Greenwashing risk assessment consulting focuses on identifying and mitigating deceptive environmental claims in corporate practices, ensuring transparency and credibility in sustainability reporting. Sustainable finance advisory emphasizes integrating environmental, social, and governance (ESG) criteria into investment decisions to promote responsible capital allocation. Explore the distinct benefits and methodologies of each approach to enhance your organization's sustainable impact.

Why it is important

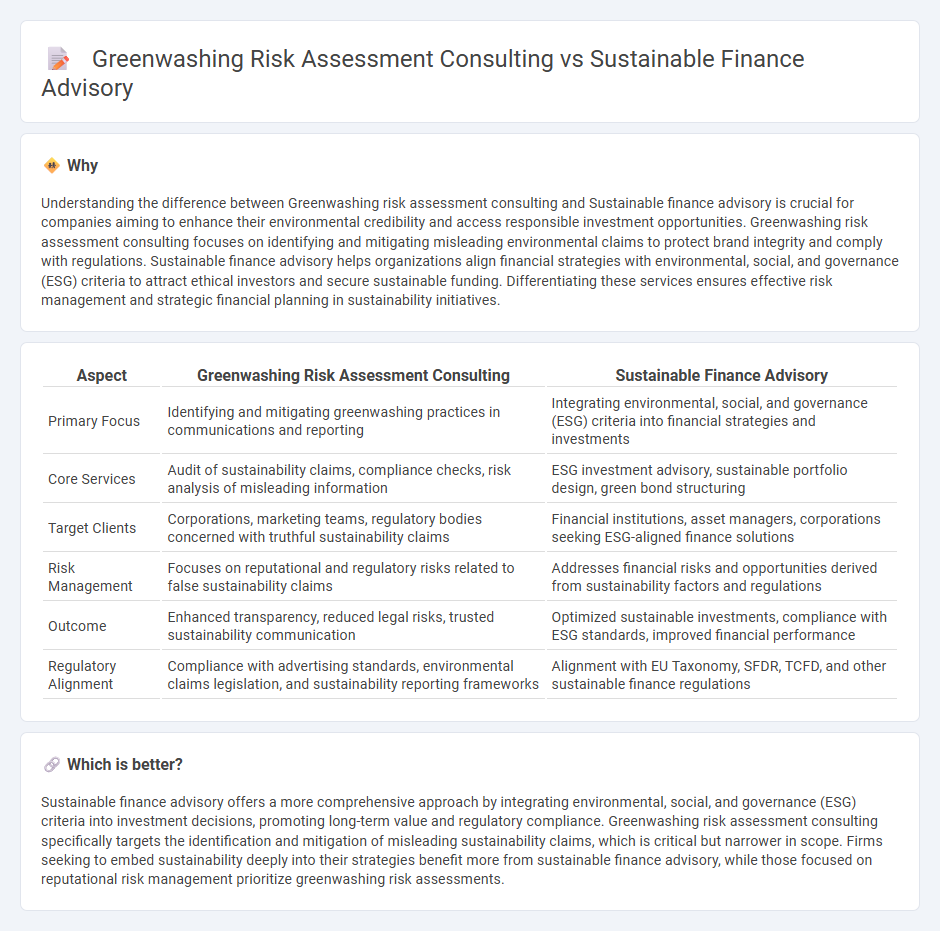

Understanding the difference between Greenwashing risk assessment consulting and Sustainable finance advisory is crucial for companies aiming to enhance their environmental credibility and access responsible investment opportunities. Greenwashing risk assessment consulting focuses on identifying and mitigating misleading environmental claims to protect brand integrity and comply with regulations. Sustainable finance advisory helps organizations align financial strategies with environmental, social, and governance (ESG) criteria to attract ethical investors and secure sustainable funding. Differentiating these services ensures effective risk management and strategic financial planning in sustainability initiatives.

