Stakeholder capitalism advisory focuses on aligning business strategies with the interests of a broad range of stakeholders, including employees, customers, communities, and the environment, promoting sustainable and ethical growth. Shareholder value advisory prioritizes maximizing financial returns and stock price performance to benefit investors and shareholders. Discover how these distinct consulting approaches can drive your organization's long-term success.

Why it is important

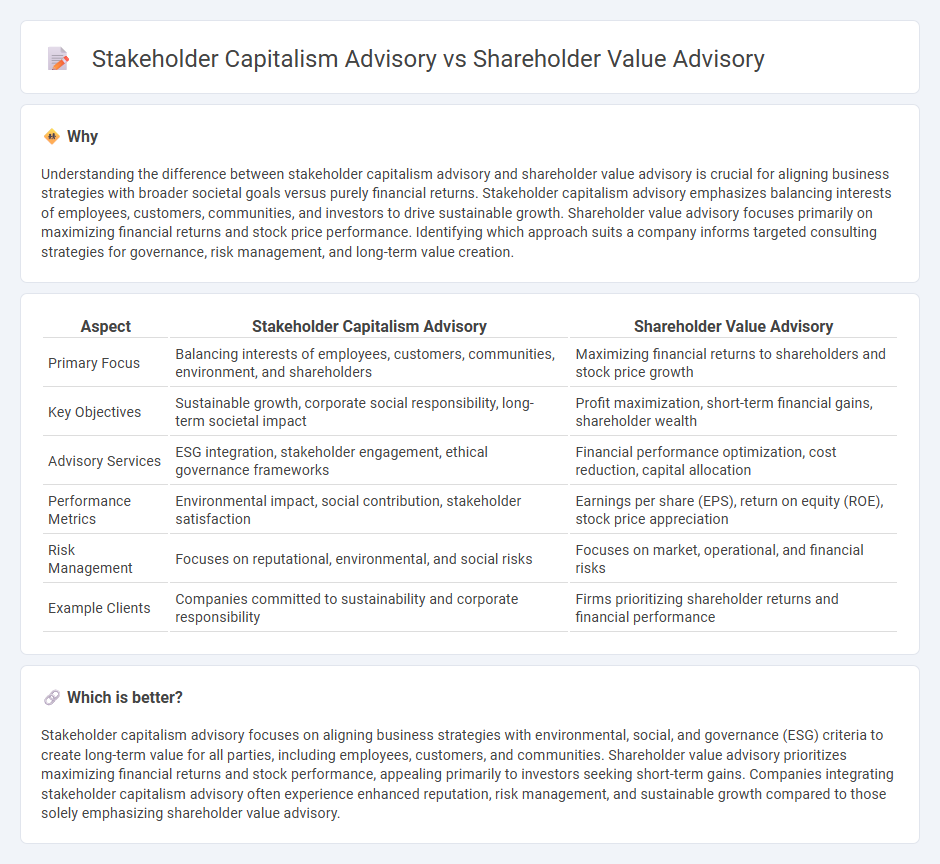

Understanding the difference between stakeholder capitalism advisory and shareholder value advisory is crucial for aligning business strategies with broader societal goals versus purely financial returns. Stakeholder capitalism advisory emphasizes balancing interests of employees, customers, communities, and investors to drive sustainable growth. Shareholder value advisory focuses primarily on maximizing financial returns and stock price performance. Identifying which approach suits a company informs targeted consulting strategies for governance, risk management, and long-term value creation.

Comparison Table

| Aspect | Stakeholder Capitalism Advisory | Shareholder Value Advisory |

|---|---|---|

| Primary Focus | Balancing interests of employees, customers, communities, environment, and shareholders | Maximizing financial returns to shareholders and stock price growth |

| Key Objectives | Sustainable growth, corporate social responsibility, long-term societal impact | Profit maximization, short-term financial gains, shareholder wealth |

| Advisory Services | ESG integration, stakeholder engagement, ethical governance frameworks | Financial performance optimization, cost reduction, capital allocation |

| Performance Metrics | Environmental impact, social contribution, stakeholder satisfaction | Earnings per share (EPS), return on equity (ROE), stock price appreciation |

| Risk Management | Focuses on reputational, environmental, and social risks | Focuses on market, operational, and financial risks |

| Example Clients | Companies committed to sustainability and corporate responsibility | Firms prioritizing shareholder returns and financial performance |

Which is better?

Stakeholder capitalism advisory focuses on aligning business strategies with environmental, social, and governance (ESG) criteria to create long-term value for all parties, including employees, customers, and communities. Shareholder value advisory prioritizes maximizing financial returns and stock performance, appealing primarily to investors seeking short-term gains. Companies integrating stakeholder capitalism advisory often experience enhanced reputation, risk management, and sustainable growth compared to those solely emphasizing shareholder value advisory.

Connection

Stakeholder capitalism advisory and shareholder value advisory are interconnected through their focus on optimizing corporate performance by balancing diverse interests. Both approaches emphasize sustainable growth, with stakeholder capitalism integrating environmental, social, and governance (ESG) criteria to enhance long-term shareholder returns. Effective advisory services align stakeholder engagement strategies with shareholder value maximization to drive resilience and competitive advantage.

Key Terms

**Shareholder value advisory:**

Shareholder value advisory prioritizes maximizing returns for shareholders through strategic financial planning, capital allocation, and performance improvement initiatives aligned with market expectations. This approach emphasizes increasing stock prices, dividends, and long-term investment value by driving profitability and operational efficiency. Discover how shareholder value advisory can enhance your company's financial health and investor confidence.

Return on Equity (ROE)

Shareholder value advisory centers on maximizing Return on Equity (ROE) by prioritizing financial performance and profit distribution to shareholders, often emphasizing cost efficiency and strategic investments. Stakeholder capitalism advisory integrates broader interests, including employees, customers, and society, aiming to enhance ROE sustainably through long-term value creation and corporate social responsibility. Explore how aligning ROE strategies with stakeholder interests drives resilient business growth and ethical governance.

Earnings Per Share (EPS)

Shareholder value advisory prioritizes maximizing Earnings Per Share (EPS) to enhance investor returns and stock price performance, often emphasizing short-term financial metrics. Stakeholder capitalism advisory expands the focus to include environmental, social, and governance (ESG) factors, aiming for sustainable growth that benefits employees, customers, and communities alongside shareholders. Explore how integrating these advisory approaches can balance financial performance with corporate responsibility for long-term success.

Source and External Links

What Is Shareholder Value and How Is It Calculated? - SmartAsset - Shareholder value refers to the return shareholders receive through profit growth, stock price appreciation, and dividends, often calculated as market capitalization (stock price x shares outstanding) plus total dividends paid.

Shareholder value - Wikipedia - Shareholder value is the concept that a company's primary goal is to increase shareholder wealth by maximizing dividends and stock price, and performance should be assessed relative to benchmarks like cost of capital.

Shareholder Value Advisors - Shareholder Value Advisors is a consulting firm specializing in helping companies enhance performance by designing effective business unit incentives and improved value-added measurement systems.

dowidth.com

dowidth.com