Climate risk advisory focuses on assessing and mitigating environmental impacts and financial exposure related to climate change, helping organizations align with sustainability goals and investor expectations. Regulatory compliance ensures businesses meet mandatory laws and standards set by government bodies to avoid legal penalties and maintain operational legitimacy. Discover how tailored consulting services can bridge the gap between climate risk management and regulatory adherence for your organization.

Why it is important

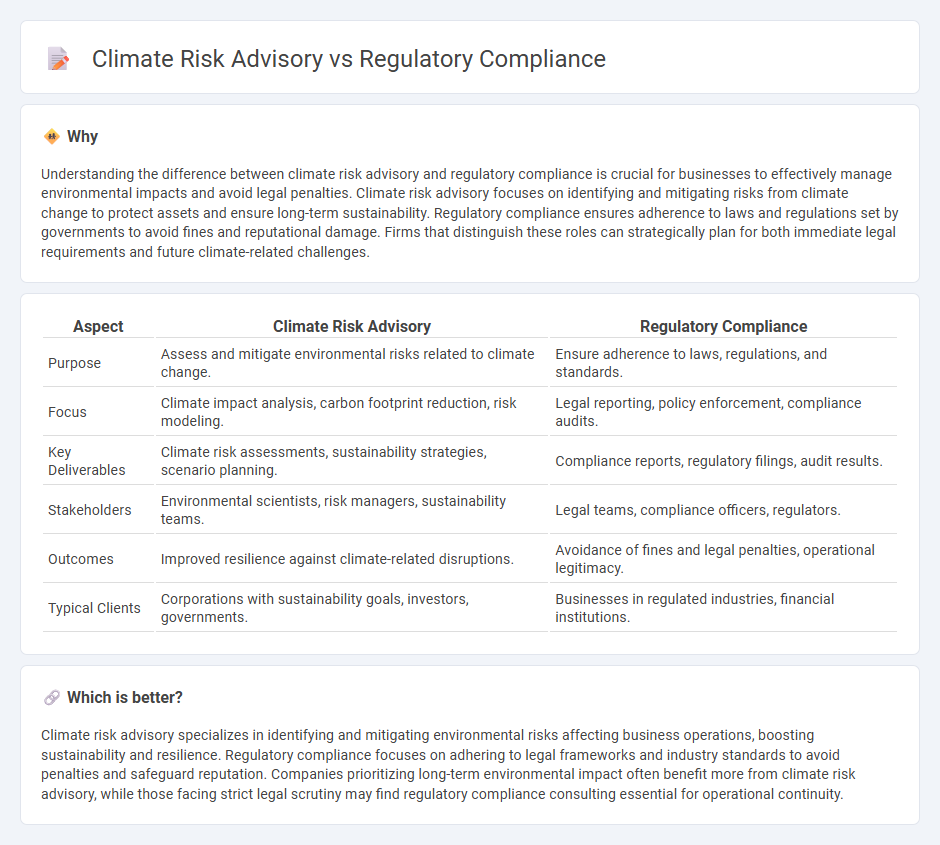

Understanding the difference between climate risk advisory and regulatory compliance is crucial for businesses to effectively manage environmental impacts and avoid legal penalties. Climate risk advisory focuses on identifying and mitigating risks from climate change to protect assets and ensure long-term sustainability. Regulatory compliance ensures adherence to laws and regulations set by governments to avoid fines and reputational damage. Firms that distinguish these roles can strategically plan for both immediate legal requirements and future climate-related challenges.

Comparison Table

| Aspect | Climate Risk Advisory | Regulatory Compliance |

|---|---|---|

| Purpose | Assess and mitigate environmental risks related to climate change. | Ensure adherence to laws, regulations, and standards. |

| Focus | Climate impact analysis, carbon footprint reduction, risk modeling. | Legal reporting, policy enforcement, compliance audits. |

| Key Deliverables | Climate risk assessments, sustainability strategies, scenario planning. | Compliance reports, regulatory filings, audit results. |

| Stakeholders | Environmental scientists, risk managers, sustainability teams. | Legal teams, compliance officers, regulators. |

| Outcomes | Improved resilience against climate-related disruptions. | Avoidance of fines and legal penalties, operational legitimacy. |

| Typical Clients | Corporations with sustainability goals, investors, governments. | Businesses in regulated industries, financial institutions. |

Which is better?

Climate risk advisory specializes in identifying and mitigating environmental risks affecting business operations, boosting sustainability and resilience. Regulatory compliance focuses on adhering to legal frameworks and industry standards to avoid penalties and safeguard reputation. Companies prioritizing long-term environmental impact often benefit more from climate risk advisory, while those facing strict legal scrutiny may find regulatory compliance consulting essential for operational continuity.

Connection

Climate risk advisory and regulatory compliance are intrinsically connected as businesses must navigate evolving environmental laws while managing climate-related financial and operational risks. Effective climate risk advisory supports organizations in identifying, assessing, and mitigating climate impacts, ensuring alignment with stringent regulatory frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the EU Taxonomy Regulation. This integrated approach enhances transparency, reduces liability, and drives sustainable decision-making critical for regulatory adherence.

Key Terms

Regulatory Frameworks

Regulatory compliance ensures adherence to established laws and regulations, minimizing legal and financial risks for organizations. Climate risk advisory evaluates environmental impacts and integrates climate-related regulations into business strategies to foster sustainability and resilience. Explore how aligning regulatory frameworks with climate risk advisory can strengthen your organization's governance and long-term viability.

Climate Risk Assessment

Climate risk assessment plays a crucial role in both regulatory compliance and climate risk advisory by evaluating potential environmental impacts on business operations and financial stability. Regulatory frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) mandate transparent reporting, while advisory services provide strategic insights to mitigate identified risks. Explore detailed methodologies and best practices in climate risk assessment to enhance your organization's resilience and compliance.

Disclosure Standards

Regulatory compliance mandates organizations adhere to established disclosure standards such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB), ensuring transparent reporting of climate-related risks. Climate risk advisory goes beyond compliance by offering strategic insights to identify, assess, and mitigate environmental risks that impact long-term business resilience. Explore how aligning with disclosure standards can enhance your organization's sustainability strategy and risk management.

Source and External Links

What is Regulatory Compliance? - MetricStream - Regulatory compliance is the process of adhering to applicable laws, regulations, policies, procedures, and standards set by governments and regulatory bodies, varying by industry and jurisdiction.

What is Regulatory Compliance? Meaning and Best Practices Guide - Organizations use regulatory compliance policies to outline processes and responsibilities for following relevant laws, boosting stakeholder confidence and reducing legal risk.

Regulatory compliance 101: Definition, requirements & solutions - Regulatory compliance involves policies and practices ensuring a company follows external mandates from governing bodies to reduce legal risks and maintain operational integrity.

dowidth.com

dowidth.com