Comparison Table

| Aspect | Greenwashing Risk Assessment Consulting | Sustainable Finance Advisory |

|---|---|---|

| Primary Focus | Identifying and mitigating greenwashing practices in communications and reporting | Integrating environmental, social, and governance (ESG) criteria into financial strategies and investments |

| Core Services | Audit of sustainability claims, compliance checks, risk analysis of misleading information | ESG investment advisory, sustainable portfolio design, green bond structuring |

| Target Clients | Corporations, marketing teams, regulatory bodies concerned with truthful sustainability claims | Financial institutions, asset managers, corporations seeking ESG-aligned finance solutions |

| Risk Management | Focuses on reputational and regulatory risks related to false sustainability claims | Addresses financial risks and opportunities derived from sustainability factors and regulations |

| Outcome | Enhanced transparency, reduced legal risks, trusted sustainability communication | Optimized sustainable investments, compliance with ESG standards, improved financial performance |

| Regulatory Alignment | Compliance with advertising standards, environmental claims legislation, and sustainability reporting frameworks | Alignment with EU Taxonomy, SFDR, TCFD, and other sustainable finance regulations |

Which is better?

Sustainable finance advisory offers a more comprehensive approach by integrating environmental, social, and governance (ESG) criteria into investment decisions, promoting long-term value and regulatory compliance. Greenwashing risk assessment consulting specifically targets the identification and mitigation of misleading sustainability claims, which is critical but narrower in scope. Firms seeking to embed sustainability deeply into their strategies benefit more from sustainable finance advisory, while those focused on reputational risk management prioritize greenwashing risk assessments.

Connection

Greenwashing risk assessment consulting identifies misleading environmental claims made by companies, ensuring transparency and credibility in sustainability communications. Sustainable finance advisory integrates these assessments to guide investments toward genuinely green projects, reducing exposure to reputational and financial risks associated with false sustainability practices. Together, they protect stakeholders by promoting integrity and accountability in sustainable investment decisions.

Key Terms

**Sustainable finance advisory:**

Sustainable finance advisory specializes in guiding businesses and investors toward environmentally responsible investment strategies that align with global sustainability goals such as the UN SDGs and the Paris Agreement. This advisory service emphasizes integrating ESG (Environmental, Social, and Governance) criteria into financial decision-making processes to promote long-term value creation and mitigate climate-related risks. Discover how sustainable finance advisory can transform your investment approach and drive impactful change.

ESG integration

Sustainable finance advisory focuses on integrating Environmental, Social, and Governance (ESG) criteria into investment strategies and corporate finance, promoting long-term value creation and risk management. Greenwashing risk assessment consulting identifies and mitigates false or exaggerated sustainability claims, ensuring credibility and compliance with ESG standards. Explore how expert services can enhance genuine ESG integration and prevent reputational risks in your organization.

Impact investing

Sustainable finance advisory specializes in guiding investors towards impactful opportunities aligned with environmental, social, and governance (ESG) criteria, ensuring authentic impact investing strategies. Greenwashing risk assessment consulting identifies and mitigates misleading claims that can undermine genuine sustainability efforts, protecting stakeholders from reputational and financial risks. Explore how combining these services enhances your impact investing decisions and safeguards integrity in sustainability commitments.

Source and External Links

Sustainable Finance Advisor - Green Careers Hub - A Sustainable Finance Advisor provides expert advice on financial sustainability strategies and frameworks, analyzing sustainability data and aligning businesses with global standards to inform investment decisions.

Overview of sustainable finance - European Commission - Sustainable finance integrates environmental, social and governance (ESG) factors into financial decisions to promote long-term sustainable economic growth aligned with policy goals like the European Green Deal.

Sustainable Finance and Advisory - Investment Banking - Wells Fargo - This practice supports clients by providing strategic advisory, developing sustainable finance frameworks, structuring bespoke financing solutions, and offering market insights to advance sustainability objectives.

dowidth.com

dowidth.com