Consulting retainer models ensure consistent access to expert advice through fixed, ongoing fees, providing predictable budgeting and sustained support. Success fee arrangements link compensation directly to achieved results, aligning consultant incentives with client outcomes and driving performance-based collaboration. Explore how each model can be tailored to maximize value in your consulting engagement.

Why it is important

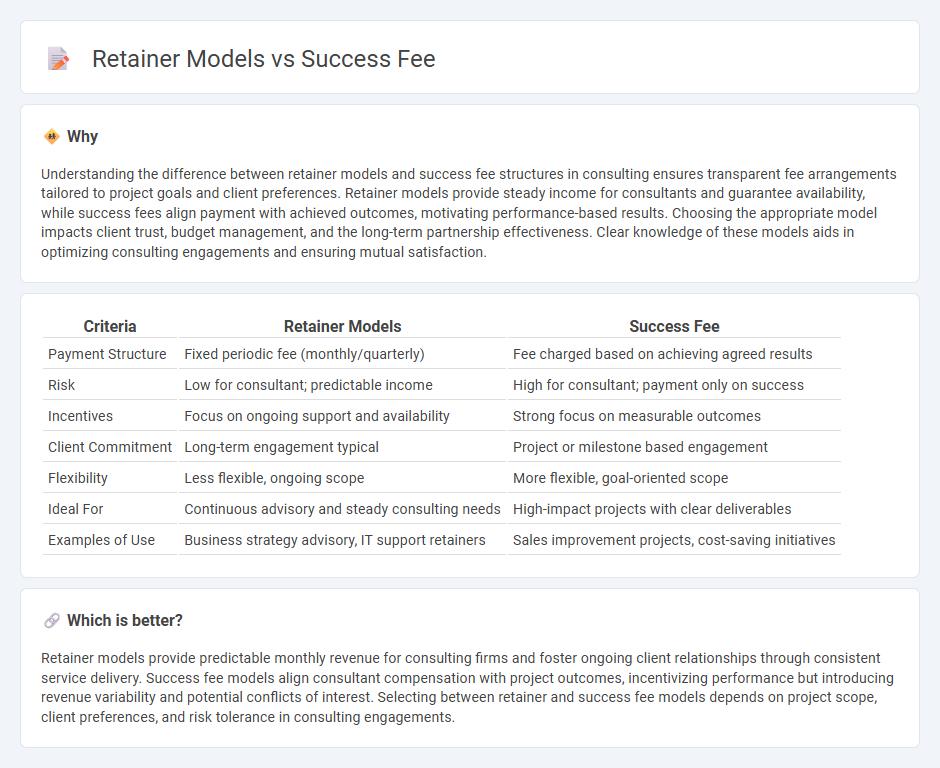

Understanding the difference between retainer models and success fee structures in consulting ensures transparent fee arrangements tailored to project goals and client preferences. Retainer models provide steady income for consultants and guarantee availability, while success fees align payment with achieved outcomes, motivating performance-based results. Choosing the appropriate model impacts client trust, budget management, and the long-term partnership effectiveness. Clear knowledge of these models aids in optimizing consulting engagements and ensuring mutual satisfaction.

Comparison Table

| Criteria | Retainer Models | Success Fee |

|---|---|---|

| Payment Structure | Fixed periodic fee (monthly/quarterly) | Fee charged based on achieving agreed results |

| Risk | Low for consultant; predictable income | High for consultant; payment only on success |

| Incentives | Focus on ongoing support and availability | Strong focus on measurable outcomes |

| Client Commitment | Long-term engagement typical | Project or milestone based engagement |

| Flexibility | Less flexible, ongoing scope | More flexible, goal-oriented scope |

| Ideal For | Continuous advisory and steady consulting needs | High-impact projects with clear deliverables |

| Examples of Use | Business strategy advisory, IT support retainers | Sales improvement projects, cost-saving initiatives |

Which is better?

Retainer models provide predictable monthly revenue for consulting firms and foster ongoing client relationships through consistent service delivery. Success fee models align consultant compensation with project outcomes, incentivizing performance but introducing revenue variability and potential conflicts of interest. Selecting between retainer and success fee models depends on project scope, client preferences, and risk tolerance in consulting engagements.

Connection

Retainer models and success fees are linked by aligning client and consultant incentives through a hybrid payment structure, where a fixed monthly retainer ensures ongoing services and a success fee rewards achievement of specific project milestones or business outcomes. This combination fosters accountability and motivates consultants to deliver measurable results, balancing risk between both parties. Effective use of these models enhances long-term client relationships and drives value-based consulting engagements.

Key Terms

Payment Structure

Success fee models tie payment directly to the achievement of specific outcomes, ensuring clients pay only if results are delivered. Retainer models involve regular, fixed payments regardless of immediate results, providing ongoing access to services. Explore our detailed analysis to determine which payment structure best suits your business needs.

Risk Allocation

Success fee models allocate greater financial risk to the advisor, as payment depends on achieving specific results, incentivizing performance alignment with client goals. Retainer models impose a fixed-cost risk on clients, ensuring steady advisor availability and predictable expenses regardless of project outcomes. Explore how shifting risk impacts partnership dynamics and decision-making in professional engagements.

Incentive Alignment

Success fee models align incentives by linking payment directly to achieving specific outcomes, motivating service providers to prioritize client results. Retainer models ensure consistent availability and ongoing support but may lack direct performance incentives, potentially affecting the urgency of service delivery. Explore the advantages and applications of each model to determine which best suits your business objectives.

Source and External Links

What is a success fee? - Resource - Francis Wilks & Jones - A success fee is an agreed uplift on a lawyer's costs payable upon winning a case, calculated as a percentage increase on standard hourly rates, typically up to 100% of those rates.

Success Fee - Defintion, How it Works, Benefits, Limits - In finance, a success fee is a commission paid to an advisor, usually an investment bank, contingent on successfully completing a transaction, often structured as a percentage of the deal value.

What is a Success Fee in a Business Sale? - A success fee in business sales is a commission paid to a broker or intermediary upon successful sale completion, structured variously as fixed, flat percentage, scaled, or reverse scaled fees depending on the deal and business size.

dowidth.com

dowidth.com