Competitive intelligence war gaming simulates market scenarios to anticipate rivals' moves and optimize strategic responses, while strategic due diligence evaluates potential investments by analyzing risks, opportunities, and business viability. Both approaches provide critical insights but serve different purposes--war gaming focuses on dynamic competition, and due diligence ensures informed decision-making. Explore how integrating these methods can enhance your consulting strategy.

Why it is important

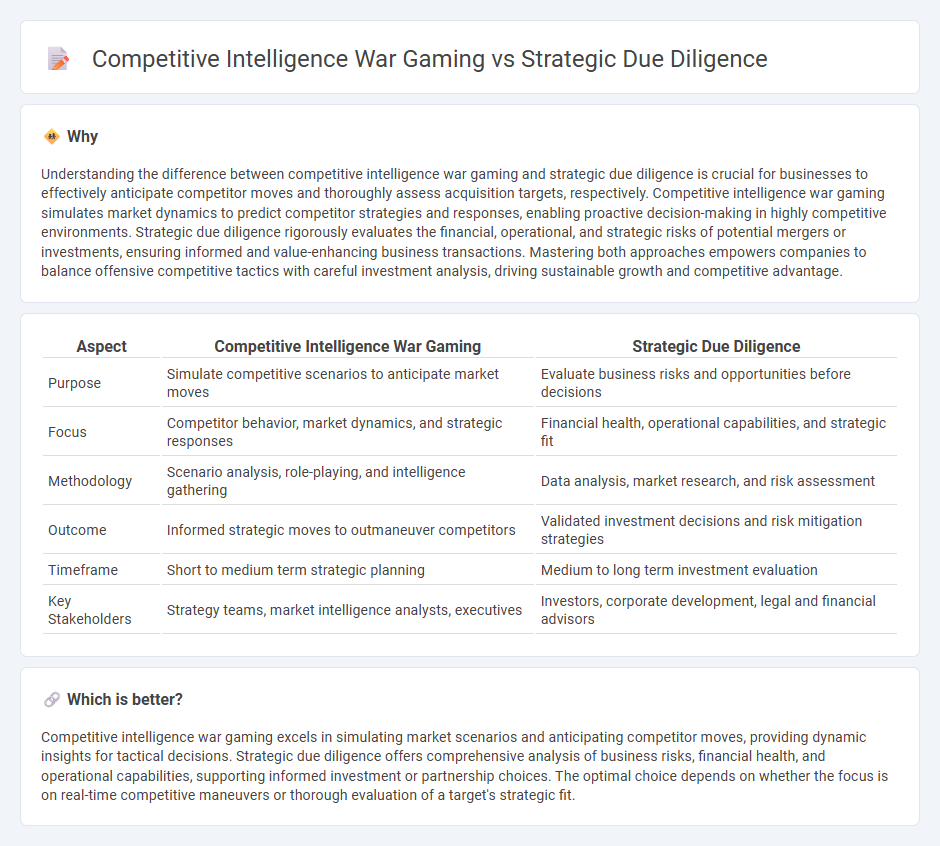

Understanding the difference between competitive intelligence war gaming and strategic due diligence is crucial for businesses to effectively anticipate competitor moves and thoroughly assess acquisition targets, respectively. Competitive intelligence war gaming simulates market dynamics to predict competitor strategies and responses, enabling proactive decision-making in highly competitive environments. Strategic due diligence rigorously evaluates the financial, operational, and strategic risks of potential mergers or investments, ensuring informed and value-enhancing business transactions. Mastering both approaches empowers companies to balance offensive competitive tactics with careful investment analysis, driving sustainable growth and competitive advantage.

Comparison Table

| Aspect | Competitive Intelligence War Gaming | Strategic Due Diligence |

|---|---|---|

| Purpose | Simulate competitive scenarios to anticipate market moves | Evaluate business risks and opportunities before decisions |

| Focus | Competitor behavior, market dynamics, and strategic responses | Financial health, operational capabilities, and strategic fit |

| Methodology | Scenario analysis, role-playing, and intelligence gathering | Data analysis, market research, and risk assessment |

| Outcome | Informed strategic moves to outmaneuver competitors | Validated investment decisions and risk mitigation strategies |

| Timeframe | Short to medium term strategic planning | Medium to long term investment evaluation |

| Key Stakeholders | Strategy teams, market intelligence analysts, executives | Investors, corporate development, legal and financial advisors |

Which is better?

Competitive intelligence war gaming excels in simulating market scenarios and anticipating competitor moves, providing dynamic insights for tactical decisions. Strategic due diligence offers comprehensive analysis of business risks, financial health, and operational capabilities, supporting informed investment or partnership choices. The optimal choice depends on whether the focus is on real-time competitive maneuvers or thorough evaluation of a target's strategic fit.

Connection

Competitive intelligence war gaming and strategic due diligence are interconnected processes that enhance decision-making in consulting by simulating market scenarios and assessing potential risks. War gaming provides a dynamic framework to anticipate competitor moves and market responses, while strategic due diligence offers a comprehensive evaluation of a target company's operational, financial, and strategic position. Integrating both methodologies enables consultants to deliver informed, data-driven recommendations that mitigate risks and uncover value in mergers, acquisitions, and strategic initiatives.

Key Terms

Market Analysis

Strategic due diligence involves comprehensive evaluation of market trends, competitor positioning, and financial health to inform mergers and acquisitions, while competitive intelligence war gaming simulates competitor responses and market dynamics to anticipate strategic moves and vulnerabilities. Market analysis in strategic due diligence prioritizes data-driven assessment of industry growth, customer segments, and regulatory impacts, whereas war gaming emphasizes scenario planning and real-time decision-making under competitive pressure. Explore detailed methodologies and case studies to deepen understanding of these critical tools in market analysis.

Scenario Planning

Strategic due diligence involves in-depth analysis of potential investments and acquisitions, emphasizing risk assessment and validation of business models through scenario planning to predict future market conditions accurately. Competitive intelligence war gaming focuses on simulating competitor actions and market responses, leveraging scenario planning to evaluate strategic moves and competitive dynamics under various hypothetical scenarios. Explore deeper insights into how scenario planning enhances decision-making in both strategic due diligence and competitive intelligence war gaming.

Competitor Profiling

Strategic due diligence in competitor profiling involves a comprehensive analysis of a competitor's financial health, market position, and strategic initiatives to assess potential risks and opportunities in mergers or acquisitions. Competitive intelligence war gaming simulates market scenarios and strategic moves, helping organizations anticipate competitor actions and develop proactive strategies based on real-time data and behavioral insights. Explore detailed methodologies to enhance your competitor profiling and strategic decision-making processes.

Source and External Links

Strategic Due Diligence - The key to unlocking a deal's full potential - Strategic due diligence thoroughly vets the investment thesis, evaluates the target company's capabilities and culture, scrutinizes financial projections, and uncovers synergies to provide a data-driven opinion on the deal's potential success and risks.

Strategic Due Diligence: A Comprehensive Guide to Smarter Decision-Making - Strategic due diligence involves a comprehensive investigation of financial, legal, operational, and strategic factors to assess risks and benefits before mergers, acquisitions, partnerships, or investments, ensuring informed decision-making and cultural fit.

Strategic Due Diligence: A Foundation for M&A Success - Strategic due diligence helps determine the value and purchase price of a deal by validating financial projections and synergies, tailoring the process to each transaction's unique value drivers and integration challenges to ensure the business can realize the anticipated value.

dowidth.com

dowidth.com