ESG reporting advisory focuses on helping organizations measure, disclose, and improve their environmental, social, and governance performance to meet regulatory requirements and stakeholder expectations. Risk management consulting identifies, assesses, and mitigates potential threats to a company's operational, financial, and reputational stability. Explore how specialized consulting services can enhance your company's sustainability and resilience initiatives.

Why it is important

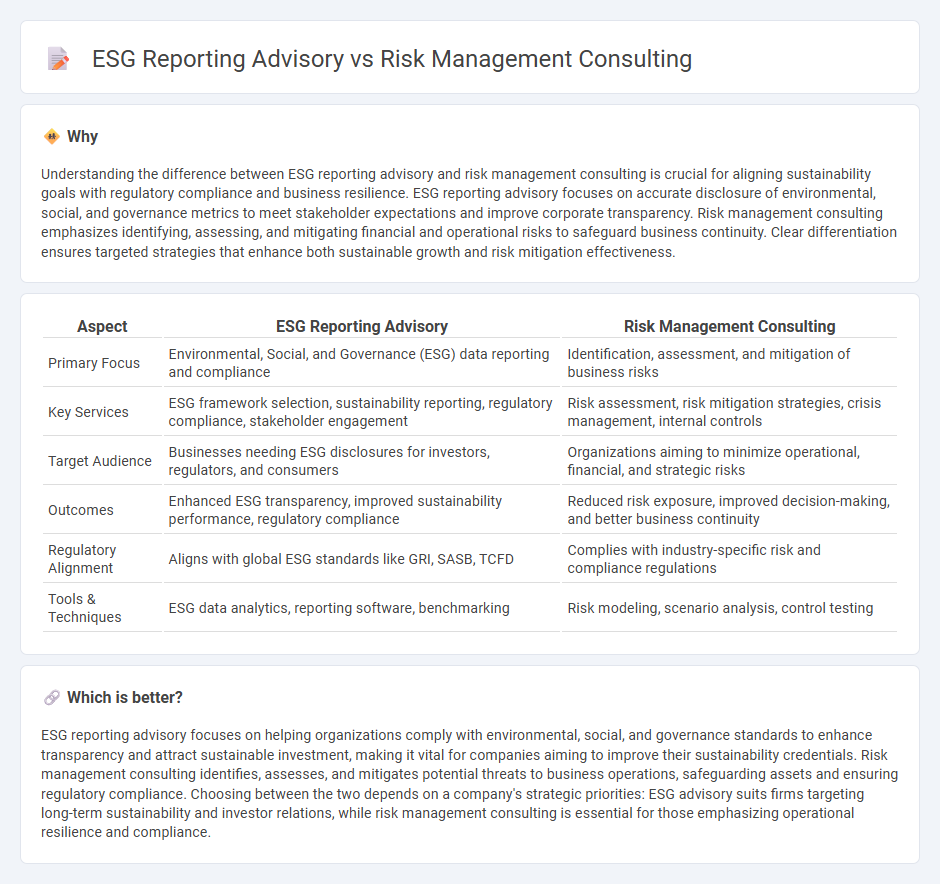

Understanding the difference between ESG reporting advisory and risk management consulting is crucial for aligning sustainability goals with regulatory compliance and business resilience. ESG reporting advisory focuses on accurate disclosure of environmental, social, and governance metrics to meet stakeholder expectations and improve corporate transparency. Risk management consulting emphasizes identifying, assessing, and mitigating financial and operational risks to safeguard business continuity. Clear differentiation ensures targeted strategies that enhance both sustainable growth and risk mitigation effectiveness.

Comparison Table

| Aspect | ESG Reporting Advisory | Risk Management Consulting |

|---|---|---|

| Primary Focus | Environmental, Social, and Governance (ESG) data reporting and compliance | Identification, assessment, and mitigation of business risks |

| Key Services | ESG framework selection, sustainability reporting, regulatory compliance, stakeholder engagement | Risk assessment, risk mitigation strategies, crisis management, internal controls |

| Target Audience | Businesses needing ESG disclosures for investors, regulators, and consumers | Organizations aiming to minimize operational, financial, and strategic risks |

| Outcomes | Enhanced ESG transparency, improved sustainability performance, regulatory compliance | Reduced risk exposure, improved decision-making, and better business continuity |

| Regulatory Alignment | Aligns with global ESG standards like GRI, SASB, TCFD | Complies with industry-specific risk and compliance regulations |

| Tools & Techniques | ESG data analytics, reporting software, benchmarking | Risk modeling, scenario analysis, control testing |

Which is better?

ESG reporting advisory focuses on helping organizations comply with environmental, social, and governance standards to enhance transparency and attract sustainable investment, making it vital for companies aiming to improve their sustainability credentials. Risk management consulting identifies, assesses, and mitigates potential threats to business operations, safeguarding assets and ensuring regulatory compliance. Choosing between the two depends on a company's strategic priorities: ESG advisory suits firms targeting long-term sustainability and investor relations, while risk management consulting is essential for those emphasizing operational resilience and compliance.

Connection

ESG reporting advisory and risk management consulting are interconnected through their focus on identifying, assessing, and mitigating environmental, social, and governance risks that can impact a company's operational resilience and reputation. ESG reporting provides critical metrics and disclosures that inform risk management strategies by highlighting potential vulnerabilities related to regulatory compliance, stakeholder expectations, and sustainability challenges. Integrating ESG insights into risk management enhances decision-making, ensures compliance with evolving standards, and supports long-term value creation for investors and stakeholders.

Key Terms

**Risk management consulting:**

Risk management consulting provides organizations with strategies to identify, assess, and mitigate financial, operational, and strategic risks, enhancing overall resilience and compliance. Experts use advanced risk assessment tools and frameworks to tailor solutions that align with industry standards and regulatory requirements, ensuring sustainable business continuity. Discover how specialized risk management consulting can safeguard your enterprise against emerging threats.

Risk Assessment

Risk management consulting emphasizes identifying, evaluating, and mitigating potential threats to an organization's assets and operations, ensuring business continuity and regulatory compliance. ESG reporting advisory guides companies in disclosing environmental, social, and governance risks, aligning risk assessment with sustainability goals and stakeholder expectations. Explore how integrating these approaches enhances comprehensive risk evaluation and strengthens corporate resilience.

Mitigation Strategies

Risk management consulting emphasizes identifying, assessing, and prioritizing risks to develop robust mitigation strategies that protect organizational assets and ensure business continuity. ESG reporting advisory focuses on integrating environmental, social, and governance risks into corporate reporting frameworks, enhancing transparency and stakeholder trust while addressing regulatory compliance. Explore more about how tailored mitigation strategies in these domains drive sustainable success.

Source and External Links

Enterprise Risk Management Consulting Services - Marsh - Marsh Advisory helps organizations implement an integrated approach to identify, assess, and manage business-critical risks, offering risk analysis, mitigation strategy evaluation, and tailored risk management solutions for senior leaders and stakeholders.

ICA Risk Management Consultants - Insurance, Financing, Advisory - ICA provides independent risk management and insurance consulting with over 67 years of experience, specializing in designing customized risk programs, employee benefits consulting, and enterprise risk management for clients across multiple U.S. states.

Risk Consulting - KPMG International - KPMG's risk consulting professionals assist companies in financial risk management, IT and data security, regulatory compliance, and IFRS conversion, helping organizations navigate complex risks and regulatory changes to maintain competitive advantage.

dowidth.com

dowidth.com