ESG due diligence focuses on evaluating environmental, social, and governance factors to identify potential risks and opportunities within a company's operations and supply chain. Reputational due diligence assesses public perception, stakeholder trust, and brand integrity to prevent damage from controversies or negative publicity. Explore how integrating both approaches enhances comprehensive risk management strategies.

Why it is important

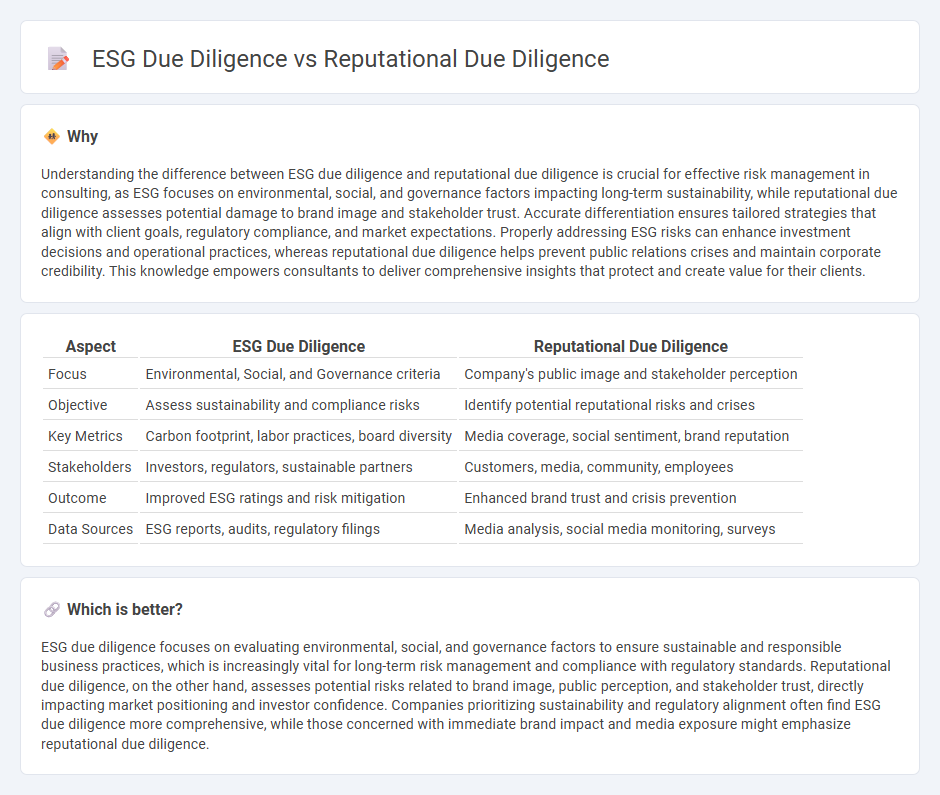

Understanding the difference between ESG due diligence and reputational due diligence is crucial for effective risk management in consulting, as ESG focuses on environmental, social, and governance factors impacting long-term sustainability, while reputational due diligence assesses potential damage to brand image and stakeholder trust. Accurate differentiation ensures tailored strategies that align with client goals, regulatory compliance, and market expectations. Properly addressing ESG risks can enhance investment decisions and operational practices, whereas reputational due diligence helps prevent public relations crises and maintain corporate credibility. This knowledge empowers consultants to deliver comprehensive insights that protect and create value for their clients.

Comparison Table

| Aspect | ESG Due Diligence | Reputational Due Diligence |

|---|---|---|

| Focus | Environmental, Social, and Governance criteria | Company's public image and stakeholder perception |

| Objective | Assess sustainability and compliance risks | Identify potential reputational risks and crises |

| Key Metrics | Carbon footprint, labor practices, board diversity | Media coverage, social sentiment, brand reputation |

| Stakeholders | Investors, regulators, sustainable partners | Customers, media, community, employees |

| Outcome | Improved ESG ratings and risk mitigation | Enhanced brand trust and crisis prevention |

| Data Sources | ESG reports, audits, regulatory filings | Media analysis, social media monitoring, surveys |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance factors to ensure sustainable and responsible business practices, which is increasingly vital for long-term risk management and compliance with regulatory standards. Reputational due diligence, on the other hand, assesses potential risks related to brand image, public perception, and stakeholder trust, directly impacting market positioning and investor confidence. Companies prioritizing sustainability and regulatory alignment often find ESG due diligence more comprehensive, while those concerned with immediate brand impact and media exposure might emphasize reputational due diligence.

Connection

ESG due diligence and reputational due diligence are interconnected as both assess non-financial risks impacting a company's sustainability and public image. ESG due diligence evaluates environmental, social, and governance factors that influence long-term value, while reputational due diligence focuses on identifying potential threats to brand integrity and stakeholder trust. Integrating these processes enables consulting firms to provide comprehensive risk management strategies that safeguard corporate reputation and ensure compliance with evolving stakeholder expectations.

Key Terms

**Reputational due diligence:**

Reputational due diligence evaluates a company's public perception, media presence, and stakeholder trust to identify potential risks that could impact brand value and investor confidence. This process involves analyzing social media sentiment, past controversies, and leadership integrity to anticipate reputational damage before it affects business operations. Explore more to understand how reputational due diligence safeguards corporate reputation and supports sustainable growth.

Stakeholder analysis

Reputational due diligence centers on assessing how a company is perceived by key stakeholders, analyzing public opinion, media coverage, and community impact to identify potential reputational risks. ESG due diligence incorporates stakeholder analysis by evaluating environmental, social, and governance practices, emphasizing transparency, ethical standards, and compliance with regulatory frameworks. Explore deeper insights into stakeholder analysis and its critical role in mitigating risks across reputational and ESG due diligence processes.

Media screening

Reputational due diligence prioritizes media screening to identify risks related to public perception, controversies, and adverse news that could impact a company's image or stakeholder trust. ESG due diligence incorporates broader environmental, social, and governance criteria, evaluating media reports to assess compliance and sustainability performance alongside reputational factors. Explore in-depth methodologies and tools used in media screening for both due diligence types to enhance risk mitigation.

Source and External Links

Assessing Reputational Risks in Private Equity Transactions - Reputational due diligence is a process combining thorough research and market intelligence to identify non-financial risks such as past legal, financial, or ethical issues of a company and its key individuals, critical in private equity transactions to avoid financial losses and reputational harm.

Reputational Due Diligence for Corporate Integrity - This involves assessing the character, history, and credibility of a company or individual before engagement to mitigate risks, build trust, and ensure legal compliance by examining non-financial aspects beyond financials like affiliations, media presence, and ethical conduct.

How AI improves reputational due diligence - Reputational due diligence includes research, analysis, and delivery phases, where AI tools enhance efficiency by effectively gathering vast online data, filtering relevant insights, disambiguating information, and supporting informed decision-making.

dowidth.com

dowidth.com