ESG due diligence focuses on evaluating environmental, social, and governance risks and opportunities to ensure sustainable and ethical business practices, while financial due diligence assesses a company's financial health, assets, liabilities, and cash flow to validate investment decisions. Both processes are crucial in mergers and acquisitions, providing comprehensive insights that reduce risk and enhance value creation. Explore how integrating ESG and financial due diligence can drive better strategic outcomes.

Why it is important

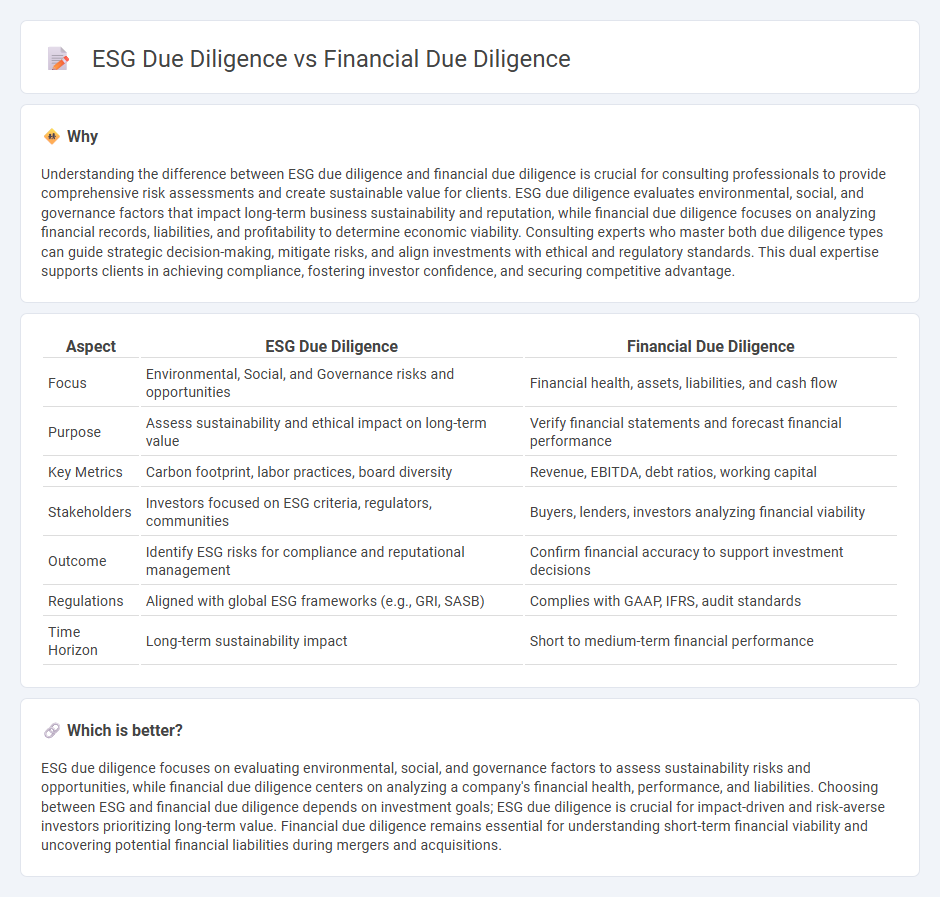

Understanding the difference between ESG due diligence and financial due diligence is crucial for consulting professionals to provide comprehensive risk assessments and create sustainable value for clients. ESG due diligence evaluates environmental, social, and governance factors that impact long-term business sustainability and reputation, while financial due diligence focuses on analyzing financial records, liabilities, and profitability to determine economic viability. Consulting experts who master both due diligence types can guide strategic decision-making, mitigate risks, and align investments with ethical and regulatory standards. This dual expertise supports clients in achieving compliance, fostering investor confidence, and securing competitive advantage.

Comparison Table

| Aspect | ESG Due Diligence | Financial Due Diligence |

|---|---|---|

| Focus | Environmental, Social, and Governance risks and opportunities | Financial health, assets, liabilities, and cash flow |

| Purpose | Assess sustainability and ethical impact on long-term value | Verify financial statements and forecast financial performance |

| Key Metrics | Carbon footprint, labor practices, board diversity | Revenue, EBITDA, debt ratios, working capital |

| Stakeholders | Investors focused on ESG criteria, regulators, communities | Buyers, lenders, investors analyzing financial viability |

| Outcome | Identify ESG risks for compliance and reputational management | Confirm financial accuracy to support investment decisions |

| Regulations | Aligned with global ESG frameworks (e.g., GRI, SASB) | Complies with GAAP, IFRS, audit standards |

| Time Horizon | Long-term sustainability impact | Short to medium-term financial performance |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance factors to assess sustainability risks and opportunities, while financial due diligence centers on analyzing a company's financial health, performance, and liabilities. Choosing between ESG and financial due diligence depends on investment goals; ESG due diligence is crucial for impact-driven and risk-averse investors prioritizing long-term value. Financial due diligence remains essential for understanding short-term financial viability and uncovering potential financial liabilities during mergers and acquisitions.

Connection

ESG due diligence and financial due diligence are interconnected processes that collectively assess a company's sustainability and financial health, ensuring comprehensive risk management. Integrating ESG factors into financial due diligence enables consultants to identify potential environmental, social, and governance risks that could impact valuation, compliance, and long-term profitability. This holistic approach supports informed investment decisions and enhances the credibility of merger and acquisition activities.

Key Terms

Financial Analysis

Financial due diligence rigorously evaluates a company's financial health, examining cash flow, profitability, and liabilities to uncover risks and validate valuation. ESG due diligence incorporates environmental, social, and governance factors that can influence long-term financial performance and sustainability risks. Discover how integrating both financial and ESG due diligence can enhance investment decision-making and risk management strategies.

ESG Risk Assessment

Financial due diligence primarily evaluates a company's fiscal health, analyzing balance sheets, cash flow, and profitability to inform investment decisions. ESG due diligence focuses on environmental, social, and governance risk assessment, identifying potential liabilities related to sustainability practices, regulatory compliance, and corporate social responsibility. Explore how integrating ESG risk assessment can enhance decision-making and long-term value creation in due diligence processes.

Compliance Standards

Financial due diligence evaluates a company's fiscal health, focusing on assets, liabilities, cash flow, and profitability to ensure compliance with accounting standards and financial regulations. ESG due diligence assesses environmental, social, and governance practices, emphasizing adherence to ethical codes, sustainability metrics, and corporate social responsibility guidelines. Explore the critical compliance standards distinguishing financial due diligence from ESG due diligence to enhance risk management strategies.

Source and External Links

How to Conduct Financial Due Diligence + Checklist - DealRoom.net - Financial due diligence is a deep investigation into a company's financial statements, including income statement, balance sheet, and cash flow, analyzing earnings volatility, expense irregularities, asset valuations, and debt ratios over the past five years to assess financial health.

Difference Between Audit and Financial Due Diligence | ML&R - Financial due diligence focuses on understanding sustainable earnings, sales and expense trends, management forecasts, working capital needs, and qualitative insights about management and accounting systems, going beyond historical audits to assess future business viability.

What Is Financial Due Diligence & How To Do It - Ansarada - Financial due diligence verifies the accuracy of financial data in M&A transactions through analysis of financial statements, forecasts, market data, and interviews, structured around three pillars: income statement, balance sheet, and cash flow examination.

dowidth.com

dowidth.com