting efficient resource allocation by eliminating redundant or unnecessary costs. Explore how integrating these approaches can optimize financial planning and strategic resource management.

Cost Control

Value-based management (VBM) prioritizes aligning company activities with key value drivers to maximize shareholder value, emphasizing strategic cost control linked to performance outcomes. Zero-based budgeting (ZBB) requires building budgets from scratch each period, ensuring every expense is justified for tight, granular cost management. Explore deeper insights into how VBM and ZBB uniquely contribute to effective cost control strategies.

Source and External Links

What is value-based management? - Value-based management (VBM) aligns a company's aspirations, techniques, and processes to focus decision-making on creating value, measured by discounted future cash flows and returns above the cost of capital.

Demystifying value-based management - VBM is a hierarchical system linking all company levels to shareholder value through measurable objectives and value drivers, such as Economic Value Added (EVA), cascaded from strategy to daily operations.

Value Based Management In Work - VBM requires defining value (often as shareholder value), setting measurable objectives at all organizational levels, and embedding a value-focused culture through leadership, targets, and aligned rewards.

dowidth.com

dowidth.com